24 Illinois Parks & Recreation www.ILparks.org May/June 2007

|

"In total, Illinois has lost more than 90 percent of its original wetlands and 99.99 percent of its original prairie. Only one percent of Illinois is protected, state-owned land."

|

|

The Illinois Association of Park Districts, with a little help from its friends, took an early, pro-active stance toward setting this legislative session's agenda on funding for the preservation natural areas in Illinois.

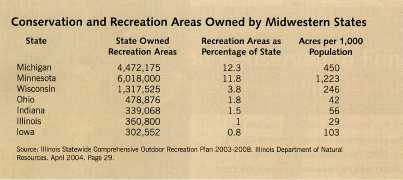

On March 1, IAPD President and CEO Ted Flickinger - along with representatives from the Trust for Public Land, the Nature Conservancy, the Illinois Environmental Council and some of the more than 130 other organizations that comprise the Partners for Parks and Wildlife grassroots coalition - announced the release of a study that shows that Illinois ranks in the bottom third of states in spending for open space and is dead last by a wide margin in the Midwest in state-owned, protected land.

|

State Representative Kathleen Ryg was one of six legislators to speak on behalf of the Illinois State Land Conservation Funding report upon its release on March 1.

|

www.ILparks.org May/June 2007 25

But the Illinois State Land Conservation Funding report does far more than criticize. It calls for new state investments of $100 million per year to protect open space and asks for a state commitment to fully fund existing programs at approximately $50 million a year. More important, the report offers ideas about how to finance that investment.

Lending their support to the announcement were State Representatives Beth Coulson, Paul Froehlich, Robert Pritchard and Kthleen Ryg and State Senators Michael Noland and Susan Garrett.

An Alarming Rate of Loss

Parcels of open land are getting more expensive as real estate values rise, and many are lost to development. The report shows that rural farmland real estate prices have skyrocketed, and, in places like Chicago's collar counties, development is happening at a ferocious rate.

In total, Illinois has lost more than 90 percent of its original wetlands and 99.99 percent of its original prairie. Only one percent o Illinois is protected, state-owned land. Illinois is sixth out of seven Midwestern states in percentage of state-owned area and is last by a wide margin on a per capita basis.

Recent history indicates that preservation efforts aren't keeping pace with the rate of development and that the expense of protecting open space will continue to escalate rapidly in the coming years; this, at a time when the difficulty of finding quality open land will increase. Consider these statistics:

|

• In the five years from 1995 to 2000, the Chicago metropolitan region lost more than 140,000 acres of rural grasslands and wetlands.

• Kendall County is now the third fastest growing county in the nation, with Grundy County ranked number 11. Will and Boone Counties are also amongst the fastest growing in the country.

• The price for farmland statewide has risen steadily, an increase of 68 percent from 2000 to 2006.

|

|

As the real estate market has boomed, land prices have risen steadily throughout the state, making open land both scarcer and more expensive. If Illinois continues to fall behind in land purchases, it will be increasingly more expensive to catch up.

Under-Funded Efforts

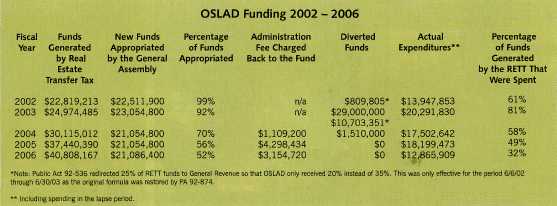

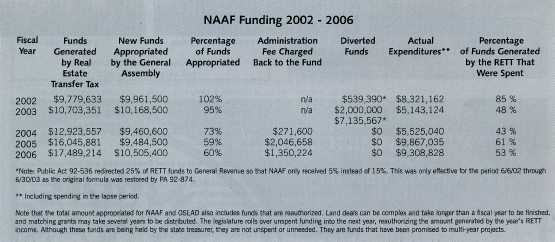

The state of Illinois already has two primary sources for open space acquisition funding in place: the Open Space Lands Acquisition and Development (OSLAD) grant program and the Natural Areas Acquisition Fund (NAAF). But the revenues actually flowing out of those two programs aren't enough to meet the state's land acquisition needs and are oftentimes less than the amount that the legislature has allocated to these programs.

From 1998 to 2006, OSLAD provided approximately $40 million to applicable projects, but local agencies had requested more than $72 million. However, in theory, OSLAD and NAAF should have had the capacity to meet the $72 million demand.

The two programs should be providing more than $50 million a year for open space. Because both the need for and the cost of open space grow when a hot real estate market fuels new development, the legislation that created OSLAD and NAAF tied funding to the Real Estate Transfer Tax (RETT). However, both OSLAD and NAAF have been severely affected by the state's fiscal problems. Despite some significant allocations of funds for conservation in the 2007 fiscal year, recent history shows that the Illinois Department of Natural Resources spent less than half of the money generated for the open-space funds by the Real Estate Transfer Tax, due to such budgetary procedures as diverted funds, charge backs and spending allowances.

Ideas for Increased Funding for Open Lands Acquisition

The financial recommendations set forth in the Illinois State Land Conservation Funding report are not made in a vacuum. Supporters of the report recognize that the state budget problems that have affected Illinois' funding for open space acquisition in the past continue to have an impact. However, despite the state's current fiscal crisis, providing funding for open space at this crucial juncture will protect rapidly disappearing open space that cannot be replaced once it is gone.

The coalition report details several economically feasible measures to provide revenue sources to be spent on land acquisition, conservation and park and recreation development. Some of these ideas are summarized below.

Recommitment to the Available Funding

Rerouting of OSLAD and NAAF dollars has undercut the state's commitment to open space, with more than $80 million diverted from these funds since fiscal year 2002. Protecting the funding to OSLAD and NAAF is the logical first step in fully funding open space acquisition and stewardship in Illinois.

Include Funds for Open Space Acquisition in Any New Capital Budget

In addition to the state's annual operating budget, there is also an occasional capital budget that includes money for big-ticket infrastructure and construction projects. These budgets are generally funded through revenue bonds, where a specific state tax revenue is dedicated to support the bond payments. Open space acquisition is logically a capital expenditure and should be included in the next capital budget.

26 Illinois Parks & Recreation www.ILipra.org

|

Use General Obligation Bonds as a Funding Source

Issuing bonds presents a number of advantages. An influx of revenue secured by bonds can provide the state with the liquidity and flexibility it needs up front to fund large-scale park and open space projects, when land is available and less expensive than it will be in the future. General obligation bonds are a popular open space acquisition financing tool at the state and local levels across the country. In Illinois, bonds could be issued in conjunction with a capital budget.

|

Dedicate the Proceeds of a Sales Tax to Natural Areas

I Illinois could increase the state's sales tax on all goods sold and dedicate the proceeds to open space acquisition throughout the state. Missouri can serve as an example. In 1976, Missouri voters approved a constitutional amendment to establish a 1/8-cent sales tax to fund fish, forest and wildlife conservation. Since the sales tax was established, it has generated more than $1.3 billion and helped the state acquire more than 450,000 acres of habitat land. The sales tax generates

|

more than $100 million annually and is now primarily used to support the state's wildlife management agency. If the same measure were adopted in Illinois, it would raise between $119 million and $126 million annually.

Bolster the Real Estate Transfer Tax

Illinois' rate of taxation for the RETT (0.10 percent) is lower than 27 of the 36 other taxing bodies that use this tax. (Wisconsin's rate is 0.30 percent. Florida's is 0.70 percent, and Connecticut's is 1.25 percent, for example.) Not all RETTs help support open space acquisition, although the tax does provide very substantial funding for programs in New York, Maryland and Florida.

|

|

www.ILparks.org May/June 2007 27

|

IAPD, working in conjunction with environmental groups and the Affordable Housing Coalition, is at the forefront of the effort to lobby for a couple of proposals before the general assembly that will increase this revenue stream to better assist local park, recreation and conservation agencies with their acquisition and development needs. Most notably, Senate Bill 445 presents a graduated increase in the real estate transfer tax, based on the value of the property being sold. A portion of the increase will flow into OSLAD and NAAF funding, while other monies will be used for affordable housing initiatives.

|

Use the Existing Sales Tax on Sporting Goods to Fund Conservation and Recreation Land Acquisition

Illinois could follow the lead of several states that help fund fish and wildlife conservation through a set aside of the sales tax paid on items that are specifically associated with hunting, fishing and other wildlife-associated recreation. This is not a higher tax on these items than other goods in the state. Rather, a portion of the funds already captured by the existing sales tax for sporting goods would be carved out and dedicated to open space acquisition. In this way, hunters and sport fishers would help provide for natural resources funding.

People Support Parks, Recreation and Conservation - And They Are Willing to Pay

Lawmakers and the citizens they represent are generally averse to raising their taxes. But records show that the people of Illinois use and appreciate the value of Illinois' parks, public recreation sites and protected natural areas. Of the residents in Illinois counties with park districts, 83 percent visited a park in the last year, averaging more than a dozen visits. And there is an economic impact that comes with the enjoyment of the outdoors. Fishing, hunting and wildlife-associated recreation generates nearly $4.2 billion in economic activity each year in Illinois.

Moreover, during the past ten years, every countywide open-space financing referendum in northeastern Illinois has succeeded. In addition, of the 80 local votes for land conservation taxes and bonds in Illinois between 1988 and March 2007, 52 passed, generating nearly $1 billion in funds for land conservation.

The Illinois State Land Conservation Funding report suggests that voters at the local level have done and are willing to do their share in the fight to preserve natural areas. State policymakers can follow suit and adopt the recommendations of this report to ensure there is constant and adequate funding to preserve natural areas and provide recreational opportunities for future generations.

28 Illinois Parks & Recreation www.ILipra.org

|