By REP. DOUGLAS N. KANE

DOUGLAS N. KANE A Democratic state representative of the 50th district, he holds the Ph.D. degree in public finance from the University of Illinois and is a former news reporter.

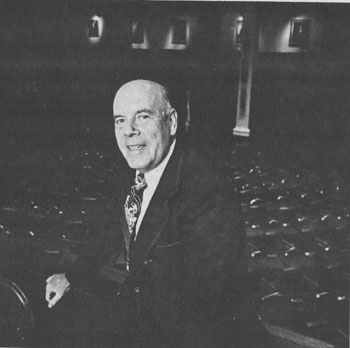

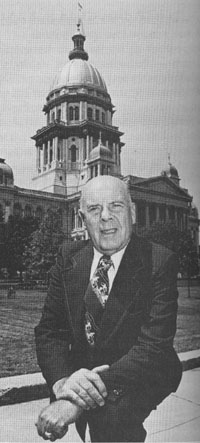

Maurice Scott

The taxpayers' man in Springfield for 30 years

|

HE walks with a sure step through the high-ceilinged, marbled hallways of the state capitol. From long experience he knows who to talk to to get things done. County, township and municipal officials from Zion to Cairo know him by sight, call him by first name and seek his counsel. When he talks, legislators, mayors, county clerks and assessors listen because from experience they know they can depend on the accuracy of what he says. More than any other single individual in the last 30 years he has influenced the level and kind of taxes that the men, women and businesses of Illinois pay.

That kind of political "power" one usually associates with governors, other high-elected officials or men with access to corporate wealth and influence. But Maurice Scott, 63, who resigned July 1 of this year as executive vice president of

|

the Taxpayers' Federation of Illinois has been none of these. His type of "power" has been peculiarly personal and built on a base that politicians who practice the politics of the new media, confrontation or patronage would not understand. Their kind of politics makes for good copy and good reading and for even better stories to recount over a beer in the back booth of a bar. Scott's politics have been much plainer. In listening to him talk one keeps hearing the words "research. . . statistics. . . programs . . . reasonable . . . effective . . . practical. . . planning. . . facts." His influence has been based on a reputation of being straightforward; of knowing what he is talking about; of being the best informed person in the room.

Studies tax cases

''I haven't told many people this," he said, "but back in 1947 I told myself I wanted to know more about the property tax than anyone else in the state. I read the law. I read all the cases. . . . The big taxpayers can afford their own

attorney to fight their taxes in the courts. But most people don't know the law. It's a good feeling when the little homeowner calls you up, and he goes by your decision, and you know you have been able to help him."

Scott was relaxed as he reminisced recently about his 30 years in Springfield with the Taxpayers' Federation, his work with state and local government, his views on politics and how he sees state and local government developing in the future. What comes through his conversation is this. He is a pragmatist. A man who wants to see government work better, but who understands the human condition and limits and is not willing to waste his time pursuing the ideal at the expense of reaching the achievable. A typical Scott aphorism reflects tenacity, moderation and a basically optimistic feeling about the political process.

"As a young man, I used to think, 'Why can't this be done right away?' But progress goes slowly, and it is probably a good thing that it does.

"Paul Powell had a good idea. If you

September 1977 / Illinois issues / 13

can't get a loaf, take a sandwich. There is a lot of merit to that. Don't be afraid of compromising. If it's a good compromise, both sides get something out of it.

"I remind people of the prom committee in high school. Nobody had it all their own way, but it was a good prom and people had a good time."

Scott was graduated from Springfield College in Illinois in 1935 and for nine years taught school in nearby Rochester. During that time he went nights to Lincoln College of Law in Springfield and was admitted to the bar in 1941. In 1946 he answered an advertisement in a newspaper, and on July 1 that year he took over the legal work for the Taxpayers' Federation. Ten years later he became executive vice president. "Taxes to an outsider is a dull subject," he says, "but it got into my blood, and I liked it."

Develops action program

In the early years the Taxpayers' Federation was largely a research group. But in Scott's words, "Research is no good sitting on a shelf, and we developed an action program based on the research." That was a natural progression which became a part of Scott's way of doing things. Research is basic. According to Scott you have to know what you are talking about — the background, the effects — but from that beginning an overall program has to be developed.

He has unkind words for public officials who too often do things on the basis of a bright idea with little knowledge of future costs and effects, and for single-issue citizens groups that form to promote or defeat one proposition. These groups usually act on emotion rather than on fact. They are "splinter groups that don't last long" in Scott's opinion, and to his way of thinking, they are not good for the political system.

Scott's schooling in property taxes was practical as well as scholarly. When he first started with the federation, property taxes were limited by the Butler formula. The formula, which Scott still takes delight in reeling off, set the taxing limit for each unit of government at the maximum taxes for 1945, divided that by 100 per cent of the 1946 assessed valuation and multiplied the result by 105 per cent. "There were only two copies of the books with the 1945 valuations," he explains. "The Department of Revenue had one, and the

federation had the other. Since administrations kept changing at Revenue, local officials came to us, and for six months every year we would help county clerks work the formula and set their tax rates."

This led to what Scott looks on as his greatest achievement — the success of the 1967 Arrington Commission in which Scott and the Taxpayers' Federation played a large role. That commission recommended and introduced 108 bills into the General Assembly and resulted in the repeal of the Butler formula, the setting of tax rate limits for every unit of local government in the state and the reform of the assessing practices in the counties. Of the 108 bills introduced, 105 were passed and signed into law — an impressive record.

The one major bill that was defeated would have required county boards to abolish all townships with an equalized assessed valuation of less than $10 million in three years. "Townships with a smaller base than that can raise just about enough money to pay their officials with nothing left over to fix the roads and do the other things a township is supposed to do," Scott says. Reminiscing about the township bill, he says, "The hearing was on the fifth floor of the Capitol. The state police had to help make room for me to get into the room in order to testify because all the township people from around the state had turned out to oppose the bill. We got one vote. I expected two. The one was a legislator from the middle of Chicago, and the bill didn't affect him one way or the other... . Maybe I was ahead of my time. Several years later Troy Kost [director of the Township Officials Association] took that same bill, reduced it to $6 million and passed it. Local officials were beginning to see that township government was in jeopardy because townships were weak and services weren't being delivered."

|

Sees consolidation

For the future Scott sees continued consolidation of local governments: "It may be 5 years away or 10 years away, but I think it's going to come. We have too many units of local government. The counties could take over the health protection districts, the forest preserve districts, the park districts and handle those functions and the functions of other special taxing districts. There

should be more road district consolidations and townships should be further consolidated. I think we have cut down as much as we can on school districts. Kids are on buses too long now." (For more on special districts, see page 22.)

Scott also sees more regional types of government developing, but ever the pragmatist interested in what will work, he notes that what might be good for a downstate rural area might not fit further north: "In some areas there is a lot of jealousy between communities, and there are still hard feelings from school consolidations that took place 10 and 15 years ago."

Scott and the Taxpayers' Federation also played a large role in the development of the Personnel Code for the state. "We were able to set some standards," he says. "They are good guidelines, good principles, but like a lot of good principles the administration has not been the way I would like."

Some people think that the Taxpayers' Federation is an organization ideologically opposed to taxes and increased spending of any kind. Not so. Scott describes the federation's goal more modestly as "working toward some control of spending, more efficiency and

|

|

14 / September 1977 / Illinois Issues

more economy." If the need can be demonstrated, the federation has supported increased taxes at both the state and local levels. In this past session the federation lent support to increasing the maximum property tax limits for county corporate funds, forest preserve districts and cemetery districts. In the past the federation supported passage of the state income tax and removal of the referendum requirement for imposing the local sales tax. The key word in Scott's vocabulary is "reasonable." If the need can be demonstrated and the increase is "reasonable," the Taxpayers' Federation has given support.

Although Scott has worked with elected officials all his life, he has held only one office himself— delegate to the 1970 Illinois Constitutional Convention, in which he represented the counties of Morgan and Sangamon. "Everyone should have to run once for public office, but I wouldn't want to do it again," he says. "I liked the campaigning, and I liked making the speeches. What I didn't like was having to be at three different dinners on the same night. I wasn't used to the double dealing. People would come up to me, blow their beery breath in my face and tell me they were all for me, and I knew perfectly well they weren't." Summing it up, he adds, "I liked serving. I liked the debates. I thought I knew something about politics, but I learned." One thing that left a lasting impression on Scott was the "amazing discipline of the Chicago delegates. The Republicans don't have it."

After watching the legislature in action for 30 years, Scott's reaction is that "the public gets a better shake today. The ordinary person can sign a witness slip, have his say before a committee and be listened to. That person would have been ignored in the old days. There is much more attention by the media today to the legislature. Actions and votes are out to the people right now. There is more accountability. The bosses don't have as much control. Party leaders are not as influential."

As one might expect, Scott does not advocate more government spending — unless he is convinced the need is there: "Democracy is the best form of government, but history tells us they tax themselves out of existence .... The state income tax that was passed just eight years ago will bring in $ 1.8 billion this year, yet the state is broke. I can't

explain it, and the people don't understand it." He believes that "at all levels of government there are things that can be cut out, but it's going to take strong backbones on the part of officials and the people. More and more the first question is being asked first: 'What does this cost, and who's going to pay for it?'"

Predicts tax increase

In spite of what he sees as a generally more conservative attitude on the part of voters and officials toward public spending, Scott predicts that state taxes will be increased in the next few years:

"The income tax will be going up and possibly also the sales tax. The pressures for increased spending for education, both higher and elementary and secondary, will be too great. And with the condition of our highways, the gasoline and motor vehicle taxes will have to be increased."

He sees the increases coming in the next several years, "maybe '81." Although he recognizes the pressures that are building, Scott is ambivalent: "We are told that the people are demanding services, but often that's imaginary, When I drive into a city, I have yet to see people lined up outside city hall demanding more services."

Scott talks easily and with obvious enjoyment about his life's work and takes pride in showing off the scrapbook he has compiled of pictures and letters having to do with the testimonial dinner given him by his friends in Springfield this June. The banquet hall was crowded, and political leaders and friends from throughout the state attended. Scott says, "I've had a good life; good kids, a good wife. I've enjoyed my work and met a lot of good people."

His rules for being a successful lobbyist are simple: "At all times be honest. When you open your mouth, have the facts and figures to back up your position. If you don't respect the people you are working with, get out of the game." In many ways Maurice Scott represents the best of what has become known as the "old school of politics" — a school in which accomplishment counts more than headlines; solutions are preferred to confrontations; something that works is better than an untested idea, and allowances are made for human weakness. Maurice Scott's presence will be missed at the State House.

September 1977 / Illinois Issues / 15