|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

|

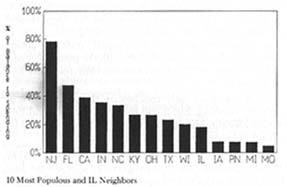

Perspective On Road Funds Balances By JOHN W. McCREE There have been recent reports, primarily from the Comptroller's office, concerning record high balances in the State's Road "Funds." The balances are the sums available on any given day, usually month's end, for issuing warrants (checks). In concept, this balance is similar to an individuals checkbook balance which reflects deposits (revenues) and checks (expenditures) to date on any given day. Recently, balances have been increasing and are higher than they were in the early 1980s. These high balances have been confused with the discussion about the need for increased highway funding. Balances are not an indication of the amount of revenues or expenditures, the long-term sufficiency of revenues, or the degree of control over expenditures. For instance, a balance of $1,000 in an individual's checking account means one thing if the rent due is $500 and quite another if the rent is $1,200. The simple function of a balance, whether in an individual's account or a state highway fund, is to pay bills between deposits. Monthly balances in highway funds vary a great deal within the year, primarily because of seasonal construction spending. Light construction spending during the winter builds up balances, while heavy spending in the summer and fall reduces balances. The "Funds" reported by the Comptroller are two separate funds — the Road Fund and the Construction Funds. While both funds can be considered one unit for financial planning purposes, it must be taken into account that each fund has its own unique balance pattern and each requires its own minimum balance. The balances for the two funds must be held higher than the balance required by just one fund. Funding highway maintenance and construction is a complicated process. Improvement and construction projects take several years from the time the need is perceived to completion. Engineering, programming and construction all have to be prioritized and scheduled to fit within financial constraints over a long period of time. Other things that need to be taken into consideration include: payments for highway bonds that can stretch over a 25 year period, significant amounts in the State Police and Secretary of State budgets come from the Road Fund but are out of the control of DOT, the complexity of federal aid for highways and how much will be available as the federal government battles its own deficit. Operation expenses for the Department are determined and can be controlled from year to year. However, even this "traditional" state budgeting activity is subject to uncertainty with the possibility of a severe winter and the need for overtime for snow and ice removal. This summary only touches on the complexity of highway funding, but it still shows the fiscal condition of highway funding cannot be adequately described by a fund balance (or balances) on any given day. The amount of current obligations that have yet to be spent provide a useful perspective on a simple balance figure. At the end of December 1988, the combined Road and Construction Fund balances were $385 million, as recorded by the Comptroller. However, unspent obligations were over $720 million. Financial and program plans are now in place to draw down balances within the long-term, five-year time frame in which the highway construction process must be conducted. Current balances do not mean that revenues with current tax rates are growing adequately to fund future highway programs, they are not. The need for nearly $2 billion more in state support over the next five years to finance road and bridge programs cannot be met by current balances and/or tax rates. Compared to other states, Illinois' balances are modest. Comparing different states of different sizes and populations can be misleading if the different sizes are not somehow accommodated. Expressing balances as a percent of spending adjusts for different sizes simply and accurately. The chart compares Illinois' February 1989 / Illinois Municipal Review /Page 11 balance to those of the ten most populous and contiguous states, expressed as percentages of spending. (New York is excluded because it does not have a dedicated highway fund.) In Fiscal Year 1987, the last year of known actual data, Illinois' balance was in the bottom third of all the selected states. This comparison shows that Illinois' balances are not out of line with what Illinois' peer states believe to be a prudent level. •

HIGHWAY FUND BALANCES

Credits to: Randy K. Vereen, Deputy Director, Office of Finance and Administration Page 12 / Illinois Municipal Review / February 1989 |

|

|