Gov. James R. Thompson is proposing an $11.8 billion budget for fiscal 1980, a small, 2 per cent, appropriation increase, well below the expected 7.8 per cent rate of inflation. Thompson says the budget will be balanced for the third successive year of his administration if lawmakers follow his budget advice. The comptroller's office disagrees with that assertion on traditional accounting grounds.

The governor says the available balance in crucial general funds at year's end in fiscal 1980 will total $ 136 million, the same final balance projected in fiscal 1979. General funds include the Common School Fund, the General Revenue Fund, the Federal Assistance Trust Fund and the Federal Public Works Assistance Fund. These funds are expended for local school aid, higher education, public aid, operations of state institutions and administrative costs of state government. The available balance must be enough in general funds to meet debts or state services will suffer, according to the Bureau of the Budget (BOB). By this gauge then, state revenues are healthy and no new tax increase appears necessary.

But new Comptroller Roland W. Burris claims that "lapse period spending" appropriations approved and spent in one year but paid out from the next year's revenues have caused two actual negative balances under Gov. Thompson of over $150 million each. This appears true. However, Burris is a Democrat, Thompson a Republican, and Burris has offered no good explanation as to how such accounting of lapse period spending harms the state, or why it is wrong.

Gas tax increase

Not contained in the governor's budget is a proposed four-year, $568 million highway tax and spending program offered by Gov. Thompson on March 5. The road fund is broke. To bail it out Gov. Thompson calls for an increased gas tax to 9 cents per gallon from 7 1/2 cents and higher license plate fees. License fees would rise $3 to $15 per vehicle this year, depending upon the size of the vehicle. Also, the gas tax would be increased in future years based upon a complex percentage, conversion formula to take effect four years from now.

The amount of new fiscal 1980 expenditures proposed for roads, but not computed in the budget, is approximately $360 million, according to Robert L. Mandeville, BOB director and the administration's fiscal whiz. Nearly half the new $360 million would be federal matching funds. Mandeville says the added revenue and spending in the program aren't included in the budget because "we're not counting on revenue we do not have."

It is not known whether the legislature will go along with politically sensitive tax and road fee increases. It may depend on the degree of open public opposition that arises, or on party-oriented pride of sponsorship. Yet if the program is enacted as advanced, the budget would actually total over $12.1 billion (instead of $11.8 billion), a fairly energetic jump from this fiscal year (1979), when appropriations are projected to total $11.6 billion. The statehouse press corps has questioned whether budgeting for the road program should be omitted, since the plan is part of the governor's overall economic strategy. But, to be fair, the last two Thompson budgets excluded such hoped-for, but uncertain revenues. For example, one-time federal Title XX funds (reimbursing the state for past services) totaling $33 million were received as expected last year, but weren't budgeted originally. But 25 years of gubernatorial budgeting precedent also supports the comptroller's claim that lapse period spending, prior to the Thompson administration, was not excluded from year-end accountings of available balance in the general fund. A more valid criticism of Thompson administration budget plans is made of the proposed continued diversion of $125 million in road fund revenues. The governor proposes a four-year phase-out of road fund diversions, eliminating $25 million the first year from diversions

April 1979/Illinois Issues/24

which now go to among other things the secretary of state, the state police, traffic courts and special fare rates on mass transit for students and the elderly. From $15 million to $25 million of the money now used to pay for such things would be replaced by "closing a sales tax loophole" on used cars not sold commercially, according to Gov. Thompson. Experts in the Bureau of the Budget maintain that no more than $25 million worth of diversion can be stopped next year without disastrous results for other funds. For example, if diverted road funds are replaced with general funds, school and welfare programs would suffer, they say, because not enough revenue growth is expected in tight economic conditions (without a tax boost) to both maintain present programs and fully stop diversion. BOB says most funds diverted from the road fund go for services to motorists: supporting the state highway police, the secretary of state's licensing division, and road-related court of claims administration. Therefore "diversion may actually be a misnomer," according to Richard Kolhauser, BOB deputy director.

Road fund diversion

Why, if this is so, is the governor proposing a gradual plan to "stop increased diversion dead in its tracks?" Perhaps because diversion is not a sound budgeting practice, since it makes for deceptive fund transfers and confuses administrative work. It is an inherited practice that played a central role in depleting the road fund. But the damage is already done and is irreparable. An immediate end to diversion is out of the question unless revenue is raised from another source to replace money now flowing from the road fund. The income tax initiated a decade ago is not bringing in enough revenue to allow diversion to end.

Meanwhile, the road fund must be bailed out or "eventually we will suffer the loss of a multi-billion dollar transportation system," according to Gov. Thompson. The governor is proposing a gas tax increase. He says the taxpayers will support it when they see where their money is going: to help repair the roads which are in bad condition after three unusually harsh winters. Yet if the governor had discontinued diversion at the start of his first term of office, the general funds, not the road fund, would now be broke (Burris says it already is, under normal accounting standards). Whenever general funds are depleted, government services must be cut or the state must raise the income, sales or property tax, because the state cannot legally operate in the red. Either alternative would have been politically disastrous. Instead the state has maintained a tight incremental budgeting system and state agencies are suffering. Inflation is growing faster than most agency budgets.

Department of Children and Family Services (up 19.6 per cent) and the Department of Corrections (up 15 per cent) to handle child abuse prevention and deplorable prison conditions. DCFS could hire 142 more caseworkers, and DOC could hire 144 more guards.

The Department of Public Aid would receive a $150 million increase (up 6.6 per cent) largely to fund the skyrocketing cost of medical care (up 13 per cent every year since 1974) under medicaid. Welfare recipients (most are children or single women with children) would not receive a cost of living increase, although they have received only one increase since 1974 (5 percent in fiscal 1979) while the rate of inflation has been over 5 per cent each year, and nearly 9 per cent annually for the last two years.

Education would receive a $136 million increase a 4.2 per cent boost for elementary and secondary education and a 6.6 per cent hike for higher education. There would be no increase in real dollar purchasing power for education if inflation is 7.8 per cent as the administration predicts. Under a new contract between the state and the American Federation of State, County and Municipal Employees (AFSCME), most state employees will receive a pay increase of around 7 per cent, at a state cost of $42 million. Funding is to come from about $50 million not expected to be spent in fiscal 1979.

The Department of Personnel is budgeted for a $13.4 million increase, a gain of 15 per cent over estimated fiscal 1979 appropriations. This does not include the AFSCME raise, but is mostly for increased cost of the state group insurance program. The Department of Mental Health and Developmental Disabilities would

April 1979/Illinois Issues/25

get an 8 per cent or $36 million increase. Community based programs would again be underfunded, despite an 11 per cent boost for services. And state operated facilities will get only a 3.9 per cent funding boost for direct services. For the third successive year the state budget calls for reducing state bond appropriations and new bond sales. General obligation bond sales are recommended to fall to $380 million in fiscal 1980, from $390 million in fiscal

1979, $405 million in fiscal 1978 and $535 million in fiscal 1977, the last budget proposed by former Gov. Daniel Walker. New bond appropriations would be $272 million, and bond reappropriations would be $884 million. Both figures are below this year's level. However the debt service payment principal and interest due on outstanding general obligation bonds will grow this year by $32.1 million. It has grown at an ever slower rate since Thompson took office. Long-term state debt was obligated at a much higher rate under Walker than under Gov. Thompson.

Bond appropriations make up most of the state capital budget for fiscal 1980. The capital budget includes: $1,156 billion in general obligation bond appropriations, $958 million in Road Fund appropriations, $58 million in current state revenue fund appropriations (including the General Revenue Fund) and $62 million in appropriations from federal sources. Capital spending from these four sources goes for seven purposes: highway construction, grants for local airport and public transit facilities, construction of water resources projects, construction and upkeep of facilities for state agencies and public higher education, construction of elementary and secondary schools, grants to local governments for waste water treatment facilities and construction of new coal and energy technological projects. The governor said, "This budget contains the strongest capital construction program we can mount without endangering our triple-A bond rating or curtailing critical services."

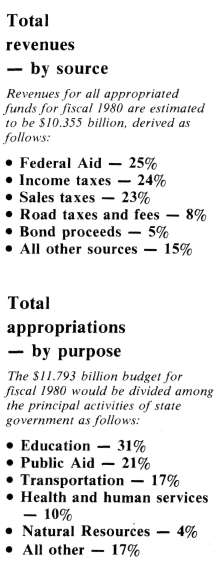

General funds appropriations are up 6.3 per cent, from an estimated $6,522 billion in fiscal 1979 to a proposed $6,930 billion in fiscal 1980. Revenues in the general funds are expected to rise by 6.5 per cent, from an estimated $6,951 billion this year to $7,404 billion in fiscal 1980. General funds revenues total more than appropriations because the appropriations figures do not include transfers out of funds, including revenue sharing to local governments, debt service payments and sales tax payments to the Regional Transportation Authority. General funds available balance will not grow this year, but will remain at $136 million, nearly 2 per cent of general fund revenues. Gov. Thompson says that general funds appropriations are an estimated 6.4 per cent of Illinois personal income in fiscal 1979 and about 6.3 per cent in fiscal 1980. Since 1970, general funds appropriations have grown at an average rate of 12 per cent a year, while Illinois personal income has averaged a 10 per cent yearly growth.

April 1979/Illinois Issues/26

Illinois Periodicals Online (IPO) is a digital imaging project at the Northern Illinois University Libraries funded by the Illinois State Library

|