By JOYCE KUSTRA and ROBERT KUSTRA : She is a graduate of the Public Affairs Reporting Program

at Sangamon StateUniversity. He teaches at Loyola University

where he is director of the Center for Research in Urban Government.

Previously he was assistant professor in administrationat Sangamon State University.

Joyce and Robert are wife and husband and reside in Glenview.

The battle of the budget: Sorting out the money and maneuverswith

a lame duck governor

The legislature passed $19.4 billion in appropriations;

$461million more than the governor proposed. Using his vetopower.

Walker sliced the budget to $9.87 billion and hastied up extra money

for schools to a last-ditch effort toget his tax collection speed-up bills passed

|

GENERAL Assembly action on Gov.Dan Walker's proposed $9.909 billion budget

request for fiscal year 1977 increased the state's spending plan to $10.370 billion

by the time the legislature adjourned its spring session. The governor's

$496 million worth of vetoes as of August 15 are aimed at cutting outthe increase

of $461 million approved by the legislature in excess of the governor's original

budget request and at capital appropriations passed without adequate bond authorization.

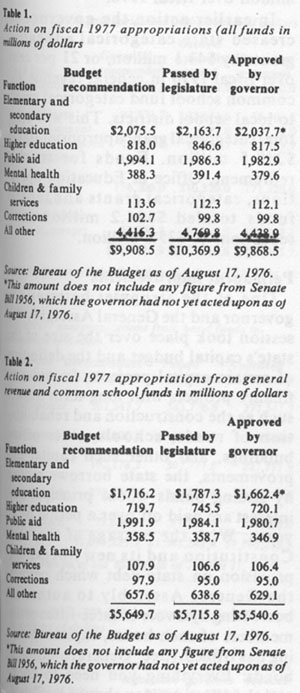

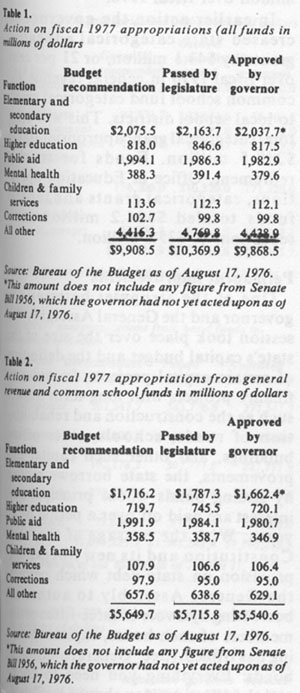

Table 1 details action on appropriations for allfunds by major function.

General fund balance

Throughout most of the 1976 fiscal year, the state's fiscal experts kept a watchful eye on the available balance of the general

funds (General Revenue Fund and Common School Fund). The general funds receive income and sales taxes and federal aid, and monies expended from the funds go for welfare, schools and operating cost of state government. Because the general

funds support most major state expenditures, it serves as the best indicator of the financial condition of the state. Table 2 summarizes final action on general funds' appropriations. The general funds' available balance has been called the state's checkbook balance because of its similarity to an individual's checking account balance. According to Comptroller George

Lindberg, as it dips below a $100 million balance, the state has difficulty paying its bills. Just such a situation occurred in the fall

of 1975 when the general funds' available balance hit new lows and some of the state's bill collectors found their payments for

goods and services being processed late.

Although the magnitude of the legislature's increases over the governor's recommendations was less than in recent years, Gov. Walker, a lame duck, has maintained the offensive. He called a special session for September 8, forcing a pre-election issue of more money for school districts this year if the legislature passes

his tax speedup bills to provide the funds.(The special session was starting at press time.)

|

In Gov. Walker's 1977 fiscal year budget request, he proposed to alleviate the cash flow problem by accelerating the collection of corporate, with holding and sales taxes and by changing the dates when the state makes particular aid payments to schools. The tax acceleration plan was estimated to inject an additional $95 million of additional revenue into the general funds in fiscal1977. The legislature rejected the plan which Walker, a Democrat, maintained was vital in order to keep the state on firm financial ground. Republican Comptroller Lindberg urged the law-makers to pass Walker's proposal along with a number of other proposals the governor submitted to the General Assembly which were included in Lindberg's 19-point austerity plan to avoid new taxes.

October 1976 / Illinois Issues / 7

In bond funds, the governor vetoed $154 in new appropriations and $151 in reappropriations, bringing the total fiscal 1977

bond budget down to $1.4 billion

Another key development to give the state's general funds a financial boost was passage of two bills designed to change September lump sum payments of about $180 million to schools to a series of quarterly payments. These quarterly payments for special education and transportation costs will eliminate the once-a-year drain on the state's treasury which was a major factor in causing last fall's fiscal crisis. Passage of the quarterly payment plan by the General Assembly and approval by the governor will lighten the crushing financial burden usually occurring in the fall.

Veto action

Relying on the veto power given him by the 1970 Constitution, one of the strongest veto provisions in the states, the governor could exercise three options as he trimmed the appropriations passed by the General Assembly. He could veto an appropriation bill in its entirety, he could single out line items in the appropriation bills, or he could reduce the amount of a line item in an appropriation bill. For the General Assembly to override a full or item veto, a three-fifths vote of the member selected to each house — 36 votes in the Senate, 107 in the House of Representatives — is required. Only a simple majority — 30 votes in the Senate, 89 in the House — is needed to over ride a reduction veto.

Putting a new twist to the amendatory veto, Gov. Walker bargained for passage of his $95 million tax speed-up plan when he gave lawmakers on August 5 two alternatives in his veto message for S.B. 3518, the school aid formula bill. (The outcome of the special session will be reported in November's magazine.) Walker said he generally supports the formula changes in the bill, but that he didn't believe the state would have the funds to finance the changes because his tax speed-up package was not passed. So, he recommended in his veto message to delay the effective date of the bill until July 1, 1977, but Walker added an alternative veto recommendation to the bill: If the legislature passes his $95 million tax collection plan there would be no delay in the bill's effective date.

In both alternatives he cut the bill's section that reduces the $56 million penalty of the Chicago schools. On August 11 when Walker announced his veto reduction of the education funding bill, S.B. 1712, he cut the $56 million item passed by the legislature to relieve Chicago of its penalty payment which developed last spring when Chicago closed schools early when they ran out of money but had already received state money to cover the full school calendar. If the legislature doesn't restore the section in S.B. 3518 to allow relief to Chicago, the $56 million appropriation couldn't be spent by the state, according to the governor.

Walker's total cuts in the education funding bill, S.B. 1712, are $84.5million, leaving the total at $1.202 billion. Another cut in this bill was tied to his earlier veto message on the formula aid changes in S.B. 3518. He cut $22 million from the funding bill which was included as a "hold Harmless "provision to assure that, after the several changes were implemented in the formula bill, that no local district Would receive fewer dollars than it had counted on before the changes. If the formula changes don't go into effect this year, the$22 million won't be needed.

The governor added that if the legislature does act so that the new education formula changes go into effect for this year, he will recommend that the General Assembly restore the "hold harmless" appropriation but at a greater amount, $25 million, because be doesn't believe $22 million is enough Walker, also proposed to relieve $25 million of Chicago's $56 million penalty if his conditions are met. The rest of Walker's cuts from the funding bill include $3 million from the basic formula total of $1.259 billion, a cut recommended by Supt. of Education Joseph Cronin, and $1 million from summer school payments and $2.5 million from impaction payments. This would bring funding of the distributive aid formula to $1.259 billion, $111million over fiscal 1976.

In earlier action the governor increased state categorical education grants by $43.1 million, or 21 percent over fiscal 1976 in general revenue and common school fund categorical grants to local school districts. This will bring total categorical grant appropriations to $248.5 million. Funds for teacher retirement. Office of Education operations, categorical grants and federal funds totaled $834.2 million after reductions of $35, 6 million.

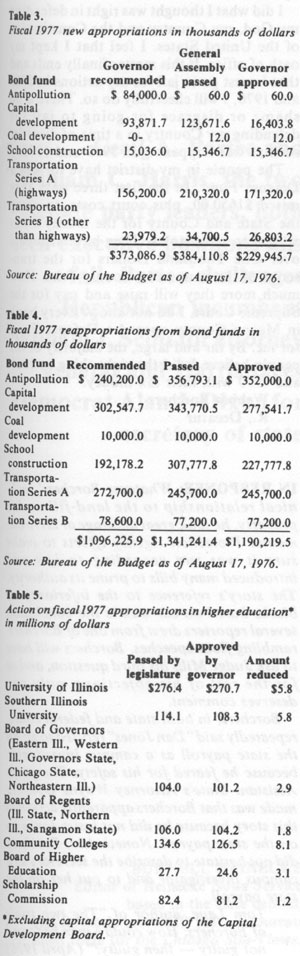

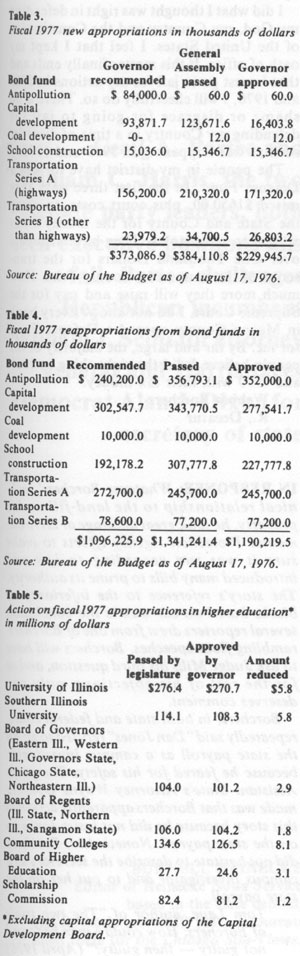

Permanent improvements

One of the struggles between the governor and the General Assembly this session took place over the size of the state's capital budget and the definition of certain capital projects. In order to finance projects with long-term impact such as the construction and rehabilitation of roads, schools, state office buildings, and other such capital improvements, the state borrows money by issuing bonds whose principal and interest are paid off over a period of 25years. With the passage of the 1970Constitution and its new liberalized provision on state debt which permits the General Assembly to authorize borrowing by a vote of three-fifths of the

members of each house, capital spending has tripled. (See "General obligation bonds: Everything you need to know and the questions you should ask," July1976 p. 18.)

Gov. Walker proposed $373.1 million new bond funded capital budget for fiscal 1977. The governor also requested$1.0% billion in reappropriations which are not additions but continuations of appropriations which originated in a previous fiscal year for projects not completed in that year and have to be appropriated each year until spent (see Tables 3 and 4). However, the governor vetoed over $171 million in Capital Development Bond Fund appropriations

8 / October 1976 / Illinois Issues

because the legislature did not enact a bond authorizations bill content with the approved appropriation bills. Some of the

propels cut include flood control, specialized living enters for the mentally retarded, and improvements in hospitals and homes for

the mentally ill and troubled children. In total, the governor vetoed$154, 2 million "1 new appropriations and $151 million in

reappropriations, bringing the fiscal year 1977 bond funded capital budget, down to $229.3 million in new money and $1.190 billion in reappropriations.

|

Some legislators disagreed with the governor on his use of bonding authority. The House Republican leadership contended that bond funds were being used to pay for items that should be financed out of current operating revenues, such as new picnic tables, minor repairs and other items which will wear out, long before the bonds will be repaid. The governor's budget bureau, on the other hand, claimed that the use of bonds for repairs and maintenance work is offset by the use of the bond money for projects with useful lives of more than 25 years, like acquiring land constructing buildings.

Higher education

Operations and grants for the state's colleges and 'universities will be funded at 4.4 per cent over fiscal year 1976 at a total of $818 million, representing a $29million cut by the governor in areas he claimed were legislative add-ons. According to the governor, his vetoes bring the higher education budget in line with his budget

recommendations as allocated by the Board of Higher Education. Table 5 gives a breakdown of action on appropriations for

state colleges and universities.

Public aid

Walker cut $3.4 million from the welfare budget and criticized the General Assembly for chopping another$7.8 million earmarked to combat welfare fraud. The funds were to be used to crack down on certain medical providers such as doctors and clinics found to be cheating the state out of millions of dollars .last year by submitting false or duplicate bills to the state for the care of welfare recipients. The Department of Public Aid budget stands al $ 1 .982 billion,

$72 million above fiscal 1976.

Mental health

The Department of Mental Health and Developmental Disabilities suffered one of the biggest general funds cuts of the governor's vetoes, a $8 2million reduction from the $391 million passed by the General Assembly. In explaining his veto. Walker proposed that $5 million of the money he cut from the funds be appropriated from the Mental Health Fund, a special fund to be used only for certain mental health activities. Such an action will inquire legislative approval this fall. The governor attributed the rest of the cuts in mental health grant money to legislative add-ons not planned for in the governor's budget.

Collective bargaining

A snag developed in the closing hours of the budget session over the controversial collective bargaining issue. The collective bargaining unit representing institutional workers in three state agencies. Mental Health, Children and Family Services, and Corrections, had negotiated a contract with the governor including a 4 per cent pay increase for a total of $10.2 million. The Senate refused to fund the wage pact, claiming that the executive branch did not have the authority to spend money without legislative approval. Pro-union forces in the House of Representatives refused to pass the agency budgets without the collective bargaining money. Finally, the House withdrew its demands, but provided some of the budgeted amount to pay for the wage hike, leaving the specific issue of collective bargaining for state employees unresolved.

Transportation

A power struggle over the controversial Regional Transportation Authority resulted in the legislature's reducing $24.3 million earmarked for RTA operations. Walker slashed another $73 million 'from the Department of Transportation budget as approved by the General Assembly. This included$9.3 million for flood control and waterway improvements, capital projects Walker said he was forced to veto because of the legislature's failure to pass authorizing legislation for bonding Fiscal 1977 funding for transportation now stands at $ 1.9 billion, a drastic $303 million below last year. However,

|

October 1976 / Illinois Issues / 9

Can Illinois avoid a major tax increase? Pressure will be on legislators to restore Walker's budget cuts

this difference is really not that significant because of the inflated 1976 transportation budget which resulted from a one-time only release of impounded federal highway funds.

Fiscal outlook

Can Illinois avoid a major tax increase? That seems to be the question everyone is asking and that is related directly to how well the state's budget is proposed, approved and executed. According to Comptroller Lindberg's monthly fiscal report for July 1976, the state ended one of its most difficult fiscal years having spent $189 million more than it took in, the largest deficit ever. The state's end-of-year available balance of $126 million was the lowest since fiscal 1969, the year preceding the enactment of the state income tax. However, Lindberg believes that the state's budget can remain

balanced if certain key elements are fulfilled. Three of these have already been realized including a 1976 general funds deficit

of less than $215 million, supplemental appropriations not in excess of $189million, and the quarterly payment plan for school aid which will do away with the huge September drain on the state treasury.

On November 17 the legislature will meet to act upon the governor's vetoes and consider the options. Walker has made substantial cuts in the operations and programs of some state

agencies. When the legislature returns there will be much pressure to restore the cuts.

However, with focus on the state's fiscal health, it is not likely that

those cuts can be restored unless the legislature approves the tax acceleration package and adds

$95 million to the general funds for fiscal 1977. Even then, there will be concern that restoring

the cuts and boosting state spending will necessitate a tax increase. ž

10 / October 1976 / Illinois Issues