|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

Appropriations at $14.6 billion, but recession knocks at door

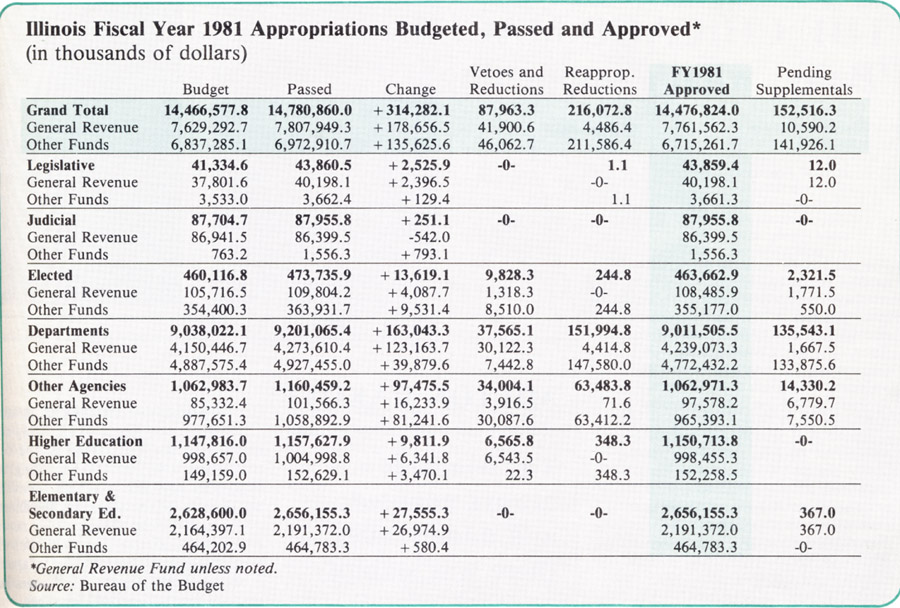

By DIANE ROSS GOV. JAMES R. Thompson breathed a little easier in January. Fiscal 1981, Illinois' second fiscal year under recession, was half over. Inflation could still cut the state's cash reserve in half by July, but Illinois would hardly be bankrupt. When the state cannot control inflation, it must control spending, according to Thompson, and he has apparently succeeded this year. By the new calendar year, it appeared the total appropriations for fiscal 1981 would be $14.629 billion, only 1.1 percent over Thompson's budget request. For fiscal 1982, Thompson has already said new revenues will not increase by the same percentage they have in previous years. And he said his new budget will hold spending to that level. Obviously, he wants to succeed again. During an inflation-driven recession, however, even Gov. James R. Thompson's budget will be strained. For fiscal 1981, spending in the crucial general revenue funds is now expected to increase 11 percent over the prior fiscal year, instead of 8.9 percent as projected last March. That means general funds spending may run at least $116 million beyond general funds revenue, pulling the general funds year-end balance down from $390 million to $274 million. And, if spending for public aid, for example, continues to increase at the rate it did during the first quarter of fiscal 1981, general funds spending could run $166 million beyond revenue, plunging the year-end balance to $224 million. To recap the fiscal 1981 appropriation picture, last March, Thompson unveiled a budget with $14.466 billion in appropriations. This was an 18 percent increase over appropriations he proposed for fiscal 1980, but only a 6.3 percent increase over actual spending he expected in fiscal 1980. The General Assembly had a total of $14.879 billion in appropriations bills introduced last spring. That was $412.5 million over budget. At session end last summer, the General Assembly had cut its total by $98.4 million. The total as passed last summer was $14.780 billion, only $314 million, or 2.2 percent, over budget. This was by far the closest a Democratic-controlled General Assembly had ever come to a Thompson budget. The biggest add-ons the Democrats approved were in: capital projects, $16.8 over budget; public aid, $63.5 million over; transportation $46.7 million over; education, $27.5 million over; revenue, $18.7 million over; mental health, $14.4 million over; and conservation, $11.6 million over. Thompson veto record Thompson vetoed only 87.9 million, or .6 percent of the total appropriations passed. That is the least he has cut in his four years. In fiscal 1978, the first year of his administration, the General Assembly went $704 million over budget, prompting Thompson to veto $170 million. In fiscal 1979, legislators ran $1.113 billion amok and forced Thompson to slash $969 million. In fiscal 1980, the General Assembly went even further — partly at Thompson's insistence, and went $1.361 billion over his budget, but Thompson vetoed only $321 million since $600 million of the overrun was for bonds for his own ill-fated road program. Thompson's vetoes for fiscal 1981 were mainly in capital appropriations. The biggest cut of $39.6 million (nearly half of the total vetoed) came from the $268.4 million appropriation for the Capital Development Board (CDB). Still, Thompson approved $16.3 million more for CDB than his capital budget had called for. The final appropriation for CDB stood at $228.8 million (S.B. 1665, sponsored by Sen. Roger A. Sommer, R., Pekin). 2/February 1981/Illinois Issues Specifically, Thompson cut six major capital projects: $10.7 million to build public schools; $8 million to build public libraries; $2.3 million to buy the DuPage/West Cook Special Ed Manor, a residential facility for multiply disabled students, which is currently leased; $2 million to the Chicago Park District; $600,000 for Southern Illinois University to build a food production and research facility; and $520,000 for Southern Illinois University to build an ethacoal demonstration facility. Thompson's second largest appropriation veto was nearly $20 million from the $1.2 billion appropriation for the Illinois Department of Revenue (H.B. 3025, sponsored by Rep. Harry Woodyard, R., Chrisman). The veto cut the funds for senior citizens tax relief grants, which was consistent with Thompson's veto of the substantive legislation (H.B. 3204) that would have provided new grants to offset increases in fuel costs. The third biggest cut was $10.4 million from the $ 1.025 billion appropriation for the Illinois Department of Transportation, eliminating unbudgeted projects (H.B. 3084, sponsored by "Minority "Leader George Ryan, R., Kankakee). This year, in addition to the $87.9 million Thompson vetoed, another $216 million in reappropriations was not needed. Therefore, Thompson approved $14.477 billion of the $14.780 billion the General Assembly had passed, a mere $10 million or .07 percent over his original budget. In the fall lame duck session, the General Assembly didn't override a single dollar of Thompson's appropriations vetoes, which may be another record for the Democrats under Thompson. The only money matter overridden by the legislators was a tax exemption for gasohol, which the Illinois Department of Revenue had said would cost nearly $5 million in fiscal 1981 alone; but Thompson's Bureau of the Budget (BOB) now says it should cost less than $3 million.

There were approximately 10 vetoes on substantive bills which would have allowed tax exemptions, deductions, credits, etc. Thompson had warned these bills would cost the state $183 million in. needed revenue (see "Legislative Action," page 24). Legislators did pass a potentially costly piece of substantive legislation during the veto session to require public schools to bus students to private schools at state expense. But since the bill's effective date is July 1, it would not effect fiscal 1981 appropriations. The Illinois State Board of Education urged Thompson not to sign the bill and estimated it would cost Illinois another $9 — $15 million a year. The lame duck General Assembly also passed $144 million in supplemental appropriations. In previous years, BOB records show the General Assembly appropriating additional funds via supplemental or overrides: $209 million for fiscal 1980, $181 million for fiscal 1979 and $241 million for fiscal 1978. Pending supplemental Two controversial supplementals, totaling $8 million, were left to be dealt with January 14, in the final hours before the 81st General Assembly adjourned sine die and the 82nd was to be sworn in. Legislators were expected to pass both, bringing the total in supplementals to $152 million. But that's almost all the supplemental that BOB expects to be requested for fiscal 1981. Of that $152 million total of supplemental appropriations, the largest single item was $112 million for the Department of Commerce and Community Affairs (DCCA). Most of that addtional money, $86 million, would go to DCCA's Low Income Energy Assistance Program (LIEAP), while the res, $24 million, would go for Comprehensive Employment Training Act (CETA) programs. (H.B. 3627, sponsored by Rep. J. J. Wolf, R., Chicago). The two supplemental pending during the holidays were expected to be approved January 14 despite the controversy that prevented passage during the fall veto session. One wo\M appropriate $2.3 million to the secretary of state, including $1.2 million to pay for pamphlets which explained constitutional questions on the November ballot. But the bill contains a controversial $550,000 for the transii tion from Alan J. Dixon to Jim Edgar, and neither Dixon's nor Edgar's staff was eager to explain why such a hefty amount was needed. (H.B. 3622, sponsored by Rep. Thaddeus Lechowicz, D., Chicago.)

12/February 1981/Illinois Issues

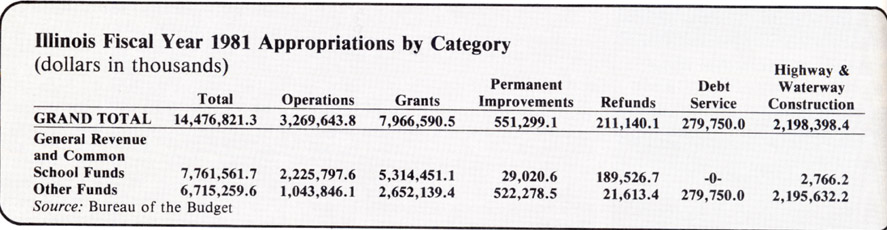

The other pending supplemental would originally have given the Illinois State Scholarship Commission an extra $9.9 million to retroactively fund scholarships awarded but not funded for the 1980-81 fall semester, and to fund scholarships awarded for the spring semester. However, the lame duck General Assembly reduced the supplemental to $5.8 million to fund only the spring scholarships, but did not take the final vote on the bill (S.B. 2038, sponsored by Sen. Aldo A. De-Angelis, R., Olympia Fields.) Of the total $152 million possible in fiscal 1981 supplemental, however, less than 10 percent, only $10.6 million would come from the crucial general revenue funds. Most of the rest of the money would come from federal funds. And of the crucial $10.6 million in general funds supplemental, Thompson is expected to sign at most $8.8 million. The Bureau of the Budget had built supplemental into its revised general funds spending estimates in November. So 1981 supplemental should have virtually no affect on the general funds year-end balance. If Thompson did approve all $152 million in supplemental, the total appropriations for fiscal 1981 would be $14.629 billion, only $162 million or 1.1 percent over budget. That would be 7.7 percent over the $13.574 billion that was finally appropriated for fiscal 1980. It is 31.8 percent over the $ 11,103 billion that was actually spent in fiscal 1980, but that is the usual difference. Governmental spending How will Illinois spend $14.476 billion in fiscal 1981? By category, more than half, about $8 billion, will go as grants. The largest single chunks will go for grants under state aid to schools ($2.6 billion) and for grants through welfare benefits ($2.5 billion). About one-fifth of the total will fund state government operations, with most of that $3.3 billion spent on salaries. About a seventh or $2.2 billion will go to transportation bonds, mainly to finance road and bridge construction. Of the rest, about $550 million will go for other capital projects, about $280 million for debt service and about $200 million for refunds, mostly through the Department of Revenue. By agency, the $14.476 billion in fiscal 1981 appropriations breaks down this way. Almost two-thirds, or $9 billion, will go to the executive code departments, including two of the three biggest spenders, public aid and transportation. The third biggest spender is education, which will receive $3.7 billion. After these three huge bites are taken, only $1.8 billion is left to spend. The legislature gets $43.9 million; the judiciary receives $88 million; the governor and other elected executive officers get $463.7 million; and all other agencies receive $1 billion. That about wraps up appropriations for fiscal 1981. The picture for fiscal 1982 will come into focus March 4 when Gov. Thompson unveils his new budget to the 82nd General Assembly. February 1981/Illinois Issues/13 |

|

|