Legislative Action By GARY ADKINS

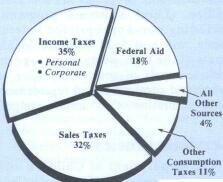

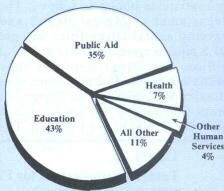

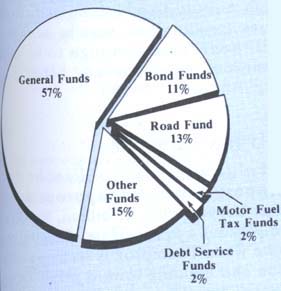

Thompson balances state's budget THE LARGEST budget in Illinois history, totaling $11.26 billion, was proposed by Gov. James R. Thompson, March 1. If the legislature follows Thompson's plan the budget will be balanced. For the second year in a row there will be a surplus in the all-important general funds, which are derived from state income and sales taxes and federal aid, as well as taxes on consumption of cigarettes, liquor, public utilities and insurance premiums. An available cash balance of $96 million is projected in general funds for the end of fiscal 1979, $ 11 million higher than at the end of fiscal 1978. Because of this, Thompson said no new tax increases will be necessary for fiscal 1979, since the day-to-day operations of Illinois government, financed through the general funds, will be covered. Funding increases The overall 4.7 per cent increase in appropriations will mean a funding increase for most areas of state spending. There will be a $ 194 million increase in education appropriations; $121 million more than last year for transportation, and $135 million more for public aid. The cost of operating state agencies will increase 9.9 per cent, a boost that Comptroller Michael J. Bakalis called "excessive, almost double the rate of inflation." Bakalis the Democratic nominee for governor would receive a 12.2 per cent appropriations increase for the operation of his office as comptroller under Thompson's budget. Because state programs are financed from various funds, the budget divides appropriation requests by fund. The largest and most important area of funding is called general funds, which is comprised of the General Revenue Fund, the Common School Fund, the Federal Assistance Trust Fund and the Federal Public Works Assistance Fund. Expenditures from general funds support local school aid, higher education, public aid, operations of state institutions and administrative costs for all three branches of Illinois government executive, legislative and judicial. For fiscal year 1979, general funds make up 57 per cent of state appropriations (see chart 1). Chart 2 shows where the state gets its resources for the funds shown in chart 1. Chart 2 excludes old resources the available balance in all state funds at the beginning of fiscal 1979 and the transfers from one fund to another within state government (where the state, in effect, pays itself). Chart 3 shows the origin of the money in general funds. It illustrates that the state income tax and the state sales tax account for around a third each of the general funds, apiece, the income tax being the largest at 35 per cent. With a total of $6.735 billion in fiscal 1979. general fund revenues will be $388 million higher than in fiscal 1978, Gov. Thompson has proposed that the state spend $377 million of that increase. With an $85 million balance to begin with, fiscal 1979 should thus end with a $96 million balance in general funds, quite close to the $100 million margin believed necessary by budget chief Robert L. Mandeville. Chart 4 shows how general funds are to be appropriated under this budget plan. A total of $6,438 million will be appropriated. Of this total, 43 per cent will be for education, 35 per cent for public aid, 7 per cent for health, 4 per cent for human services and 11 percent

26/May 1978/ Illinois Issues for all other appropriations from the federal funds. Reappropriations Appropriations are not synonymous with spending. The total cost of new capital projects must be appropriated in the year they are begun. Since many capital projects usually take years to complete, any amount not spent from one year's appropriations must be reappropriated the next. The fiscal 1979 budget recommends a state spending level of $9.88 billion $ 1.38 billion less than the amount to be appropriated. That 1.38 billion is money not expected to be spent in fiscal 1979, but which has to be appropriated because it will be spent in the future.

Most departments of state government will receive more funds if the legislature approves Gov. Thompson's budget proposals. The largest appropriation increase is recommended for education, up $194 million to a total of $3.2 billion. Education Education will cost about one-third of the entire state budget. In addition to $3.2 billion, nearly $300 million is earmarked for capital projects for the construction of educational facilities. The education budget is divided between elementary and secondary education ($2.302 billion) and higher education ($959 million). Both figures are below the funding levels sought by the state education boards. The Board of Higher Education had proposed a $94 million spending increase, while the governor only agreed to an increase of $79 million. The Board of Education wanted a $192 million funding boost, but Gov. Thompson said $103 million would be enough to provide full funding for all state-mandated programs and for the formula for general state aid. "The amount of state funds that I am recommending in my budget will provide an estimated $901 of state aid per pupil, an increase of 8.8 per cent over fiscal year 1978," the governor said. State-mandated programs include: transportation, special education, school lunch, bilingual teaching and drivers education. The higher education budget will provide for salary raises for employees raises of 8 per cent for university staff, 10 per cent for civil service workers at universities and 6 per cent for community college staff. The budget also provides increases in funding for the university retirement system, bringing it in line with other state retirement plans, none of which are fully funded. Welfare In the area of welfare, Gov. Thompson recommended a 5 per cent increase in the standard grant level to recipients. This cost-of-living increase will cost the state $49.7 million on top of the present level of income assistance, for a total of $881.8 million. The average cash award will go up from $79 a month to $83 a month for the 728,000 eligible persons in the Aid to Families with Dependent Children (AFDC) program. The public aid appropriation will total $2.1 billion for fiscal 1979, $1.2 billion of which is for Medicaid. Medicaid will cost $100 million more this year than last year. The governor said the growth is needed to cover rising medical costs "plus rate increases for some medical providers." Administration of the Department of Public Aid will cost $168 million, $11 million more than last year. Much of the added cost is to pay for expansion of the staff training program. The Department of Transportation May 1978/Illinois Issues/ 27 would receive a total appropriation of $2.2 billion. Highway construction would account for $642.7 million of this, while highway maintenance would account for another $130.1 million, and local assistance programs will cost $516 million. (Local assistance programs, including non-appropriated federal funds, will cost $630 million.) Major goals of the transportation program include repair of nearly 550 miles of urban and rural roads and replacement or rehabilitation of 265 unsafe bridges. Service agencies The Department of Children and Family Services will get appropriations totaling $120.6 million, along with $20.3 million from other resources. "Other resources" include money from grants, gifts, donations and bequests. The budget for DCFS includes a 22 per cent increase for counseling, advocacy and homemaker services. It will allow for rate increases for foster care in private agencies and foster homes. Other human service agencies will get appropriations boosts as follows. The Department of Mental Health and Developmental Disabilities will get $23.5 million more, to a total of $427.2 million. The Department of Public Health will receive $3.2 million more, to a total of $81.2 million. The Dangerous Drugs Commission will get $1 million more, for a total of $14.6 million. The Department on Aging will get $7.6 million more, for a total of $33.8 million. And the Department of Veterans Affairs will get $.5 million more, for a total of $21.5 million. Corrections The Department of Corrections' proposed budget totals $149.8 million, $140.3 million of which requires appropriations. The appropriations increase will be $18.7 million. Construction of two new medium security prisons will begin in fiscal 1979. The cost of this and other construction is to be appropriated to the Capital Development Board, paid for by the sale of state bonds. Capital projects for the Department of Corrections will require appropriations of $83.2 million in fiscal year 1979.

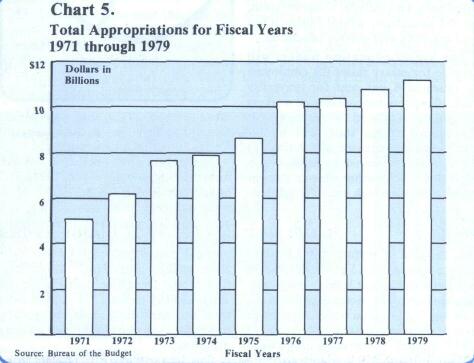

Aside from the prison construction, there will be little cause for increased bond sales. Overall, the budget recommends $400 million in general obligation bond sales, $5 million less than last year. The governor believes that this is a sustainable bond level, and according to Bureau of the Budget Director Robert L. Mandeville, "We'll probably stay here for a while." One of the few big agencies to receive a spending cut under the budget plan is the Environmental Protection Agency. EPA would get $37.4 million less in appropriations this year under the governor's proposal and a total budget of $288.9 million. The only program to be cut would be wastewater treatment grants to localities: this is because fewer reappropriations will be needed for federal funds in the sewage treatment plant construction program, EPA's largest program. Finally, the Department of Labor will undertake an expanded program of creating jobs. Gov. Thompson called employment "the heart of this budget He called on the Department of Labor to place more than 170,000 lllinoisans in jobs next fiscal year. Of the $140.2 million budgeted for the labor agency, "$138.2 million is for the Bureau of Employment Security to administer unemployment benefits and help Illinoisans find jobs," he said. The budget proposed is a 20 per cent increase for the department. Gov. Thompson is easing off on last year's successful "austerity" spending program. While he continues to give high priority to education and corrections tions spending, this year he says there will be revenues enough to be more generous toward every other code department. No tax increases Politically, it is a brilliant budget, proposing increased appropriations over last year of $ 1.25 billion, but doing so without a tax increase. Coming at a time when Thompson is seeking reelection and building toward a 1980 presidential bid, this budget would allow for increased state services without sharp tax boosts. It would also give a raise to welfare recipients and more operating expense money to executives in powerful state agencies. And it helps rebuild a needed cushion in the general funds to avoid financial disaster, These are important accomplishments. Yet when one examines chart 5, showing the mounting cost of state services in the last nine yearsthe 1979 total is nearly double that of 1971 -one wonders how much longer the state can go without a tax increase before the quality of government services must suffer. The last tax increase came with the introduction of the state income tax in 1969. That was a time when a hard choice had to be made: should the state stop doing some things or doing them so well, or should it increase revenue through new taxes? Another such decision may soon be needed. 28/ May 1978/ Illinois Issues

|

|||||||||||||||||||