Analysis by J. FRED GIERTZ

Go figure

On balance, Illinoisans might profit

from the GOP'S attempt to balance the federal budget

The tectonic shift in governmental relationships and programs promised by the massive Republican overhaul of

the U.S. budget has been attacked by opponents as a

disaster for state governments. In fact, however, states like

Illinois could experience significant economic benefits from

the congressional plan to slow the growth of federal aid to the

states in exchange for fewer restrictions on the way that federal dollars are used.

Opponents argue that huge reductions in federal aid will

force states either to raise taxes or make painful cuts in programs vital to many Illinoisans. They contend that the

increased flexibility of block grants is unlikely to compensate

fully for the reduced funding. Robert Creamer, head of the consumer group Illinois Public Action Council, told The

Associated Press: "The

congressional budget is a

thinly disguised ruse to

shift the federal deficit on

to state and local governments. For the average

Illinois family, it will

mean less health care, a

harder time sending their

children to college and

higher property tax bills."

This analysis is incomplete and unduly pessimistic, however, because it concentrates only

on the fiscal position of

the state government and

not on the relative position of citizens of the

state. Assuming that the

country genuinely wants

to balance the federal

budget over the next five

to 10 years, the only alternative to the type of cuts

approved by congressional Republicans is a major

increase in federal taxes.

Facing these choices, the people of a state such as Illinois must weigh the advantages

and disadvantages of decreased federal aid to the state compared with increased taxes that would have to be paid to the

federal government to maintain the aid. This choice has some

interesting implications for Illinois — a state that pays a disproportionate share of federal taxes and receives a relatively

small share of federal expenditures.

The silver lining

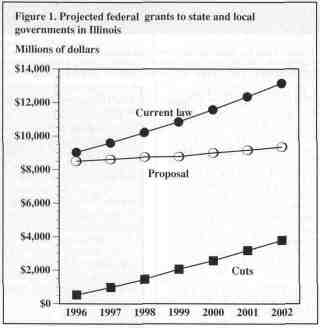

Figure 1 shows one estimate of the magnitude of the projected cuts in federal aid to state and local governments in

Illinois compared to projected aid under current law. The projected reductions would be relatively modest in 1996 (5.9 percent), but they would then increase quickly. In 2002, federal

aid would fall $3.8 billion (or 29 percent)

below the levels projected under current law.

Currently about 82 percent of federal aid in

Illinois goes to the state,

with the remaining 18

percent going directly to

local governments. Federal aid for Medicaid (a

joint federal-state program to provide medical

and nursing home care

for the poor) accounts

for the largest single

share of federal aid and

would also sustain the

largest cuts. Overall, the

loss of federal aid to the

state would result in a

loss of about 7 percent of

the state's total revenues

(including all funds) by

2002.

If there is any good

news in this story, it is

that reduced federal aid

(and other federal cut-

20/December 1995/Illinois Issues

backs) means that federal taxes will not have to be increased

substantially to balance the budget. This is a significant point

to consider for the citizens of Illinois. Estimates for 1995 suggest that Illinois' per capita federal tax burden is 15 percent

higher than the average for the United States ($5,739 vs.

$4,996). With 4.6 percent of the population, Illinois pays 5.2

percent of the federal taxes, ranking eighth highest among the

50 states. This result is understandable and not unreasonable.

Because Illinois is a high per capita income state and because

most federal taxes are based on income (and are progressive),

Illinois residents pay a disproportionate, but not necessarily

unfair, share of total federal taxes.

On the expenditure side, the results are quite different.

Illinois receives approximately 16 percent less than the U.S.

average in federal spending, ranking 40th among the states.

This ranking is also understandable since wealthier states

receive less per capita for redistribution programs than do

poorer states. In addition, Illinois is not a major producer of

military equipment, nor does it have a large number of military

bases. In regard to federal grants to state and local governments, Illinois currently receives about 4 percent of federal

grants to all state and local governments compared to its 4.6

percent of total U.S. population and 5.2 percent of total taxes

paid.

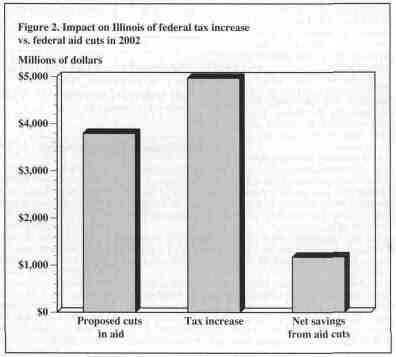

If federal taxes were increased to maintain in 2002 the current federal aid programs to all state and local governments in

the country, Illinois' share of the taxes would amount to

approximately $5 billion. This tax

increase would forestall federal aid

reductions of $3.8 billion to the state

and local governments in Illinois.

(These results are shown in Figure

2.) The net impact on the state

would be an outflow of taxes over

aid returned from Washington of

$1.2 billion. Viewed in this way, it

appears that Illinois would be better

off to accept the federal aid cuts and

to increase state and local taxes by

$3.8 billion to make up for the federal cuts.

The down side

On balance, while the "go it

alone" approach seems preferable

from a narrow perspective for

Illinois as compared with redistribution through the federal government, there are some potential negative consequences that must be considered. First, while Illinois might

gain because of its high tax-low

return position in regard to the federal government, many poorer states

would experience exactly the opposite results. For states like

Mississippi and Arkansas, the

movement to reduce grants would

generate a much greater decrease in federal aid than savings in

federal taxes. Devolution of social programs to the states,

along with reductions in aid levels, would tend to reduce the

equalizing effect that federal policy now has among states and

regions.

There would also be redistribution occurring within the

state. It is not clear the state of Illinois would choose to continue all existing programs currently paid for with federal aid

by raising state and local taxes. To the extent that program levels are not maintained in the state after federal aid reductions,

low-income citizens would suffer disproportionately, while

higher-income residents would gain by avoiding higher federal taxes. The solution to this problem, however, could be

addressed more efficiently within the state, where a dollar of

taxes collected provides a dollar of benefits to the citizens of

the state, as opposed to sending the money to Washington

where a dollar of Illinois taxes produces 75 cents in extra revenue for governments in the state.

From the Illinois perspective, this suggests that efforts to

maintain adequate services in response to federal cutbacks are

likely to be more productive than attempts to stop the changes

at the federal level — attempts that are likely to be both ill-

advised from a narrow economic standpoint and futile politically.

J. Fred Giertz is an economist in the Institute of Government and

Public Affairs at the University of Illinois at Urbana-Champaign.

December 1995/ Illinois Issues/21

Illinois Periodicals Online (IPO) is a digital imaging project at the

Northern Illinois University Libraries funded by the Illinois State Library

Sam S. Manivong, Illinois Periodicals Online Coordinator

|

|