|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

|

By JOHN B. CRIHFIELD and J. FRED GIERTZ The Quarterly Fiscal Report:

Five reasons Jim Edgar's

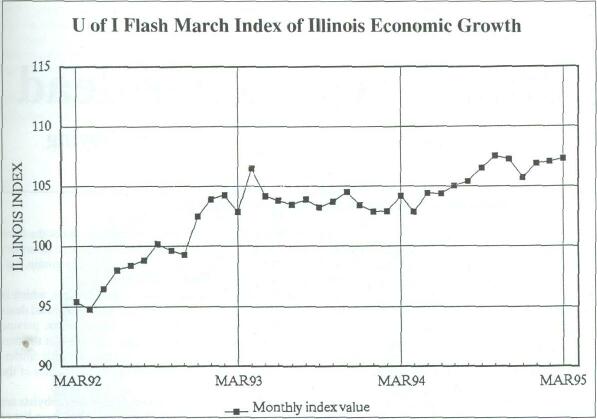

budget may work, in spite of Medicaid The Illinois economy — as well as the nation's — is in the midst of a vigorous expansion. According the University of Illinois Flash Index, the state's economy has remained strong into 1995, with the index (which forecasts future growth) registering readings near historic high levels. In recent months, unemployment has continued near a 20-year low. This should be good news for Gov. Jim Edgar and members of the Illinois General Assembly, who are now engaged in their annual budget deliberations. Unfortunately, however, economic performance has not solved the state's lingering budget problems, especially the problem of financing Medicaid. The governor's budget, released in early March, presents a bifurcated picture of the state's finances. On one hand, revenue growth for fiscal 1996 (which begins July 1, 1995) is projected at a healthy $745 million, or 4.4 percent, from General Funds sources. The state's General Fund appropriations, which cover such core state functions as education, welfare and administration, constitute 49 percent of the state's budget.

Much of the new revenue is targeted for areas of special need, including family and children's services, mental health and developmental disabilities, home care for the elderly and disabled, and corrections. In addition, the budget comes close to fulfilling the first step of the governor's campaign pledge to increase education funding $1 billion during the four years of his second term. The budget funds increased payments to the state's retirement systems as the first step in the long overdue process of reducing pension underfunding. Local governments will also receive $90 million in additional aid from revenue sharing from the state income tax, part of the 1993 legislation making the state's temporary 3 percent income tax rate permanent. If the analysis stopped here, the budget picture would be a relatively optimistic one, typical of a year of economic expansion. However, most of the state's budget problems are segregated in the portion of the budget dealing with Medicaid. Medicaid is the joint federal-state program that provides health care for the state's poor. This includes welfare recipients, as well as an increasing number of the indigent disabled and elderly population in long-term care facilities. Over the last several years, the state has accumulated a backlog of Medicaid bills amounting by some estimates to $1.3 billion that are owed to health care providers. The strategy contained in the governor's budget to deal with the Medicaid problem might be characterized as a "muddle through" approach. It envisions the continuation of some existing approaches, along with several modest reforms that together will not solve the Medicaid problem, but which may get the state through the upcoming fiscal year without the need for new tax revenues. The budget calls for the continuation of the controversial health care provider taxes that have been a key to financing Medicaid the last several years. In addition, Edgar would freeze rates for health care providers through fiscal year '96 and end bonus payments to hospitals serving a high percentage of poor patients. The budget envisions modest savings from more Medicaid recipients moving voluntarily to managed care plans. Even larger savings may be achieved if the federal government provides the necessary waiver to shift a large number of recipients to managed care. The plan does not call for a tax increase or substantial cutbacks in payments to providers. For several reasons, the jerry-built Medicaid budget just might work:

• The forbidding $1.3 billion backlog of unpaid bills is not as daunting as it appears on the surface. The backlog does not represent an annual deficit of Medicaid expenses over revenues. Instead, it is the deficit accumulated over the last several years. It will take only a one-time infusion of funds to reduce the backlog, not a major continuing increase in funding year after year. 8/May 1995/Illinois Issues

In the Flash Index, which is the analysis of the Institute of Government and Public Affairs at the University of Illinois at Urbana-Champaign, 100 equals no growth. The index accelerated to 107.3 in March, up a notch from 107.1 in February. The index is a weighted average of growth rates in corporate earnings, consumer spending and personal income. "Simply put, the state economy is booming," said John Crihfield of the IGPA.

only one-half the total amount. It should be noted, however, that the federal funds are only paid when the state antes up its portion of the funds. If things go well for the state, the "muddle through" approach could achieve a modest reduction in the backlog of unpaid bills (i.e., a speedup of the provider payment cycle) without a tax increase, and without impinging unduly on the other functions of state government. Note that the "muddle through" approach will manage, not solve, the Medicaid funding problem. It would take several years of favorable conditions to bring the problem fully under control. What might go wrong? First, if the economic expansion does not continue, the state will face severe problems. Expected tax revenues would not be realized while the Medicaid caseload would likely increase. In the governor's budget, the Bureau of the Budget projects continued strong growth in the Illinois economy for fiscal 1996, although at a somewhat slower rate than 1995. This appears to be a reasonable assumption. Although there is much talk about a slowing of the economy during the next year, there is little evidence that this slowdown is at hand. It should be noted that the Illinois Economic and Fiscal Commission, the legislative agency that monitors state fiscal developments, is considerably more negative than the bureau, although the commission is not predicting a full-fledged recession. Its estimate of fiscal year '96 revenues is approximately $150 million below the bureau's estimate. The loss of $150 million from the budgeted revenues would place severe stress on state finances. The second potential problem involves the continued cooperation of the federal government. If the federal government decides not to continue matching funds generated by the state's health care provider taxes (as they have sometimes threatened), Medicaid and the state budget in general would face an immediate crisis. Less traumatic would be the failure of the federal government to grant a waiver for the state to move many of its Medicaid patients to a managed care system. If major problems arise in Medicaid funding, it is unlikely that the firewall that has been built between Medicaid and the rest of the budget would hold. * John B. Crihfield and J. Fred Giertz are economists in the Institute of Government and Public Affairs at the University of Illinois at Urbana-Champaign.

May 1995/Illinois Issues/9

|

|

|