The state of the State

Smallest state spending increase in nine years

Thompson's budget

|

RESTORING the fiscal health of

Illinois is Gov. James R. Thompson's

aim. In his proposed $10.0 billion

budget, a cash balance of $85 million

dollars is projected for the end of fiscal

year 1978; $37 million is expected from

revenue growth and $48 million from

the fiscal 1977 year-end balance.

In presenting this austere budget to

the General Assembly on March 2,

Thompson stressed his intention to halt

the trend towards deficit spending and

to avoid a major tax increase in fiscal

1978. But maintaining a balanced

budget without a tax increase means

sacrifice, and although the overall

budget reflects restraint, Thompson

proposed bigger budgets than in fiscal

year 1977 for some areas but at the

expense of others; this obviously shows

his priorities.

Thompson hopes to restore balance

to the state's revenues gradually and

detailed his plan for the next two years.

He recommended that the increase in

spending from the general funds over

what was spent in fiscal 1977 be kept to

$311 million in fiscal 1978 and announced that his recommendation for

fiscal 1979 would be an increase of only

$300 million over the funding level of

fiscal 1978.

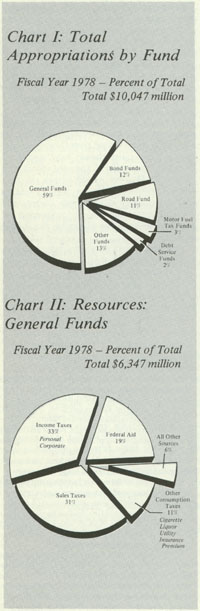

Expenditures for the different state

programs are recorded against various

funds, so the state budget appropriations are also divided by fund. Collectively, the General Revenue Fund, the

Common School Fund, the Federal

Fiscal Assistance Trust Fund and the

Federal Public Works Assistance Fund

comprise the budget appropriation fund

known as the general funds. The general

funds, in turn make up only a portion of

the total funds available for state

budgeting. Chart 1 shows all sources of

revenue for the state and indicates that

money from the general funds accounts

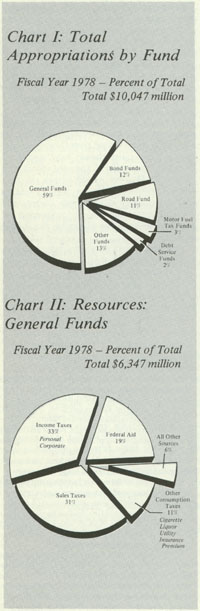

for support for 59 per cent of the budget appropriations. Chart 2 shows where

money that goes into the general funds is

obtained, and that the total revenues

expected in the general funds for fiscal

1978 is $6,347 million. That figure

reflects an increase of $426 million in the

revenues of the general funds over fiscal

1977 (See chart 3). Of that increase in

revenues, Thompson has recommended

that $311 million be spent for budget

appropriations. Thompson said he'll

need $78 million of the additional

revenue to correct the fiscal 1977 deficit

and lambasted former Gov. Daniel

Walker for three years of overspending

which caused the first negative budget

balance for the general funds in 25 years.

That still leaves $37 million in new

revenues which Thompson wants retained in the general funds and added to

the $48 million year-end balance expected for fiscal 1977. The total year-

end balance for fiscal 1978 should be $85

million, according to the governor's

proposal. Thompson plans to continue

this trend, gradually adding to the

revenue balance by limiting spending; his general funds spending limit for

fiscal 1979 will be $300 million. All of

this will happen, however, only if the

General Assembly passes appropriation

bills at the limits proposed by Gov.

Thompson's budget.

|

Of the total anticipated $6,347 million

in the general funds, Thompson has

recommended total appropriations of

$5,992 million: 43 per cent for education, 25 per cent for health (including

medicaid), 17 per cent for public aid

(excluding medicaid), 5 per cent for

other human services, and 10 per cent

for all" other appropriations from the

general funds.

Nearly all departments of government will be asked to keep a tight rein on

spending if the budget is approved by

the legislature. Funding for most departments is proposed at levels close to

24 / May 1977 / Illinois Issues

or, in some cases, below the current

funding for fiscal 1977. The departments recommended for major appropriation increases are: Public Aid (up

$106 million), Corrections (up $48.5

million) and Mental Health (up $13 million). In addition, Thompson proposed

an increase in state aid to education (up

$125 million).

The Department of Public Aid would

realize the greatest increase with a

recommended appropriation of $2.1

billion. Anticipated growths in the cost

of providing medical treatment for

public aid recipients and the expansion

of welfare fraud investigations will

account for the largest part of the

appropriation. Within the Department

of Public Aid budget, programs are

divided into three areas of activities for

budget purposes. Income assistance

would receive an appropriation of $879

million; medical assistance, $1.1 billion; and social services, $27.5 million. Public

aid administration is budgeted for

$155.4 million. No increase in benefits

for individual recipients has been made

in the past two years, and no increase is

suggested in this budget.

The largest percentage increase for

any state agency is recommended for the

Department of Corrections; its total

budget of $132.6 million is needed to

cope with the increase in admissions and

the decline in the parole rate. The adult

inmate population at state penal institutions is expected to rise to at least 13,000

and may go even higher since the

number of criminal division judges in

Cook County will be doubled by the end

of fiscal year 1978; clearing up the

backlog of cases may result in an

additional influx of inmates above the

number already expected. The major

portion of the budget is earmarked for

improving the deteriorating and overcrowded conditions in adult facilities.

This would be accomplished by hiring

additional security and program personnel, opening a new unit at the

Menard Correctional Center, renovating the Joliet Correctional Center,

converting former youth centers to

minimum security adult institutions,

spending $2 million for clothing, bedding, food service equipment, upgrading plumbing systems and adding

650 beds at the institutions. An additional $25 million in capital funds is

being requested for renovating existing

facilities.

Finally, the Department of Mental Health has a proposed $13 million

increase in a budget totaling $405

million to be used in expanding community based programs.

Most other departments would operate at budget levels close to the fiscal

1977 appropriations. Significant exceptions are the Environmental Protection

Agency and the Department of Transportation.

|

For the Environmental Protection

Agency, the appropriation would be

$296 million. This is a cut of $66 million

from fiscal 1977. The decrease is due

primarily to one-time federal funds

which were available in fiscal 1977. But

also, federal funds which are available

to local communities for the construction of waste water treatment facilities

will be relied on more heavily than other

years for EPA's appropriation.

The Department of Transportation

would receive an appropriation of $1.7

billion, which is a decrease of $245

million from fiscal 1977. The decrease is

primarily the result of a lower reappropriation for funding highway improvements currently underway from previous years' programs. Of the $1.7 billion recommendation, $1.1 billion

would be in the form of state funds — $6

million of that coming from the general

funds; $505 million would be federal

funds and $85 million would be local

contributions. In the road program,

$505 million would be used for highway

improvement, the emphasis being on

rehabilitation of existing road systems rather than construction of new ones.

An additional $117.9 million would be

designated for road maintenance efforts

such as snow removal, pothole patching, signs, and stripes. The cost to local

governments for maintenance services

would be increased to 35 per cent of the

total cost.

|

|

Realizing the state could not afford to

meet the cost of full funding for schools,

Thompson had earlier announced his

intended appropriations for education

below levels sought by the Board of

Education and the Board of Higher

Education. Thompson told the legislators, "Education is my first priority,"

and he allocated the largest dollar

amount of any budget item, $3 billion,

to this area. In fact, the appropriation is

the most provided for education in the

history of Illinois. Of the $125 million

increase over fiscal 1977, $75 million

goes towards elementary and secondary

education and $50 million for higher

education. This means that elementary

education would have almost $2.2

billion for operations and grants, and

higher education would receive more

than $864 million. In addition to these

amounts, $327 million would be used

for capital improvements at various

schools and campuses. The budget

includes increases over fiscal 1977 for

the areas of special education, vocational and regular pupil transportation,

and $2 million for desegregation assistance to metropolitan area school

districts. The State Board of Education,

when it made its recommendations for

funding levels for fiscal 1977 (as is

mandated by the 1970 State Constitution), had already advised the governor

that "if approved by the legislature, it

would fully fund all mandated state

formula programs."

Thompson's first proposed budget is

slightly smaller than former Gov.

Walker's final one. Thompson's is $70

million less than the total appropriated

for the current fiscal year. Of the $10

billion requested, Thompson said only

$8.971 billion will actually be spent in

fiscal 1978, a 4.6 per cent increase over

fiscal 1977. This would be the smallest

spending increase since 1969, when the

state income tax was adopted.

Trying to reenforce his tough fiscal

policy, Thompson told the legislators,

"This budget contains recommended

levels of appropriations. It does not

mean that all of this money should be

spent. It is our obligation, and I mean to

May 1977 / Illinois Issues / 25

In reorganization

Thompson emphasizes

mission reform and

interagency cooperation

with an eye to capturing

federal dollars

enforce it, to continue to examine this

budget through the rest of fiscal 1977

and into fiscal 1978, to make sure the

money is wisely spent. If it is not, it

won't be spent."

Thompson proposed reorganization

in his budget in the areas of law

enforcement and general services while

reserving judgment on the social services agencies.

In the social services area, he said

"mission reform" or getting services to

people who need them is more important than structural change. "It will do

us little good — in fact it will do us harm

— to wrap inefficiency, waste and

failure in a shiny new package." Thompson said he is not ready to accept the

concept of an umbrella social service

agency which would put all existing

departments and agencies under one

director. "Mission reform and interagency cooperation — especially that

designed to capture available, but

untapped, federal reimbursement

dollars — is the place to begin."

Thompson said he is creating an intracabinet group, the Governor's Council

on Social Services, which will involve

the Departments of Public Aid, Mental

Health, Public Health and Children and

Family Services. Taking a dig at

Walker, Thompson said, "We will not

repeat the examples of the last administration where the directors not only

failed to cooperate for the benefit of the

people, but oftentimes wouldn't even

talk to each other."

In a first step toward reorganization,

Thompson issued two executive orders

March 31, becoming the first governor

to exercise this constitutional power.

Executive Order No. 2 proposes to

merge the Illinois Bureau of Investigation into the Department of Law

Enforcement, which would consist of

five divisions: administration, state

police, investigation, support services and internal investigations (which

would replace the Office of Special

Investigations created by former Gov.

Walker).

In Executive Order No. 1, two departments, Finance and General Services,

would be merged into a new department

of Administrative Services. Thompson

said, "The goal of this merger is aimed

substantially at gaining better financial

management information under one

roof for the state's public service

agencies, so that the public service

agencies may, in turn, provide their

services more economically for the

taxpayer."

The governor's action had been

expected. In his budget message he had

earlier revealed the plans although he

had expressed doubts as to his ability to

meet the April 1 deadline. The proposals

fall far short of the program presented

to Thompson last fall by a Task Force

on Governmental Reorganization (see

this magazine, April 1977, page 25). If

wholesale reorganization is to come by

this constitutional route, it must come

next year.

April 1 was the deadline for the

governor to exercise a constitutional

power which allows him to reassign

functions among, or reorganize, agencies directly responsible to him. When

such reorganization would contravene a

statute, he must submit executive orders

to the General Assembly. The orders

become effective in 60 days unless either

house acts to veto them by a vote of a

majority of the members elected. The

power is spelled out in Article V, Sec. 11

of the Constitution.

Thompson said his budget will also

reduce bond sales. This reduction plus

stopping deficit spending are both

necessary to maintain investor confidence in Illinois bonds, he said. Although the state currently maintains a

triple-A bond rating, "when it comes to

the actual sale of those bonds, the

interest we have been paying during the

past year has been higher than the

normal triple-A interest rates. In fact, it

has been close to the normal double-A

rates," he said.

A general obligation bond is one that

carries the "full faith and credit" of the

state. It is issued for a 25-year period,

during which time any unpaid balance

represents future liability which the

state must pay. Thompson said he

expects bond sales of about $405 million

in fiscal 1978, compared with $535 million in fiscal 1977. The bonds will be

used to finance a road program that

includes $505 million in new projects,

down from $548 million a year earlier.

The governor also proposed reducing

the state's bond-financed capital construction appropriations from $1.5

billion to $1.1 billion. The proposed

$1.1 billion is about $400 million under

the current year's authorization level

and $800 million under the 1975-76

level. Debt service — payment of

principal and interest on outstanding

bonds — will total almost $200 million

in fiscal 1978. "The growth in bond-funded capital appropriations must

cease," Thompson said. "Bonding is not

free. The state goes into debt every time

bonds are issued, with outstanding debt

increasing from $339 million in fiscal

year 1971 to $1.8 billion this year."

Thompson said the only other option

to a tax increase is to hold spending

within revenues and to raise fees for

license plates and recreational activities

and to increase the gasoline sales tax.

"If you don't like bankruptcy as an

option," Thompson said, "then you

could choose to raise general taxes. But

there's a problem with that option, too.

Namely, I campaigned for Governor

against it. As I stand here today, I have

been Governor for almost two months

and I still can't guarantee any citizen of

Illinois that the taxes he or she is now

paying are spent wisely. How then, can

I, in good conscience, ask for more

taxes?

"If we want more new roads, if we

want to repair and modernize existing

roads, if we want to repair and replace

bridges — throughout Illinois — then

we will have to tax ourselves more to do

it. Nobody builds roads for free."

The budget document consists of two

books, the Illinois State Budget (311

pp.) and the Illinois Budget Appendix

(279 pp.). The first book summarizes the

recommended budget appropriations

by category and purpose. An overview

of the various state programs follows

the general summary and a selection of

tables and charts support the explanations. The accompanying appendix

book provides detailed appropriation

figures. The proposed budget covers the

1978 fiscal year beginning July 1, 1977,

and ending June 30, 1978.*/ Mary C.

Galligan and Therese Sheehy

*The two books can be obtained by the public

from the Bureau of the Budget, Room 100

State House, Springfield, Ill. 62706.

26 / May 1977 / Illinois Issues