|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

BRIEFLY

Edited by Donald Sevener

OBITUARY

Art Quern, admired public servant, dies in plane crash

Late in October, as the fall political campaign reached its peak of noise and nastiness, Illinois lost one of its quietest, most decent public servants.

Arthur F. Quern, chairman of the Illinois Board of Higher Education and the CEO of a multinational insurance brokerage, died October 30 with three crew members in the crash of a corporate jet upon takeoff in gusty winds at Palwaukee Municipal Airport in Wheeling. Quern was 54.

Three days after his death, more than 1,500 people — powerful people and ordinary people — gathered at the University of Chicago's Rockefeller Chapel for a memorial service.

After prayers and elegies from his family and two governors he served, mourners left the chapel singing "Amazing Grace."

Quern was an amazing public official. A native of New York, he began his public career as a program analyst in the field of education for Gov. Nelson Rockefeller. He also worked as a domestic adviser to President Gerald Ford. In 1977 Quern came to Illinois as the first director of public aid for Gov. James R. Thompson, moving three years later into the Capitol executive suite as director of governmental operations, an unpretentious title he chose himself; his predecessor had been called "deputy governor."

In 1983, Quern left government for private enterprise, but, unlike many who depart from powerful positions, he did not attempt to parlay his background or connections into personal gain. Rather, he relied upon his talents, intelligence, integrity and managerial gifts to rise to chairman and CEO of Aon Risk Services Companies. Equally rare, Quern wanted to continue his public service, not in high-visibility, ego-gratifying positions, but in low-profile endeavors where he could help shape policy, help influence the course of events.

"There was not one scintilla of ego gratification in Art Quern," recalls Paula Wolff, president of Governors State University, who was Thompson's program director when Quern was chief of staff. "He really had a sense of stewardship." He was a trustee of the University of Chicago and chaired the University of Chicago's Hospitals trustees, and he sat on the boards of the Illinois Housing Development Authority, the Lincoln Academy of Illinois, the Illinois State Historical Society and the Field Foundation of Illinois.

But it was at the Board of Higher Education that Quern left his most significant public legacy. Gov. Jim Edgar named Quern to chair the board in 1991, and late that year Quern wrote to the leaders of all the state's public colleges and universities engaging their commitment to an initiative he called Priorities, Quality and Productivity. The initiative soon became known by its acronym, PQP, and for the consternation it caused on campuses across the state as the Board of Higher Education encouraged, sometimes goaded, hidebound colleges and universities to think anew about what they did and why they did it.

PQP had a transforming effect on higher education, inspiring (or browbeating) campus officials to emphasize those things their institutions did well and eliminate programs that were duplicative or of marginal quality. Hundreds of programs have since been jettisoned or consolidated, hundreds of millions of dollars channeled to undertakings of higher priority. PQP has since won national attention as a model of sensible downsizing, and has even won praise from many campus skeptics or critics.

Though Quern was always able to confront his critics with intelligence and passion, he also treated them with respect and calm. "He was very humble in his approach," says Wolff. Others agree, citing his civility as one of his signature traits. "He could discuss issues without getting personal," says Mike Lawrence, Gov. Edgar's press secretary who as a journalist covered Quern's service under Thompson in the early 1980s. "He was a true gentleman, just a class act," says Lawrence, echoing a column he wrote when Quern left government service in 1983.

Lawrence says Quern personified an uncommon blend of principle and pragmatism. "He believed that good things could be accomplished by government; that is becoming a minority view these days. Art could talk about the limits of government, but also about the importance of government. He was someone who had a lot of feeling for those who had to turn to government for help."

In an era of politics by attack ad, those who turn to government for help have lost a quiet, but mighty, voice of decency.

Donald Sevener

8 / December 1996 Illinois Issues

BRIEFLY UPDATE

SURPRISE, SURPRISE

Voters like idea of capping property taxes, but by underwhelming margins

One of Election Day's surprises was provided by the property tax cap referendums on the ballot in 19 counties. Rather than the 80 percent-plus victories most people expected, the margins were narrow in several places, and voters in one county rejected the idea.

Caps did pass in 18 counties in all regions, from Winnebago County in the north to Union County in the south (see Illinois Issues, May 1996, page 30; November 1996, page 13).

Yet voters defied the pre-election predictions. State Sen. Dave Syverson, a Rockford Republican, is the legislature's leading proponent of tax caps and the driving force behind the law allowing county boards to authorize tax cap referendums. Before the election he had predicted universal, and overwhelming, passage.

Jim Nowlan, senior fellow at the University of Illinois' Institute of Government and Public Affairs and a former president of the Taxpayers' Federation of Illinois, says he too expected passage everywhere with at least 80 percent of the vote. "I thought it was an almost irresistible proposition."

The vote was less impressive. Taken together, 62.8 percent of the vote in the 19 counties favored tax caps and 37.2 percent was opposed. Tax caps passed by just 51 percent to 49 percent in Christian and Champaign counties and 53-47 in Randolph County.

Perhaps the biggest surprise was tiny Massac County in deep southern Illinois, where the vote was 63 percent "no" and just 37 percent "yes." Don Smith, superintendent of Massac County Unit District 1, said he initially figured tax caps would pass. "I was like everybody else. I knew it was a hopeless situation. [But] I said we had to do something." The school district mounted an opposition campaign, and spent $900 on newspaper and radio advertising and anti-cap fliers. Smith says the biggest factor was a word-of-mouth campaign among teachers and other school staffers. While they argued caps would hurt the schools, Smith says the absence of anyone pushing to pass the caps also helped.

Syverson says tax caps empower voters and passage in the other 18 counties is a "clear message that taxpayers want more control." As a result, he says, "they can expect their governments to be more fiscally responsible."

Tax caps won by impressive margins, with 70 percent of the vote, in Boone, Logan and Winnebago counties. Caps also passed in Franklin, Jackson, Kankakee, Lee, Macoupin, Menard, Monroe, Morgan, Sanga- mon, Schuyler and Williamson counties.

Syverson says that shows the voters will impose caps in areas where property taxes have been escalating at rates higher than inflation even though local governments in those areas predicted "the whole world would fall apart" if the voters imposed tax caps.

The effects are undetermined. Caps limit a local government's ability to increase the amount of money it gets from property taxes. The limit of 5 percent or the rate of inflation, whichever is lower, applies to the total amount taken in, not to an individual property owner's tax bill.

Syverson thinks one effect will be happy voters and the spread of tax caps since the Jaw allows county boards to place the referendum on the ballot in future elections. "Caps can work throughout the state, and we're going to see more people take advantage of that," he says. "In the next election you're going to see a lot more counties."

Anthony Man

QUOTABLE:

" It turned out to be trap shooting"

"You had to fire in front of the target and get ready for the next one, because you had 60 seconds to respond, 30 seconds to rebut. It was a sound bite debate. And I don't think it did a great service to the causes and the issues we were really engaged in in this campaign."

Illinois U. S. Senator-elect Richard Durbin describing for reporters on November 7 his assessment of the debate sponsored by the League of Women Voters and WLS in Chicago. In contrast, Durbin says, the Lincoln- Douglas-style debate held in Charleston enabled him to lay out in detail why he was running. That debate allowed for 20-minute opening statements and 10 minutes for rebuttal.

Illinois Issues December 1996 / 9

BRIEFLY

LEGISLATIVE HOMEWORK

Study comparing school performance raises question: Do we get what we pay for?

Does money make schools better?

A court decision and the fall election make the question more than an academic exercise. In October, the Illinois Supreme Court rejected a suit aimed at making school funding more equitable, thus handing the issue of school finance reform to the General Assembly. In November, Illinois voters gave Democrats a slim majority in the Illinois House, thus handing the speaker's gavel back to Michael Madigan of Chicago, who quickly vowed cooperation with Gov. Jim Edgar in finding a fair way to pay for schools.

Meanwhile, an academic exercise comparing the performance of Illinois school districts may inject the issue of school quality, student performance and dollars spent into the debate.

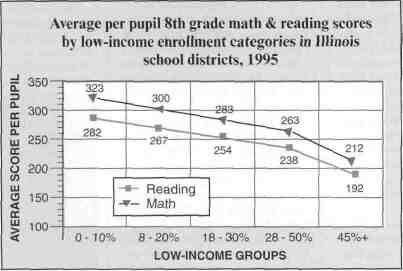

In September, three academics — economists Richard A. Stout and Martin J. Eisenberg of Knox College, Galesburg, and political scientist James Nowlan of the University of Illinois' Institute of Government and Public Affairs — released a study for the Illinois Tax Foundation comparing the performance of school districts based on their percentage of low-income students and the students' scores on a statewide achievement test. The study, says Nowlan, "probably will provide ammunition for both sides" of the debate over money and student performance, though he insists that neither side will find answers from the study that are comprehensive or conclusive.

The study aims to provide what Nowlan calls a more meaningful measure for comparing schools than overall performance on the Illinois Goals Assessment Program, commonly called IGAP. Because achievement scores from Chicago and a few other urban districts skew the numbers, most districts can claim their students are performing above average on the IGAP — the "Lake Wobegon effect," as Nowlan describes it.

The Tax Foundation research focused instead on the performance of low- income children on the basis that, in the words of the study, "The district's percentage of students from low-income families is a gauge for the educational challenges faced by a school district." A school district's proportion of low- income students correlates with mobility, parental involvement, attendance and the heterogeneity of the student body. As the percentage of low-income students declines, the achievement scores of a school rise.

The study asks the question: "Does money make a difference in achievement?" — but then backs away from it. "We cannot conclude here whether an important variable, such as instructional dollars available per student, causes measurable differences in achievement."

Source: Illinois Goals Assessment Program (IGAP) reports, Illinois State Board Education

Nowlan, in an interview, noted that those who believe money makes a difference will point to evidence in the study showing that "as you go from the top [performing] district to the bottom, it appears that most schools that are low performing also have expenditures less than the mean." On the other hand, he also noted that those who challenge the link between money and student performance might argue that the two top scoring schools both spent less than the average. Indeed, the study itself acknowledges: "We find that some districts perform better than others while spending less on instruction per student. So money is not the only variable that affects levels of educational achievement."

Nowlan concedes that those who argue in favor of increased funding for schools — as well as research demonstrating a link between dollars and student achievement — say it makes a difference where the money goes; money devoted to lowering class size, the quality of the teaching corps and such is, they contend, money well spent. Nowlan even notes that the Illinois Education Association claimed that the Tax Foundation study "somehow shows that money does make a difference."

Still, he insists the report "does not really inform the debate Over more money for schools because that was not our purpose. I don't see this report as making a case for more money or for less. But if the question is asked, maybe that will guide us to get more achievement for the resources we have."

Nowlan says that economists who "suggest that more money alone won't improve achievement have been more visible in the media than educators who should be making a strong case for how additional money will improve achievement."

Donald Sevener

10 / December 1996 Illinois Issues

|

WEB SITE OF THE MONTH Wonder who paid for all those attack ads? Check the web Now that you know who won the election, you can find out who paid for it. Advocacy Associates public interest lobbying firm in Springfield, has opened Illinois' cumbersome campaign finance apparatus to anyone with access to the Internet. Now you no longer have to trek to the offices of the State Board of Elections to complete nosy forms that inform candidates who has examined their campaign finance records and for what purpose. No longer do you need to look at mind-numbing and eye- straining microfiche (or pay an arm and a leg for paper copies or computer disks). Thanks to Advocacy Associates, you can now download complete finance records from the firm's World Wide Web site at http://www.midvvest.net/advocacy. The information is available in both Macintosh and PC formats, with clear instructions for downloading and extracting the files. Expect a wait. The database is large, and the firm cautions: "Be prepared to sit tight for awhile, or go and fix a sandwich." Those hungry for information about who influences Illinois politics can feast on the vast data now available in easily accessible form for the first time. You might also check out some of the links Advocacy Associates has available, including one to the Public Access Project, which itself offers "zillions of great research links." Among the sites you can visit through Public Access are: the Federal Election Commission, the Center for Responsive Politics, federal, state and local government, and the Declaration of Independence. Advocacy Advocates focuses its lobbying on campaign finance reform, public access and accountability, tax fairness, education funding and human services issues. Donald Sevener |

DIVIDED HOUSE

Illinois congressional delegation remains split, but GOP reps continue to gain clout

The congressional delegation from Illinois, long considered a bellwether state, clearly reflects the American public's apparent preference for divided government: Evenly split between Republicans and Democrats before the November 5 election, the state's 20-person delegation remained that way afterward, even as the division between the two parties in Congress fell to its narrowest margin in decades.

Only one Illinois incumbent seeking re-election lost: the accidental representative, Michael Flanagan, who defeated an indicted Dan Rostenkowski in the GOP "revolution" of 1994. After the party largely abandoned Flanagan, two-term state Rep. Rod Blagojevich of Chicago glided easily to office on the wings of a torrent of labor-paid advertising and the potent organizational efforts of his father-in- law, Chicago Ald. Dick Mell.

But what the alderman giveth, downstate taketh away. In the state's closest race, Democrats lost the seat Richard J. Durbin abdicated to run successfully for the Senate when state Rep. Jay Hoffman fell in a squeaker to Republican John Shimkus, the Madison County treasurer.

Illinois' other Republican freshmen — Ray LaHood of Peoria and Gerald C. Weller of Morris — both retained their seats, LaHood easily and Weller less so, narrowly defeating former state Rep. Clem Balanoff in a heatedly contested battle.

Numbers, however, tell only part of the story. The state delegation remains studded with influential lawmakers among the chamber's Republican majority. Rep. J. Dennis Hastert of Batavia, now starting his sixth term, last session shot to the eye- of-the-hurricane post of chief deputy whip. Rep. John E. Porter of Wilmette, now entering his 17th year in the House, chairs the Labor, Health and Human Services subcommittee of the powerful Appropriations Committee. And the leonine Rep. Henry J. Hyde of Addison, who last session became the first Republican in 40 years to chair the House Judiciary Committee, is expected to retain that post.

A measure of Hyde's prestige came just after the election when the conservative magazine National Review called for House Speaker Newt Gingrich, whose popularity with voters is at low tide, to step aside until his congressional ethics investigation is complete, and recommended that Hyde — respected equally by right-wing and moderate Republicans — take his place. While offering no Shermanesque declination, Hyde's office said he is flattered by the suggestion but intends to remain Judiciary chair.

Among Democrats, Jesse L. Jackson Jr. won his first full term, having gone to Congress in a special election less than a year ago to fill the seat vacated by the jailed Mel Reynolds. Opposed only by Libertarian Frank H. Stratman of Flossmoor, Jackson won 94 percent of the vote.

At the other end of the party's seniority scale is Rep. Sidney R. Yates, a Chicagoan who easily won his 24th term. At the end of this term, which he has said will be his last, Yates will be 90 and will leave Congress exactly 50 years after arriving.

Harvey Berkman

Illinois Issues December 1996 / 11

| Sam S. Manivong, Illinois Periodicals Online Coordinator

Illinois Periodicals Online (IPO) is a digitial imaging project at the Northern Illinois University Libraries funded by the Illinois State Library |