|

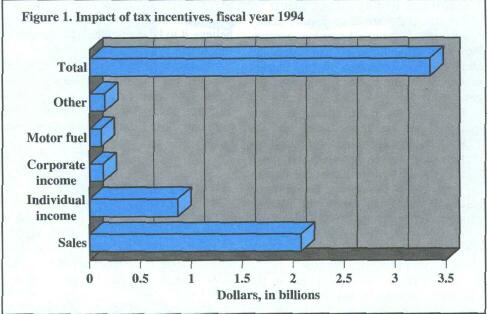

Tax incentives for various groups or purposes cost the state an estimated $3.3 billion in fiscal year 1994, according to state Comptroller Loleta Didrickson.

From breaks on sales tax for food and drugs to incentives to businesses for purchasing machinery and equipment, the benefits of tax incentives were broad-based and their impact substantial, amounting to 24 percent of total tax receipts.

Individuals received nearly half the tax break benefits, businesses about 24 percent.

Although the first tax incentives went into the tax code 60 years ago, it was the 1980s that saw the most dramatic growth, according to the comptroller.

The report on deductions, exemptions, abatements, credits and allowances is the basis for the charts on this page.

Donald Sevener

|

|