|

By GEORGE PROVENZANO

|

Natural

gas:

enough

for now,

future

uncertain

New federal laws have stimulated the production of natural gas. Coupled with the reduced demand caused by higher prices and conservation, this means Illinois will have plenty of natural gas this winter. But in coming years, pray for warm winters.

|

NO MATTER how cold the weather is this winter, residential gas customers in Illinois will have sufficient supplies of natural gas for home heating.

That's the word from company representatives of the state's seven largest gas utilities: Northern Illinois Gas Company, People's Gas, Light & Coke Company, Illinois Power Company, Central Illinois Light Company, Central Illinois Public Service Company, Iowa-Illinois Gas & Electric "Company and North Shore Gas Company. They all report that their companies have enough gas to meet highest priority residential demands even if home heating requirements reach record levels (again?) this winter. In addition, these utilities, which account for over 98 percent of the state's total gas sales, anticipate having adequate supplies available for the lower priority firm commercial and industrial demands. Firm customer demands refer to the requirements of gas users who contract for services to be available at all times. There are two basic reasons why Illinois gas utilities are confident that they will meet heating requirements for the 1979-80 winter: available gas supplies will be up and customer demands will be down from last year. Supplies will be up because interstate gas pipelines have increased their deliveries to the utilities for the second year in a row. This year, gas entitlements

— contractual agreements by the pipelines to deliver specified volumes of gas

— to individual utilities will be from 3 to 18 percent larger than last year. These incremental increases are notably larger than the increases of a year ago. Last year marked the first time since the earlier 1970's that entitlements increased in any significant manner on a statewide basis. |

Customer demands will be down because higher gas prices continue to encourage conservation. Company representatives indicate that their customers are reducing gas demands at a rate of 1 to 2 percent per year on a normalized degree-day basis. When adjustments are made for the effects of the abnormally cold weather of recent winters, the customer demands that Illinois gas utilities are meeting today are from 10 to 15 percent lower than they were prior to the Arab oil embargo of 1973.

The increases in interstate pipeline deliveries come primarily from newly developed gas from the Gulf of Mexico and certain Rocky Mountain states. Natural Gas Pipeline Company of American and Panhandle Eastern, two companies that make over 80 percent of this state's pipeline deliveries, are participants in successful gas development projects in those areas. These companies are rapidly expanding gas transmission capacity to tie the new production areas into the interstate pipeline network and ultimately to Illinois markets. Recent changes in federal law (see below), allowing interstate pipelines to transmit gas through intrastate lines, have also enabled Natural Gas Pipeline to move additional gas into the state.

Increased pipeline deliveries have aided utilities in their efforts to replenish their underground gas storage inventories. Underground storage inventories in Illinois were severely depleted by last winter's heavy usage. These inventories are essential for supplying gas during the winter peak heating season when pipeline deliveries cannot keep up with customer demands.

In addition to pipeline supplies, Northern Illinois Gas Company and People's Gas Light and Coke Company operate two synthetic natural gas plants that produce methane, the primary constituent of pipeline gas, from natural gas liquids and naphtha. The output from these Chicago-area plants is used to supplement pipeline deliveries.

More gas, higher price

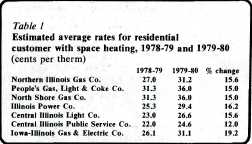

Although more gas will be available to Illinois users this winter, the price of gas will be higher than ever before. This winter residential customers can expect gas rates that are 12 to 19 percent higher than last year (see table 1). For a moderate-sized, single family dwelling, that means about a $12 per month increase for residents in the northern part of the state. Monthly bill increases for residents in the southern part of the state will be slightly smaller.

|

As indicated above, higher gas rates encourage conservation and enable utilities to stretch new supplies. This year Illinois utilities have continued to add new residential customers and have virtually eliminated all waiting lists for this class of service. In addition, all of the major Illinois gas utilities are now extending service to new commercial and industrial customers for the first time since 1972. Several company representatives noted that the new residential hookups would be offset by conservation, and that no growth in residential demand is expected.

These extensions of new service indicate continuing improvement in the gas supply and demand picture. Not only are Illinois gas utilities confident of meeting this winter's demands, but they also have reason to be optimistic about the demands of future winters.

|

|

December 1979/ Illinois Issues/ 19

|

This optimistic outlook raises several questions. Were the gas shortages that alarmed Illinois residents in previous winters simply caused by record low temperatures, or were factors unrelated to weather responsible for shortfalls in gas supplies? If weather was not the culprit, have any steps been taken to correct the chronic gas shortage problem, or will Illinois gas users continue to pray for warm winters in coming years?

Although the gas shortage problem has been most apparent during the winter, the fundamental reason for insufficient gas supplies has been economic, not cold weather. An important element of the shortage problem has been the failure of the Federal Power Commission (FPC) — now replaced by the Federal Energy Regulatory Commission (FERC) — to provide gas producers with sufficient incentives to develop new supplies for interstate transmission:

|

Under the federal Natural Gas Act of 1938, FERC has the authority to regulate the rates for interstate gas transmission. In 1954, in a controversial decision {Phillips Petroleum Company v. Wisconsin, et al 347 U.S. 672), the U.S. Supreme Court ruled that the Natural Gas Act also mandated federal regulation of the prices that pipeline companies paid to producers for gas purchased for interstate delivery. The court reasoned that regulation of the price of gas at the point of production — the so-called well-head price — was necessary in order to protect consumers from the automatic pass-through of unjustified production cost increases.

The Natural Gas Act established a "just and reasonable" criterion as the basis for setting rates. Through 1973, the FPC set maximum well-head rates for gas from different areas of the country using the average costs of production in those areas.

Incentives, reserves

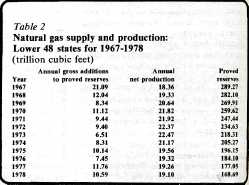

In the 1950's and 1960's most of the additions to U.S. reserves were discovered together with petroleum in Texas, Oklahoma and Louisiana. Because large reserves of gas were often found at fairly shallow depths, the average costs of production remained relatively low during this period. Under these conditions, the FPC well-head pricing policy provided little incentive to drill to greater depths in known producing areas or to explore for new gas reserves in unknown areas. As a result, in the lower 48 states, annual natural gas production has exceeded annual discoveries and additions to proved reserves since 1967 (see table 2).

Realizing that gas production obviously could not continue indefinitely if reserves were declining, the FPC attempted in 1974 to reverse this trend by establishing a single, nationwide maximum well-head price for newly developed gas. In 1974, and again in 1975, the FPC also implemented major increases in the well-head ceiling price and provided automatic annual escalation schedules to keep up with inflation.

|

Although this policy stimulated drilling for new natural gas and extended exploration over a larger geographical area, it was not entirely successful in increasing gas supplied for interstate transmission. Because FPC did not have the authority to regulate well-head prices for gas sold in into-state commerce, gas from new wells was being consumed in increasing quantities in the state in which it was produced. Consumers in producing states were able to outbid consumers in nonproducing states, and the decline in total supplies of natural gas for interstate markets continued.

|

|

The combination of insufficient exploration and drilling with declining sales of new production for interstate transmission forced the pipelines to curtail deliveries to volumes below those contracted for by local gas utilities. Curtailments to the utilities in turn resulted in restrictions on extending service to new customers; reductions in service to low priority users such as large industries and electric utilities; and occasional, but nonetheless disturbing, threats to essential residential service.

20/ December 1979/ Illinois Issues

At the same time, price increases in the unregulated intrastate markets encouraged extensive exploration and drilling on the part of producers and conservation and fuel switching on the part of consumers. As a result, major surpluses of natural gas have recently accumulated in the intrastate markets. With the enactment of the Natural Gas Policy Act (NGPA) in December 1978, Congress has attempted to correct the causes of the gas shortage problem by deregulating price controls on new gas by 1985. In the interim, this act permanently replaces the regulatory ap' proach of the Natural Gas Act with a series of maximum lawful prices for various categories of natural gas production. In addition, for the first time, the NGPA extends federal price ceilings to cover intrastate gas sales, thereby correcting the problem of intrastate and interstate price differentials.

Increased supplies

These measures are expected to increase gas supplies for interstate transmission in several ways. The price ceilings will be automatically adjusted for inflation on a monthly basis, eliminating any problems of producer uncertainty due to regulatory lag. The price ceilings are also graduated in a manner that encourages more daring exploration and development, while at the same time restraining price increases on previously discovered gas to prevent significant inflationary impact. Finally, the elimination of the intrastate and interstate price differentials means that consumers in the state in which gas is produced will no longer be able to outbid consumers in interstate markets. While the supply and demand outlook appears favorable for Illinois gas consumers for this winter and possibly several more, the outlook 5 to 10 years from now is less certain. Domestic reserve additions continue to be significantly below annual gas production rates, and future gas production capability fron conventional sources is declining. Until the influence of the provisions of NGPA on production activity can be better evaluated, no realistic forecast of natural gas availability can be projected beyond the next few years.□

George Provenzano is an economist with the Institute for Environmental Studies at the University of Illinois, Urbana.

December 1979/ Illinois Issues/ 21

|