|

Motor Fuel Tax Funds

By WILLIAM T. SUNLEY, Engineer of Local Roads and Streets

Illinois Department of Transportation

|

Effective August 1, 1989, Public Act 86-16 increased

the motor fuel tax from 13 cents per gallon to 19 cents

per gallon. This tax was imposed in two three-cent

increments, one became effective on August 1, 1989,

and the other on January 1, 1990. Motor fuel tax revenues experienced a significant increase during calendar

year 1990 due to this tax increase. Except for the months

of January and February last year, the motor fuel tax

allotments you received during 1990 included revenues

generated by the full six cent increase. January and

February allotments did not include revenue from the

last three-cent increment because of the two month lag

from the effective date to the actual collection of the

new revenue. We had anticipated that when the full

six-cent increase was collected for twelve consecutive

months, your allotments would increase by approximately 22 percent over 1988 revenues if fuel consumption remained essentially constant. Fuel consumption was only down 0.2% through the first nine months in

spite of high pump prices due to the Persian Gulf crisis.

The figures for the last three months are not yet available but will probably show some decrease.

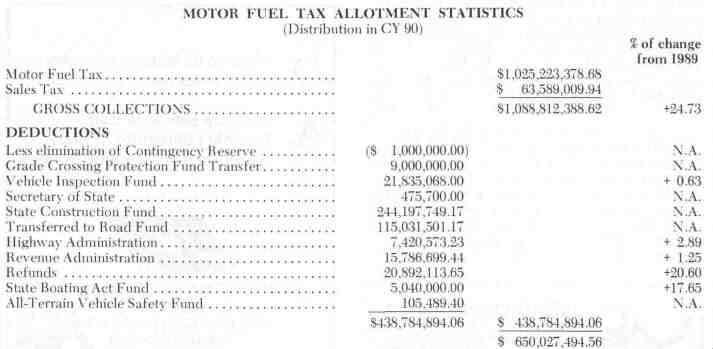

Gross collections, which included $63, 589, 009.84 of

sales tax revenue, topped the one billion dollar mark for

the first time and were 24.73 percent above calendar

year 1989. Approximately six cents of every dollar you

received during 1990 was a direct result of 1.7 percent

of the total net sales tax deposited in the motor fuel tax

fund each month.

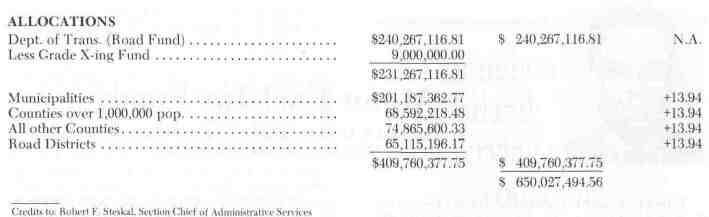

The chart below shows Illinois motor fuel tax revenues that were distributed in calendar year 1990. Municipalities received $20.38 per person, up from $17.96 last

year, Road Districts received $911.00 per mile, up from

$799.22 last year. Counties receive their allotments on

the basis of registered license fees for the previous year.

January 1991 / Illinois Municipal Review / Page 11

Each month your motor fuel tax allotment varies

directly with the total monthly motor fuel tax collection

(including the sales tax) which are deposited in the State

Treasury. Should you have questions concerning your motor fuel tax allotment or should you not receive your

monthly allotment by the end of the following month,

please call Frank McCarthy in the Bureau of Local

Roads and Streets in Springfield at (217) 785-5179. •

Page 12 / Illinois Municipal Review / January 1991

|