The state of the State

1976 budget: Spending to top $8 billion, zero ending balance

|

|

AVAILABLE BALANCES in the

state's general funds will be at zero by the end of the 1976 fiscal year, as shown in the budget which Gov. Dan Walker laid before the General Assembly on March 5. He proposed appropriations totaling $10.750 billion but indicated that actual spending will come to a lesser amount, $8.155 billion.

The governor stressed the major role that state grants play in assisting local governments and individuals, and he also laid emphasis on his Accelerated Building Program. Explaining an about-face from his parsimonious posture in two preceding annual budgets, the governor said he had been saving up for a "rainy day" which had now come. He insisted the borrowing he proposed would not lead to new taxes.

The budget document consists of two large books. An Accountability Budget for Illinois (the "budget book"), 333 pages illustrated by charts (four accompany this article), and Illinois Budget Appendix, 261 pages. The actual message, an estimated 2,800 words, required 25 minutes for delivery, but much of the meat of the administration program is packed away in the budget book. It shows the activities to be financed through appropriations and includes special sections on grant programs, capital spending, and the economic and revenue outlook. The appendix volume shows detail which will appear in appropriation bills. The fiscal year involved will begin July 1, 1975, and end June 30, 1976.

Budget highlights

Walker listed as the highlights of his annual fiscal plan the following:

"1. To help local units of government hold the line on property taxes while meeting their responsibilities, there will be aid to local school districts and other local governments totalling $3.3 billion, an increase of 33 percent.

That is equivalent to the total dollars provided to all local units of government by property taxes. Without it, local property taxes would have to increase substantially.

"2. To fight recession and, at the same time, meet vital human needs, there are appropriations of $3.5 billion to implement the Accelerated Building Program and other construction efforts. It will create jobs. It will not increase taxes.

"3. To improve the quality of life for all and help alleviate the burdens on the less fortunate, more pressing in this time of economic crisis, there are appropriations of:

"$1.7 billion for elementary and secondary education.

"$810 million for higher education operations.

"$202 million for the fight against crime.

"$2.5 billion for transportation.

"$94 million for direct services to working people.

"$1.23 billion for health, including mental health and

medicaid.

"$114 million for child welfare.

"S909 million for public aid grants,

"$410 million to help clean up the environment and increase outdoor recreational opportunities.

"$28 million for consumer protection."

These purposes total almost $8 billion, or 75 per cent of the entire budget.

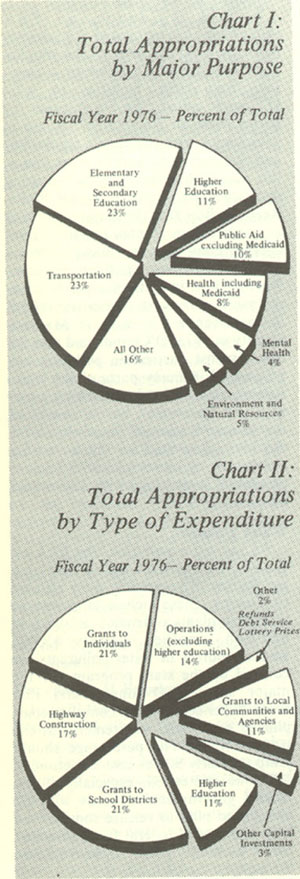

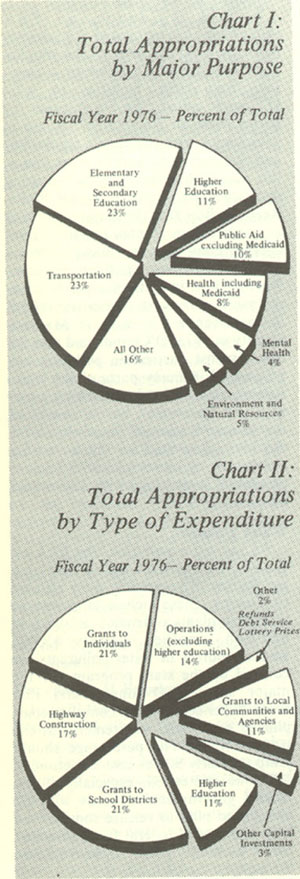

Chart I shows a breakdown of total appropriations by major purpose. Chart II illustrates the fact — which the governor stressed in his message — that major shares of the appropriations go for grants to schools, local governments, and community agencies and to or for individuals.

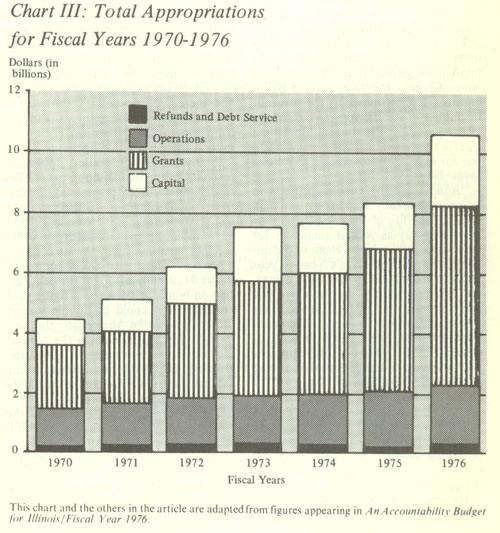

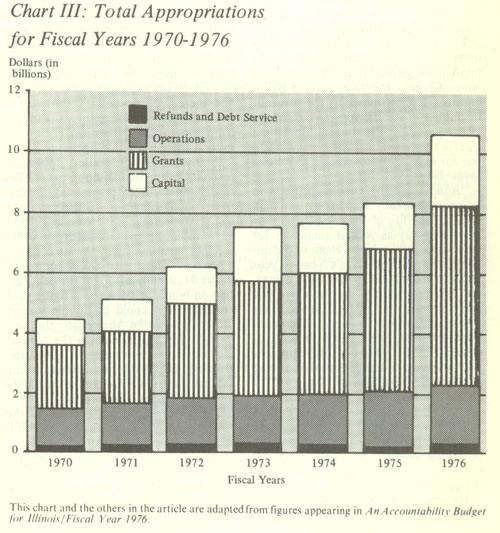

The proposed budget is sharply up over previous budgets as shown by Chart III. The increase is $2.085 billion |

148/Illinois Issues/May 1975

over the $8.665 billion total appropriations anticipated for the current fiscal year including supplemental appropriations of $261 million to finish out the year.

"The largest increases in appropriations reflected in the 1976 request are for capital and capital grant appropriations, including the Accelerated Building Program," the budget book notes (page 5). "Principal increases are $460 million for highway construction and other transportation programs, $121 million for water and sewage treatment plant construction, $59 million for state parks, and $417 million for additional school construction,"

The governor singled out other increases as follows:

$287 million more for state support of education "at all levels."

$197 million more for health and welfare.

$480 million more for improved highway maintenance, safety programs and accelerated construction.

Appropriations vs. expenditures

While the budget calls for appropriations that will exceed $10 billion, the budget book estimates that actual expenditures will total $8.155 billion. The document explains (page 4):

"Appropriations comprise the sum of requests to the General Assembly for authority for the state to enter into contracts and to spend from its revenues. Some appropriations, particularly for those capital projects such as some buildings or roads which require several years to complete, are not spent in the year first appropriated, but must be reappropriated until the projects are completed and all contracts finally paid. In that sense, the total of new appropriations and reappropriations tends to give an inflated impression of the size of state spending in any given year. In fiscal year 1976 reappropriations comprise $1.4 billion or 13 percent of the total appropriation request."

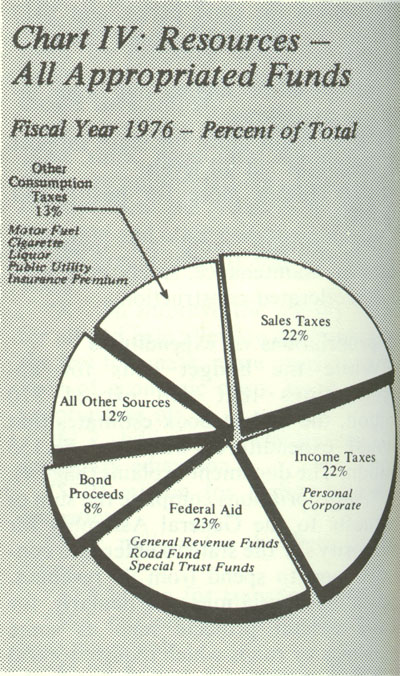

Where is the money coming from?

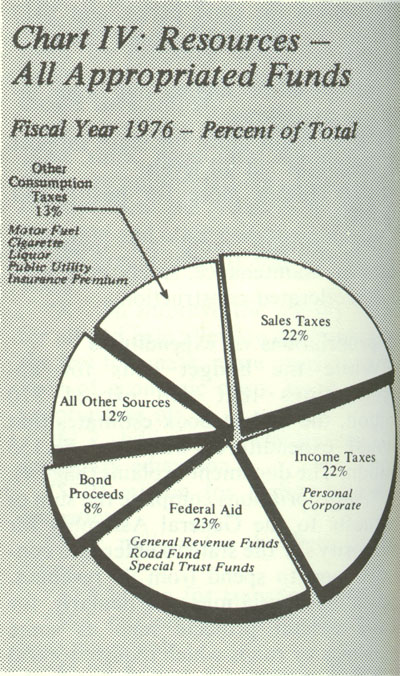

Chart IV shows the sources of the slate's anticipated income during 1976. A beginning "available" balance in all funds is anticipated in excess of $771 million. This will bring funds available to $8.464 billion. With estimated expenditures of $8.155 billion, as mentioned above, the balance at the end of the year will be approximately $308 million if tlie budget goes according to plan. But that balance will be made up of funds other than the general funds. The bad news about the general fund balance is found on page 9 of the budget book which, after predicting a $215 million balance at the close of fiscal year 1975, continues:

"During the fiscal year 1976, it is estimated that the general fund budgetary balance will be reduced to zero; that is, there will be no budgetary balance to be carried over into fiscal year 1977. The causes are several, but larger than requested appropriations in fiscal year 1975, the 'catch-up' effect of earlier inflation, causing deficiencies in fiscal year 1975 and larger appropriations in fiscal year 1976, and the impact of recession, cutting revenue growth, have eaten up the surplus which remained at the end of fiscal year 1974."

With regard to the $7.692 billion income anticipated during 1976, the budget book says this amount represents an increase of $717 million or 10.3 percent over fiscal 1975 (page 8). "Increases stem primarily from improved

yields from existing tax sources and the sale of general obligation bonds. Inflation boosts tax yields from personal income (affecting the income tax) and prices (affecting many taxes, particularly the sales tax), although these effects are somewhat offset by high unemployment reducing personal income and by recession, which cuts consumer spending, corporate profits and therefore sales tax and corporate income tax yields." An example:

Children and Family Services

The appropriation request for the Department of Children and Family Services totals $114.6 million, up $8.5 million over 1975, according to the budget appendix (page 58). An additional $3.5 million to the Capital Development Board is proposed for 80 capital improvement projects. The largest is $240,000 to connect sewage lines and water systems of Herrick House, a children's center, to the sewer system of the city of Bartlett.

The department's operations ap-

May 1975/Illinois Issues/149

propriation request is u'p $7.3 million to $50.6 million. One of the explanations is that social workers will be assigned to duty 24 hours a day to respond to emergency calls involving abuse or neglect of children. In the past, such service has been available around-the-clock only in the Chicago and East St. Louis areas. This involves adding 52 workers to the staff.

|

The department is asking for almost $64 million in grant money, up $1.5 million from 1975. Using child abuse as an example again, the department in 1975 estimates it will make available $400,000 in grants to private agencies and organizations concerned with child abuse prevention. An additional $400,000 for grants is sought for 1976.

Other activities of the department include foster family care, adoption, care of adolescents, licensing child care facilities, day care and residential care (see the budget book, pages 36-45, 248-249, and 287). Copies of the budget document can be ordered from the Bureau of the Budget, State House, Springfield, 111. 62706.

Capital budget and bond issues

The part of the budget that drew most of the criticism involved the financing of capital projects through the issue of bonds (the "Accelerated Building Program" proposed by the governor in January; see Illinois Issues, April 1975, p. 122). The budget document asserts the advantages of borrowing to pay for capital improvements as follows (page 281):

"Bond financing enables projects to be built when they are needed, and paid for over the life of the projects as they are used. Pay-as-you-go financing for needed projects subjects them to the uncertainties of the state's year-to-year revenue availability, resulting in delays. As delays lengthen, project costs rise due to inflation, adding unnecessary burdens to project financing. The use of bond financing permits the full cost of projects to be spread more equitably over present and future generations who will benefit from them."

The governor in his message contended, "These also are capital dollars which flow directly into the private sector, stimulating the local economy, providing needed facilities — roads, schools, health facilities — and creating jobs."

He contrasted conditions in his First two years with "budgets . . . prepared in

a time of rampant inflation [when] we had to hold the line on spending," with changed conditions this year. "Now, we are in a recession. A deep recession. Many of us have been speaking about maintaining a prudent balance — pointing out that like any family we must save a little money for bad times, for a rainy day .... In my book, this is the rainy day we've been protecting against .... We must spend more to meet the increasing needs of people caught in this deepening recession."

"Illinois [general obligation] bonds carry a premium triple-A rating," the budget book states (page 281). "They are the highest quality investment securities available among all state and municipal bonds."

No new taxes?

In 1975, payment of interest and;

repayment of principal on state bonds will amount to 1.5 per cent of the revenues of the general revenue fund and road fund; in fiscal 1976, this will call for about $122 million or 2.1 per cent.

The governor insisted that the bond financing will not require an increase in taxes. "These costs can be managed readily in future years from growth in state revenues from existing sources," he said. "Further, construction payrolls and increased consumer spending will generate state tax revenues ranging from $15 to $20 million for each $500 million in construction spending."

|

Analysis of a detailed table on revenues in the budget book (page 320) reveals that after leaving out income from bond sales and federal aid, the state is expecting an increase in 1976 of $298 million from state taxes and other receipts, an annual growth rate of under 6 per cent. This figure can be compared to the $122 million sought for debt service on bonds in 1976 and a figure (our estimate) that could be double that in future years. In the past, the administration has looked to the natural growth in its revenues to cover the growing costs of government. This natural increase may not be available for that purpose in the future.

The governor's final defense of the building program was that it is useful, necessary work. "It is not a make work program of government jobs," he said in his message. "Ask the farmer who loses an axle on the road to market if resurfacing rural roads is make work. Ask the commuter stuck in traffic if

eliminating urban bottlenecks is make work. Ask the parents of children who must attend dangerous, unsafe schools if rehabilitation or replacement of deficient schools is make work."

He also argued it is prudent to build now and thus "short-circuit inflation, and save many millions of dollars in future construction costs."

It is the Genera] Assembly which will weigh the legitimacy of these claims. Although authorizations for borrowing are now in existence in the bond issues acts — for antipollution, capital development, school construction, and capital — the money cannot be spent without appropriations, and the administration is not likely to borrow unless the appropriations are made. ž

150/Illinois Issues/May 1975