Understanding Managed Care

IPEHN presents its version of "Managed Care 101" to soothe the pain and confusion caused by today's healthcare environment

BY SANDY BURK

Spurred by voter

outcry, state and

Federal governments

have begun to

mandate reform in

managed care. The

most visible example

is a guaranteed two-

or three-day hospital

stay for women and

newborns following

delivery.

Over the years, the rising costs of healthcare—resulting from a rapidly changing healthcare system—have

translated into similarly increasing insurance premiums.

By the late 1980s, annual increases for health insurance

premiums outpaced inflation, reaching as high as 19

percent at its worst point. Employers were finding that

providing health insurance benefits was becoming too

expensive.

In response, health insurers introduced "managed care," a series of

options that manage the cost of

healthcare and, thus, help employers keep premiums under control.

Managed care quickly became the

norm as enrollment in all types of

managed care plans at large employers rose from 6 percent of covered

workers in 1994 to 73 percent in

1995.

This explosive growth gave rise to

a plethora of managed care plans,

some of which unscrupulously placed

quality in a back seat to cost. As a result, "horror stories" about managed care plans, particularly health maintenance organizations (HMOs), appeared in the media. Spurred by voter outcry, state and federal governments have begun to mandate reform in managed care.

The most visible example is a guaranteed two- or three-

day hospital stay for women and newborns following

delivery.

Unfortunately, the horror stories and mandates have

caused many people to equate managed care with less

care. But that's like throwing out the baby with the

bath water! Through careful planning and investigation by employers, managed care can and does provide

quick access, quality of care and competitive cost.

What is managed care?

|

|

It's important to remember that "managed care" is a

concept. It's not an HMO or any other kind of specific

plan. The concept can best be described as a broad spectrum of cost controlling options designed to coordinate the financing and provision

of healthcare to produce high-quality healthcare for the lowest possible

cost.

Managed care has two key components: utilization review and healthcare provider networks/ arrangements. Utilization review

serves to screen against medical tests

and treatments that are unnecessary.

The screening is done by the insurance company's medical staff (using

nationally accepted standards of medical practice) to

make sure that the treatment is medically necessary

and will be delivered in the most cost-effective manner

possible. To accomplish this, techniques such as preapproval of hospital admissions and surgeries, review

of treatment received, and case management for patients needing high-cost care are employed. Utilization

review techniques arc widely used today in varying degrees in most insurance plans.

|

It is the second component—health provider networks/arrangements—that is most misunderstood and

July/August 1997 /21

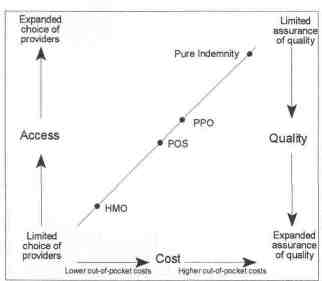

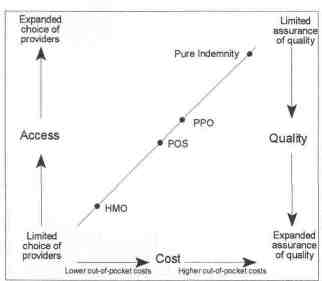

viewed with trepidation. Managed care networks represent a variety of arrangements with healthcare provider

groups which enable insurance providers to have more

control over costs. While these arrangements are constantly evolving, they can be succinctly categorized into

three basic plans: health maintenance organizations

(HMO), preferred provider options (PPO) and point of

service (POS). These plans are basically contracted arrangements which establish alliances between insurance

companies and a select group of doctors and hospitals

who agree to provide services at a discounted or fixed

cost. HMO, PPO, and POS plans all offer employers

the ability to control their healthcare expenditures. They

range in a continuum which balances cost against freedom of choice among healthcare providers.

At one end are the traditional indemnity plans which

are fee-for-service arrangements. In this arrangement,

a premium is charged for each covered person. In return, covered individuals may use any doctor, hospital

or other healthcare provider of their choice and expect

to have medical expenses reimbursed. These plans typically have the highest premiums.

+HMOs

At the other end of the continuum are HMOs, the

most tightly controlled of managed care arrangement

with the lowest premiums (see chart on page 23). HMO

plans are made up of a specific network of doctors and

hospitals who agree to care for a group of patients for a

fixed cost per member per month (capitation) and assume responsibility for providing all necessary healthcare

for a fixed premium payment without regard to the

actual cost of providing these services. The HMO establishes a network (or panel) of participating doctors and other providers who meet the plan's criteria

for participation, including licensure, training, and practice patterns. The treatments that are covered are much

broader than those covered under the traditional indemnity or PPO plans. Preventive care such as wellchild care and routine physicals are cornerstones of these

plans. Some HMOs require a deductible for hospital

charges and almost all require a minimal co-payment

for physician office visits.

Although HMOs offer the greatest control of

healthcare costs and thus the lowest premiums, they

do so at the expense of freedom to use a provider of

choice. HMO members are required to use a plan doctor or hospital in order to have their expenses covered,

Treatment provided outside of the network is not covered at all. Use of a primary care physician (PCP), also

known as a "gatekeeper," to oversee all care and treatment is common and hospitallzation or treatment by a specialist requires a referral by the PCP in order to be

covered.

While many people see the gatekeeper approach as a

negative, there are definite advantages inherent in this

process. Specifically, there is more emphasis on the patient/physician relationship, preventive services are provided, and the determination of the appropriateness of

treatment and site of care is performed before the treatment is received rather than afterwards which optimizes

the likelihood of a successful outcome. All parties—

patient, health plan and providers—benefit under this

methodology.

+ PPOs

PPOs plans came next in the evolution of managed

care and were developed to take advantage of the cost controlling strengths of HMOs while providing more

freedom of choice. PPOs retain the characteristics of

22/ Illinois Parks and Recreation

the indemnity plans including freedom to choose a provider outside the network who will be reimbursed on a

fee-for-service basis. However, PPOs offer a higher co insurance reimbursement for services performed innetwork This steers patients to specific doctors and

hospitals who have contracted with the PPO plan to

provide discounted fees and results in reduced overall

claims costs and lower overall premiums.

Park district and

special recreation

associations are

usually smaller

employers and are

not able to assume

the financial risk that

is inherent to self insurance.

+ POSs

Point-of-service (POS) plans are a hybrid of the HMO

and PPO, combining the strengths of each. In a POS

arrangement, medical providers agree to charge discounted fees. The network of hospitals and doctors is

wider than PPO networks. POS plans allows patients

to choose any doctor or hospital, but pays a larger benefit when network doctors are used. On the other hand,

POS plans provide greater cost controls than PPOs

because they function much the same as HMOs, including the gatekeeper provision. A specialist may be

used without a referral by the primary care physician

but again the coverage is reduced which increases the

employee's out of pocket cost, thus providing an incentive to stay within the network.

Traditional indemnity plans have been incorporating several of the managed care techniques in recent

years in order to contain costs: utilization review, preadmission certification, and case management for highcost chronic or catastrophic cases. The managed indemnity plans offer the least control of any of the

managed care arrangements.

Managed care arrangements are constantly evolving

because of changing economic constraints, technological advances and the social environment. As they continue to evolve, specific areas of healthcare such as

mental health (also known as behavioral health), prescription drugs, dental service and vision care often are

"carved out" and included under single-service or limited-service managed care plans. Many managed care

plans now use centers of excellence, medical facilities

that provide specialized forms of treatment for highcost chronic conditions such as organ transplants, cancer therapies, cardiac surgery. The centers are chosen

based on their outcomes and expertise, location and

willingness to negotiate discounted rates. A large number of managed care plans also provide hospice benefits

for palliative care for terminally ill patients.

|

|

Another cost-saving concept being adopted by large

employers (more than one thousand employees) is "selfinsuring," which means the employer self-funds the

cost of medical care. Employers find self-insurance desirable because of potential savings that can be achieved.

For instance, administrative costs are reduced because

employers insurers typically add risk charges onto the

administrative fees to protect themselves against adverse deviation in claims. In addition, significant cash

flow savings can be realized by taking advantage of the

lag between incurring of services and actual payment

for them. This lag can average as much as three month

and the employer is able to use the cash for an additional three months. Finally, employers have wide latitude designing the benefits of the plan and self-insured

plans typically are not subject to state-mandated benefits.

|

Park district and special recreation association are

usually smaller employers and are not able to assume

the financial risk that is inherent to self-insurance. They

may wish to have the protection of an insurance contract but may find their bargaining power regarding

options such as cost, scope of coverage and access are

limited because of their size. However, there are intergovernmental self-insured health coverage pools that

allow the typically smaller employers of the park and

recreation field to take advantage of the additional savings that large employers can generate through self insurance.

With the significant amount of money that employers spend on healthcare plans, it is important to choose

a plan that meets employees needs, does not cost more

than it should, and yet meets the employer's basic policy

objectives. To do this, employers need to make difficult decisions concerning scope of benefits and benchmarks for choosing plan administrators and provider

networks. Although the final decision rests with the

employer, assistance can be provided by a consultant or

broker.

Clearly, managed care doesn't deserve the bad rap!

In fact, it has actually served as a catalyst to provide

much broader and more proactive care. But caution is

in order when making a managed care choice.

SANDY BURK

is the benefits manager for the Illinois Park Employees Health Network (IPEHN), a

self-insured pool of 54 park districts and special recreation associations providing

healthcare coverage for its members' employees and dependents.

July/August 1997 /23