SPECIAL STAFF REPORT

Holding the line to build up end of year balance

Appropriations for 1978

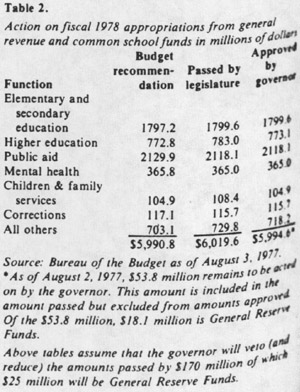

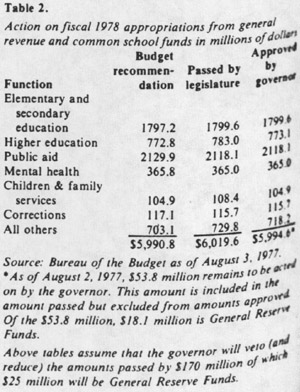

THE 1977 General Assembly came incredibly close to giving the governor the budget he requested for fiscal year 1978. The lawmakers passed appropriations totalling $10.751 billion, about $700 million over Gov. James Thompson's recommendation of $10.047 billion. (In the state's critical general fund, appropriations passed totaled $6.020 billion, only $29 million over requests.) The governor then cut $170 million by veto, of which $114 million was in so-called pork-barrel highway projects in the Department of Transportation's budget. Final appropriations then totaled $10.581 billion, $329 million over last year.

General funds' balance

The Bureau of the Budget (BOB) estimates the general funds' balance after this year's spending will be about $85 million — a low figure for this most important indicator of the state's financial health. (It represents only

|

|

about three days worth of state spending for welfare, schools and operating expenses,) Still, it is a much larger amount than many experts had been predicting, including some who claimed a large deficit in the General Revenue Fund and Common School Fund was unavoidable. It is considered essential that the state maintain a balance in the general funds, because they are the key funds through which the state pays for goods and services and consequently avoids a tax increase. Appropriations from the general funds totaled $6.020 billion, 3 per cent higher than last year. The governor cut $25 million of this, bringing the final approved total down to $5.992 billion, recommended in his budget.

Fiscal 1978 will be the first time since 1974 that the state's overall budget will be balanced. Yet, the predicted year-end $85 million general funds balance is one of the lowest since 1962, a precarious situation that will require a tight budget next year to avoid a general tax hike.

|

Fortunately for Illinois citizens, a tax hike would be so unpopular that all those in government will do almost anything to avoid it and thus avoid being saddled with the blame for it. At least partly because of this the state will manage in 1978 to live within its budget, not spending above present revenues for operational expenses. Herein may bean example of the two party system operating at optimal efficiency, competition is fierce to meet constituent's demands and avoid political suicide. (The state didn't live within its budget in 1975 thru 1977.)

Vetoes

As mentioned earlier, the governor vetoed the "pork barrel" part of the $700 million in appropriations added by the legislature above his requests, but he left in $536 million of those budget increases. Of the $536 million, $120 million was money reappropriated for construction already begun. Another $155 million was added for the Cross-town Expressway which was not in Thompson's original budget. (Its absence may have been a bargaining tool for the governor in reaching an agreement with Chicago Mayor Michael Bilandic to build Chicago's highway and to control state spending.) Another addition to the governor's budget was $12 million added in bond funds to rehabilitate and replace dangerous bridges on rural highways. Thompson said these projects are a "high priority" to him. Other budget increases included $66 million in bond appropriations for new Capital Development Board Projects, and $43 million in federal money for the Office of Manpower and Human Development — mostly for public works jobs.

The governor's vetoes totaled only about $170 million, a relatively low

|

|

22 / October 1977 / Illinois Issues

|

|

figure that reflects his success in getting the budget he wanted. Thus legislators made good on campaign rhetoric declaring that the state needed to hold the line on spending. (For evidence of the commonality of this viewpoint among legislators see the articles in this magazine in June and July of 1976, before the last statewide elections, on fiscal viewpoints of the candidates.)

Budget experts say it is unlikely that the legislature will override much of what the governor vetoed. It takes a three-fifths vote of the membership in each house to override a full or item veto -36 votes in the Senate, and 107 in the House. Reduction vetoes require only a simple majority — 30 votes in the Senate, and 89 in the House.

|

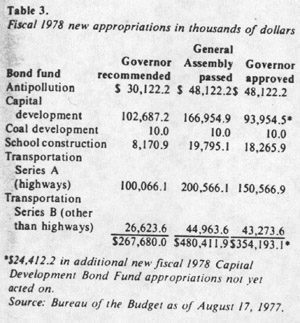

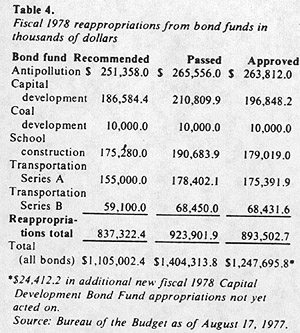

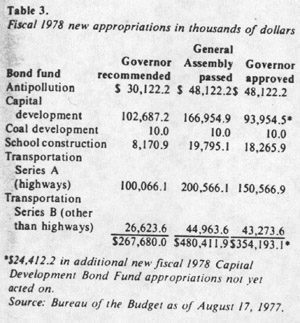

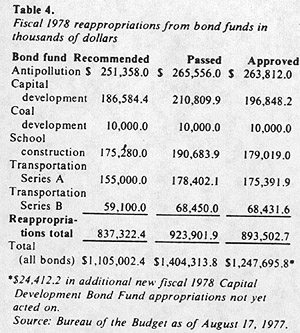

Bond funds

The state's bonded indebtedness continued to grow again this fiscal year, as it has every year since the 1970 Constitution with its liberalized state debt provisions went into effect. The governor proposed $267.7 million in appropriations for new bond funded capital projects. He also asked for $83 million in reappropriations which were not additions but continuation of funding for construction projects begun in past years. But Thompson cut $26.7 million from the $110 million new capital projects bill that the General Assembly sent to him.

Meanwhile, projections indicate that the state will sell $100 million less in new bonds than in the last fiscal year. This amount the state will offer for sale and doesn't indicate a declining demand by the market for state bonds. Experience shows that all bonds offered are sold; Illinois bonds are in relatively high demand because of their AAA credit rating with Standard and Poor's, and Moody Investors Services.)

Projected fiscal 1978 bond sales total $405 million, compared with $535 million in 1977. Gov. Thompson is expected to ask for a $20 million increase in new bond authorization — to $890 million — to meet the level of appropriations approved from the Capital Development Bond Fund. Such bond sales are a form of long-term state borrowing for capital improvements such as construction and upkeep of roads, schools, state office buildings, waste water facilities, and new capital facilities for food production research. Bonds are only marketed, though, when cash needs are generated by projects already planned, budgeted and appropriated.

The state pays off its bonded indebtedness with debt service payments, which are paid from the General Revenue Fund and the Road Fund. Nearly all Illinois bonds have a 25-year repayment schedule, calling for the state to pay back four per cent of the total principal each year, along with interest on the outstanding balance. This fiscal year's debt service payment total will come to $193.5 million, up $46.3 million from last year, and up $93.3 million from two years ago. An alarming drain on the budget is thus developing, increasing each year, as the state pays back bond purchasers who essentially loaned the state money for projects begun in the past.

|

Elementary and secondary education

Elementary and secondary education funding was the focal point for the biggest fight the legislature had this session. The battle centered on at what level the state school aid formula should be supported. The formula is designed to provide $ 1,260 for each student in the state, but pro-rating has reduced the level in recent years. This year the formula will be funded at about 96 per cent of the full amount, at a state cost of $1.292 billion. While this is a blow to many hard-pressed local districts, since the aid formula supports most education programs including teacher's salaries, it was not unexpected. Local districts had been told not to expect more than about 93 per cent of full funding. They presumably planned around this figure and will manage to stay out of debt and avoid a tax increase.

The total elementary and secondary appropriation was $2.210 billion, or $77 million more than last fiscal year.

|

|

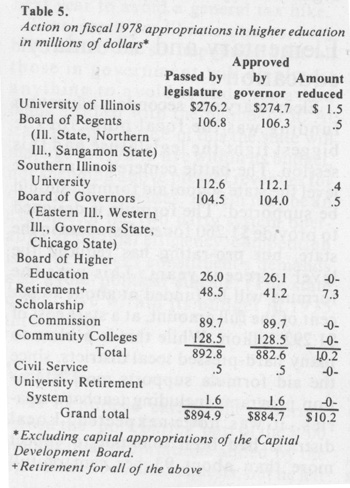

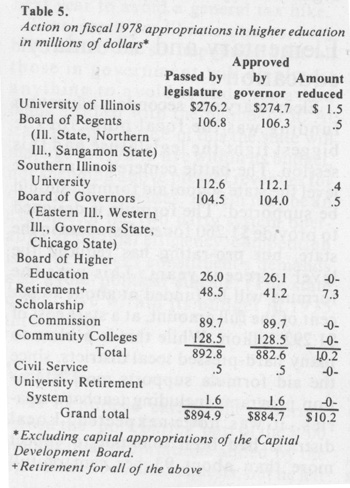

Higher education

Dollarwise one of the biggest appropriated increases over last year for any state agency went to higher education. Overall funding for higher education was raised by $71.5 million, or 8.8 per cent. The governor made cuts amounting to $ 10 million, $7.3 million of which was for increased funding of the university retirement system to meet accrued liabilities.

Approved by both the universities and the General Assembly, was a new tuition hike of about $90 per year at all of the state's colleges and universities. Bringing in $9.5 million in new income, the tuition hike will be almost offset by a $10 million raise in state scholarship funding. Part of the need for the scholarship funding boost is due to the tuition increase. But there will also be an increased number of students on scholarships this fiscal year, creating an indirect funding boost for highereducation.

Public aid

Welfare appropriations increased by over $ 100 million over last year, an incremental boost which even an "austerity budget" could not prevent. Most of the increase is to go for medical assistance, due to higher hospital costs and a larger number of people eligible for

October 1977 / Illinois Issues/23

medical assistance who do not otherwise receive public aid. The Department of Public Aid's budget topped the $2 billion mark again this year, at $2.121 billion, very close to the $2.132 billion originally proposed by the governor. It was cut by $7 million when the legislature denied an asked-for increase in the Aid to Families with Dependent Children (AFDC) program, and $1.8 million was cut out for non-therapeutic abortions, which are no longer covered as legitimate welfare medical expenses (see H.B. 333 in August Legislative Action).

Corrections

Expected because of plans for prison construction and improvement, the Department of Corrections received the largest percentage increase in budgeting for any agency, over 20 per cent. Appropriations went from $100 million in fiscal 1977 to $122.2 million in fiscal 1978. Most of the new spending requests were for additional staff personnel in adult facilities, where inmate populations have skyrocketed by 52 per cent in the past two years.

Mental health

The Department of Mental Health and Developmental Disabilities received a $404 million appropriation, a $13 million increase over last year's $391 million in appropriations.

Transportation

The governor signed a $2 billion Department of Transportation budget, after slashing out $114 million for much-needed road projects benefiting legislator's home districts. But that still left $317 million more than Thompson had originally requested for DOT, $155 million of which was for the start of construction on the Burnham Corridor, from the Stevenson Expressway to 69th Street in Southwest Chicago. The budget includes $ 1.5 billion for state and local road improvements, $263 million for public transit, $34 million in state and federal money for airports, and $14 million for waterway projects.

|

Collective bargaining

Certainly one of the major budget accomplishments of this year was not an

action by the legislature at all, but rather a formal agreement reached between Thompson administration officials and the largest public employees union, the American Federation of State, County and Municipal Employees (AFSCME). The 27,000-member union agreed to "bet on the come" on a pay hike for this fiscal year, thus making a raise dependent upon the state's ability to pay. The unique agreement calls for a one-time bonus of $ 100 per employee, and a raise of $10 per month for every $10 million that state revenues exceed projected figures at the end of this fiscal year, which ends June 30, 1978. On top of this, a $50 a month pay boost would also be awarded each employee beginning in fiscal 1979, at a cost of $31 million from the General Revenue Fund.

The pact — which is the first raise for state workers since 1974 — allows the state to live within its budget this year, meanwhile satisfying the salary demands of every major union doing business with the state.

|

|

However, an order by the governor extending the union-negotiated raise to workers in state agencies not represented by union bargaining, was challenged by Comptroller Michael Bakalis July 27. Bakalis withheld the raises from more than 16,000 workers and asked Atty. Gen. William J. Scott to review the legality of the governor's action extending the raises to non-union employees. Scott ruled the raises were legal. His August 12 opinion said they weren't retroactive pay hikes and did not violate the separation of powers doctrine. Scott's opinion is not legally binding; however, Bakalis announced he would accept it as final.

24 / October 1977 / Illinois Issues