ESTIMATING STATE SHARED MUNICIPAL REVENUES

FOR FISCAL YEAR 1997

By Anne Masters, Illinois Municipal League

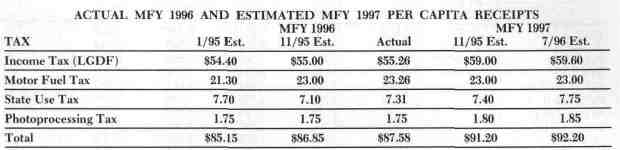

SUMMARY OF FISCAL YEARS 1996 AND 1997

For Municipal Fiscal Year 1997 (May 1, 1996

through April 30, 1997), the Illinois Municipal League

(plus an extra 10% in the first quarter due to the last

effect of the formula increase from 1/llth to 1/l0th).

We estimate total municipal sales tax will grow 5.3%, the

municipal share of the Motor FuelTaxwilldeclinel.l%,

shared use tax should grow 6.0%, photoprocessing tax

should grow 5.7%, and Corporate Personal Property

Replacement Taxes should grow 3.9%.

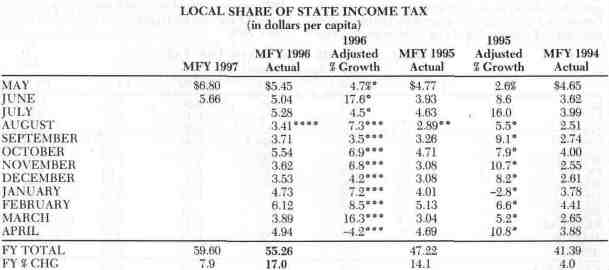

INCOME TAX

In the year ended April 30, 1996 (MRY 1996) per

capita receipts grew from $47.22 to $55.26 or 17 percent. State receipts, however, only grew 7 percent. The

other growth was caused by a 9.1% increase in the first

quarter and a 10% increase in the last three quarters due

to legislation which raised the municipal share of the

income tax from one twelfth to one eleventh and then to

one tenth of net State proceeds.

In MFY 1997 (May 1, 1996 to April 30. 1997) we

estimate State Income Tax receipts will grow 5% with an

extra 10% growth in the first quarter as the final effect of

the formula increase from one eleventh to one tenth is

felt. As a result of updating our November 1995 estimate with an additional 8 months data, we have increased our previous estimate from $59.00 to $59.60

which is a 7.9% increase over actual receipts last year.

Source: IL Department of Revenue

'Reduced to show growth in total tax, not the formula change from l/12th to 1/llth which first appears on this chart at ''

"

''First month of receipts at 1/llth of income tax versus l/12th.

'''Reduced to show growth in total tax, not the formula change from 1/llth to 1/l0th which first appears at''''

''''First month of receipts at 1/l0th of income tax versus 1/llth.

July 1996 / Illinois Municipal Review / Page 9

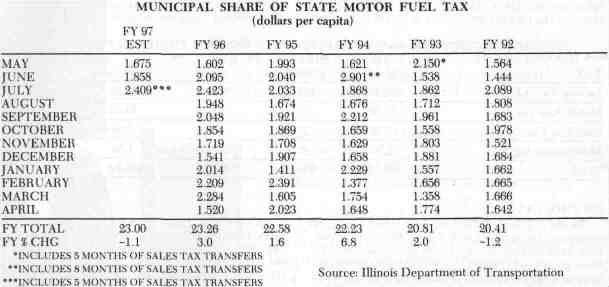

MOTOR FUEL TAX (MFT)

Actual MFY 1996 motor fuel tax revenue was $23.26

or 26 cents higher than our November estimate. For

MFY 97, IML staff estimates that MFT disbursements will decline by 1.1% to $23.00 per capita.

Motor Fuel Tax revenue has become a static, or

even a slowly declining source of per capita revenue for

municipalities as average fuel economy continues to

improve. In addition, the federal government's efforts

under the Clean Ay Act have negatively affected this

revenue source in two ways. First, Vehicle Emissions

Inspection costs are paid out of gross MFT receipts.

Second, federal efforts to impose trip reduction requirements on the Clean Air Act nonattainment areas

could also reduce receipts.

The only source of growth is the transfer each

month of 1.7% of the State sales tax into the State's Motor

Fuel Tax Fund as a proxy for the sales tax received from

sales of motor fuel.

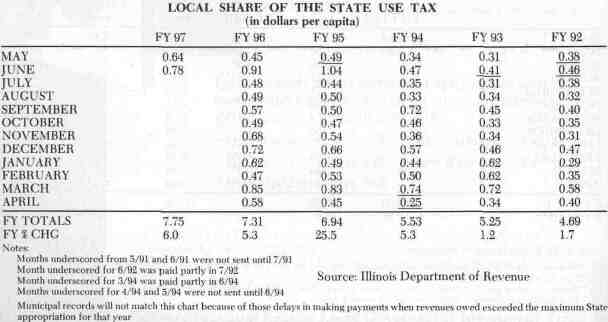

LOCAL USE TAX

The local use tax has become a rapidly rising revenue source as the Illinois Department of Revenue aggressively attempts to collect use tax on out of state catalog and electronic shopping. The increased state

auditing and voluntary use tax disclosure program appear to have been successful. MFY 1995 produced $6.94

per capita, an increase of 25.5% over MFY 1994. MFY 1996 receipts were $7.31, or 5.3% over MFY 1995. MFY

1997 revenues should grow with the sales tax. We project MFY 1997 use tax receipts will be $7.75, or 6.0% over

MFY 1996.

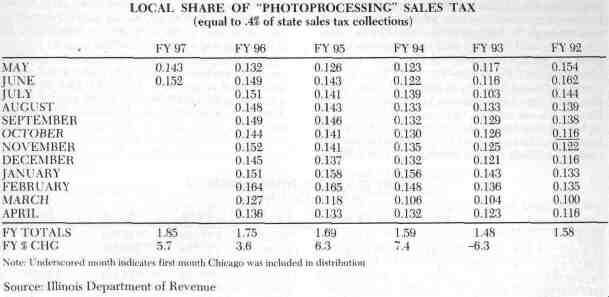

PHOTOPROCESSING SALES TAX

Photoprocessing sales tax receipts run parallel to the

estimates for statewide sales tax, as they are a percentage of total State sales tax receipts, distributed on a per

capita basis to municipalities. MFY 1996 photoprocessing sales tax disbursements were $1.75 per person, an

increase of 3.6% over MFY 1995. For MFY 1997, we

estimate $1.85 per person, an increase of 5.7%.

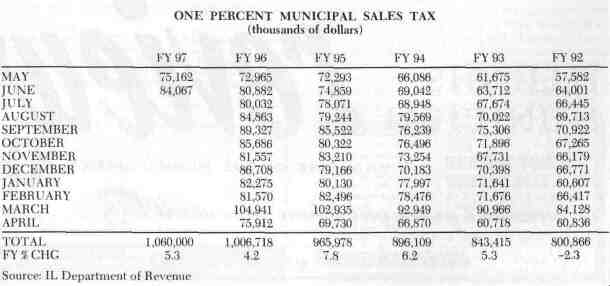

SALES, OR MUNICIPAL RETAILERS

OCCUPATION TAX (MROT)

Actual MFY 1996 receipts of municipal sales tax

increased only 4.2% to $1.01 billion for municipal sales

taxes from the 1% Municipal Retailers Occupation, Servicemen's Occupation and Use Tax (titled or registered

items only). The growth rate fell from 7.8% the previous

year. For MFY 1997 we estimate total revenue of $1.06

billion, or 5.3% more than MFY 1996.

Please keep in mind that an estimate of total statewide municipal sales tax revenue is not particularly

helpful in your forecast of local sales tax receipts. Your

receipts will vary depending on the wide swings in

retail sales as stores open and close, or the local economy expands or contracts.

July 1996 / Illinois Municipal Review / Page 11

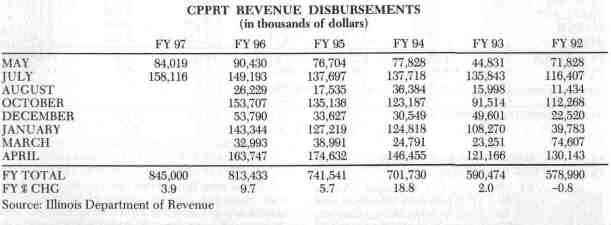

CORPORATE PERSONAL PROPERTY

REPLACEMENT TAX (CPPRT)

Since 1979, the Corporate Personal Property Replacement Taxes have been the most volatile and difficult to predict of all state-shared municipal revenues.

The reason for this volatility is that over half the receipts

come from the additional 2.5% corporate income tax.

Corporate incomes fluctuate wildly as corporations

move through the business cycle. Total Illinois corporate profits, and the taxes paid on them, can drop as

much as 30% in a recession and then grow a similar

amount during a strong economic recovery.

An additional difficulty in estimation arises due to

the availability of an investment tax credit for corporations which can only be taken against the corporate

replacement income tax, not the regular State corporate

income tax. Illinois corporations have successfully convinced the Illinois General Assembly to create this tax

credit and to provide for generous carryback and carryforward provisions which make forecasting corporate income subject to replacement tax a perilous adventure.

A measure of stability is found in the other source of

replacement revenue, the .8% tax on the invested capital

of utility companies. This revenue source grew steadily

in the '80s, but has lagged recently as utility companies

have restrained constructing new or refurbishing old

distribution and generation systems.

Over the past four years, replacement revenue has

grown from $579 million to $813 million, or 40%, but the

yearly growth was minus 1% in MFY 1992, 2% in MFY

1993,19% in MFY 1994, 6% in MFY 1995, and 10% in MFY

1996. We estimate 4% growth in MFY 1997 to $845

million.

Page 12 / Illinois Municipal Review / July 1996