|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

| Illinois coal: who runs the industry? |

|

By James Krohe Jr. |

| Coal is the energy source that will dominate the future, and conglomerate and oil interests in Illinois coal already seem to have established substantial control. |

[This is the second of four articles on Illinois coal. Article one presented an overview; articles three and four will examine technological and environmental issues and government policy-making, respectively. -- Eds.]

DURING the gloomy winter of 1978, most Americans read headline news about the coal industry and its 111-day national strike authorized by the United Mine Workers of America. Miners picketed, the President fidgeted and coal companies threatened while coal stockpiles dwindled. Needing a hero but finding only villains in the protracted haggling, most readers impatiently turned past reports from the National Coal Policy Project (NCPP), releasing its recommendations for the best use and development of America's vast coal resources.

Beginning in the summer of 1976, some 70 academics, industry experts and environmentalists met under the aegis of Georgetown University's Center for Strategic and International Studies. Their goal was to find ways to mine and burn America's vast coal resources economically without damaging its environment or the health of the people who mine it.

When they had finished, the NCPP had pinpointed Illinois, the rest of the Eastern Interior Coal Field and southern Appalachia as America's center of gravity for future energy sources. Illinois, they noted, had a lot of coal, and most of it was conveniently suited for underground mining -- which is inherently less destructive of the land than strip mining and which, with precautions, is nearly as safe. Illinois also had plenty of water which is needed to convert coal into synthetic substitutes for petroleum and natural gas. There were excellent rail and water transportation networks in Illinois, and the state enjoyed close physical access to industrial markets in the East and, increasingly, the South. Illinois, it seemed, was to be America's Saudi Arabia of the 1990's.

Who owns it?

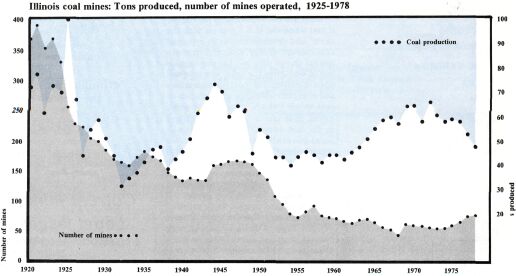

There have been booms in the Illinois coal fields before, of course, the latest beginning with World War II and lasting for seven years. Illinois mines produced about the same amount of coal in 1978 as they did in 1941. But tonnage is virtually the only way in which the industry today resembles that of 37 years ago. The changes are significant: Who owns Illinois coal? How is it mined and where? Who burns it? The answers to these questions will determine how the next coal boom will affect Illinois.

In the last 37 years, coal mining has become Illinois' invisible industry. The coal that was dug, blasted and scraped out of the ground in 1978 was estimated at a worth of more than $1 billion. Only agriculture reaps a richer harvest from Illinois' land. In the northern two-thirds of the state where most of its people live, there hasn't been much mining done since the 1920's, and much of what is done, now as then, is done below ground or in the remote countryside. Most Illinois mines are buried deep in the southernmost third of the state where the land has a thin arable layer. People there have learned to farm coal for a living rather than corn. Ten of the state's 17 top coal-producing counties are located south of Interstate 70 connecting Terre Haute and St. Louis. Among those ten are four giants: Perry, Randolph, Franklin and Jefferson counties. They alone accounted for 51 percent of Illinois' 1978 production.

Before World War II, Illinois coal was used in Illinois largely to make steel, drive railroad locomotives, heat homes, generate electricity and run factories.

August 1979 / Illinois Issues / 4

|

But changes have transformed the industry. Rising affluence produced a market for electrical convenience and luxury appliances; the transportation economy converted to oil; and, more recently, government environmental regulations have reshaped the industry. It is largely because of air pollution rules that only 39 percent of Illinois' coal production is now burned in Illinois; the rest is exported. Predictions were made in 1941 that this shift would occur. The State Geological Survey reported in 1941 that "the enactment of an ordinance in the city of St. Louis for the elimination of smoke has had the effect of shifting the sources of coal supply [away from Illinois]." And, homes now are heated by cleaner fuels -- natural gas or heating oil or electricity. Industrial customers (except for users of coking coal, a specialty item in Illinois' coal inventory) have become as scarce as the smokestacks that used to punctuate urban skylines.

Among its major markets, only the demand for Illinois coal for generating electricity has increased since World War II. Indeed, the modern coal industry is almost wholly dependent on its electric utility customers. Of every 100 tons of coal dug in the state in recent years, roughly 85 tons is "steam coal" destined for the boilers of power plants. As generating plants got bigger in the 1960's, so did the mines that fed them. (Measured by output, the average Illinois mine in the 1970's is about twice as large as its prewar counterpart.) Smaller mines could not compete for contracts to fill trains of up to 100 coal cars that were beginning to trundle into power station coal yards. Those contracts went instead to huge new postwar operations -- some of which were financed on the strength of long-term contracts with single customers. Monterey Coal's No. 1 mine at Carlinville, for example, was fathered by the Commonwealth Edison Co.'s mammoth Powerton generating station near Pekin, and the Old Ben Coal Co.'s new No. 25 mine at West Frankfort is similarly obligated to the Georgia Power Co. According to one industry source, virtually all Illinois coal is now dug under the terms of long-term contracts. |

|

Instead of serving many markets, then, the Illinois industry today serves a relatively few large ones. The concentration of demand and the economics of long-term contracting agreements have accelerated a trend toward fewer but bigger mines that had been evident in the U.S. for decades. In Illinois, where the average mine output in recent years has been nearly ten times the national average -- the No. 5 or Springfield-Harrisburg coal and the No. 6 or Herrin coal -- lie in extensive, flat beds as thick as nine feet. It is, therefore, relatively easy to mine; so easy, in fact, that the larger underground mines, like Peabody Coal's No. 10 mine at Pawnee, have tunnels sprawling for up to 50 miles.

The magnitude of the trend towards fewer but bigger mines can be read in production statistics. As noted, Illinois production was about the same in 1978 as it was in 1941. In 1941, that coal came from 143 mines employing 30,258 miners. In 1978 it took only 71 mines and 17,861 miners.

Less is more?

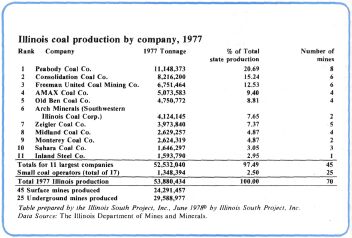

The concentration of production into fewer but bigger mines has been paralleled, if not outpaced, by a concentration of mine ownership among fewer but bigger companies. A copyrighted study entitled Who's Mining the Farm? was published in 1978 by the Illinois South Project Inc., a not-for-profit community organization in Herrin. Based on more than six months of field work by its staff, the Illinois South Project study revealed that of 1977's production of 53.9 million tons of coal, 97.5 percent was produced by 11 of the 28 companies working in Illinois. The combined production of the other 17 (2.5 percent) was smaller than that of the smallest of what might be called the industry's Big 11.

The Illinois South Project further revealed that 10 of Illinois' Big 11 are subsidiaries of national companies whose roster reads like a corporate Who's Who. The biggest producer in Illinois in 1977 (and in the U.S. as well) was the Peabody Coal Co. whose eight Illinois mines produced something like 11 million tons in 1977. Peabody was part of Kennecott Copper's empire before the Federal Trade Commission ordered Kennecott to sell it in 1977; now it is owned by a holding company comprised of insurance, aircraft and mining companies.

After Peabody comes (in order of coal production in Illinois): the Consolidation Coal Co. (1977 production in Illinois: 8.2 million tons) which is the nation's No. 2 coal producer and No. 1 coal employer and is the corporate child of the Continental Oil Co., or Conoco; Freeman United Coal, which is owned by the General Dynamics Corp., the arms conglomerate; AMAX Coal, owned by the Connecticut metals refiner AMAX Inc. and the No. 3 U.S. coal producer; Old Ben Coal, a subsidiary of Standard Oil of Ohio since 1968; Southwestern Illinois Coal, which traces its ownership back through Arch

August 1979 / Illinois Issues / 5

Minerals to the Ashland Oil Co.; Ziegler Coal, which since 1973 belongs to the Houston Natural Gas Corp.; Midland Coal, an ex-Peabody subsidiary bought by ASARCO Inc. from Kennecott; Monterey Coal, owned by Exxon; Sahara Coal, the only independent coal company in the Big 11; and Inland Steel, which supplies its Indiana Harbor coking works from two mines in southern Illinois.

|

Who mines it? The roster of companies now actually mining coal in Illinois comprises only a partial list of national firms, moving into Illinois' coal fields, and some of those firms have never been engaged in mining before. Research by Illinois South Project revealed that coal lands or underground reserves are being bought up by conglomerates (International Telegraph and Telephone; General Electric), steel companies (United States Steel), railroads (Illinois Central Gulf; Penn Central; Missouri Pacific), and electric utilities (Commonwealth Edison; the Tennessee Valley Authority). But most of the buyers are energy companies like Occidental Petroleum (through its subsidiary, Island Creek Coal, the nation's No. 4 producer); Boston's Eastern Gas and Fuel Associates; Kerr-McGee Coal, child of Oklahoma's Kerr-McGee Corp.; MAPCO Inc., an Oklahoma natural gas company; Mobil Oil; ADA Resources Inc., a Houston gas concern working through a subsidiary, Morris Coal; NICOR Inc., a holding company that controls Northern Illinois Gas Co.; Gulf Oil, owner of the Pittsburgh & Midway Coal Mining Co.; and Shell Oil. Some of these companies are acquiring Illinois coal as investments; some, like steel makers and |

|

Of these firms, only MAPCO, ADA Resources, Shell and Eastern Gas have announced specific plans to open mines in Illinois. But their presence in Illinois is an endorsement of the optimistic conclusions reached by the conferees at Georgetown University in 1978 about the role of Illinois coal in America's energy future.

Of all the changes the industry has undergone in the postwar era, the entry of the giant oil companies has caused the most stir. Oil industry planners realized, many years before the rest of the country, the commercial implications of petroleum's imminent exhaustibility. Big oil has been active in Illinois coal since 1966 when Conoco bought Consolidation Coal. Since then, Exxon, Standard Oil of Ohio and Ashland Oil have acquired mines in the state, typically by buying up existing mining firms. Among Illinois mines, the 14 owned by the four firms accounted for more than a third of the state's output in 1977. Acquisitions recorded by the Illinois South Project suggest that the oil companies' share of Illinois production in the next 20 years will, if anything, increase.

In the opinion of a growing number of critics, oil and coal don't mix. Davis Freeman, chairman of the TVA, the nation's biggest coal consumer, warned the Senate Antitrust Committee this spring of the threat of oil company control of coal and uranium markets. In promoting one fuel over another, Freeman said, "Oligopolists may have an incentive to withhold production, hamper innovation or even engage in illegal collusive behavior."

That charge has been echoed in Illinois. In March, U.S. Rep. Paul Simon, the Democrat from the coal-rich 24th District, complained that, "Many of those responsible for controlling the sale of coal are the major oil companies. If lack of coal production and sales sends oil prices up, these companies do not stand to lose." Simon suggested "greater diversity" in coal ownership might remedy the problem.

Why expand production?

Much the same charge has been made by officials and members of the Illinois United Mine Workers of America. They complain, for example, that the two coal companies whose contracts with Commonwealth Edison were canceled last year did not press Gov. James R. Thompson to petition the president to force ComEd to continue to use Illinois coal as he is allowed to do under Section 125 of the federal Clean Air Act. Instead, officials of the two companies -- each of which is owned by an oil company -- seemed concerned only with maintaining their then-current production levels, not expanding them. "A company that made its money selling coal only would have been pushing to sell all it could," said a union official recently. Given those facts, some observers have concluded that the oil companies have borrowed a page from OPEC's book and chosen to leave large chunks of their coal holdings underground on the assusmption that they will be worth more in the future.

Oil firms have denied any desire to stifle inter-fuel competition. Ralph Bailey, the chairman of Conoco, reminded

Auguts 1979 / Illinois Issues / 6

the New York Times in May that there is a current coal surplus of up to 150 million tons nationwide, and that oil subsidiaries so far control only about 20 percent of the national coal market. "That's a totally ridiculous position," Bailey said of the charge. "At the moment, competition is as severe as I've ever seen it."

TVA Chairman Freeman's worry about oil companies' abilities to "hamper innovation" is shared by state mine union officials, among many others. Oil companies (the argument goes) have a multibillion stake in not pushing badly needed alternatives to petroleum-based fuels made from coal which might cut into their own oil business. Because of this conflict, discussion continues in Washington (led by Sen. Ted Kennedy) about legislation requiring oil companies to divest themselves of their coal holdings.

But according to Bailey and other oil company executives, the oil companies bring to the coal operations precisely the kinds of capital and technical expertise needed by the infant coal conversion industry. Conoco has summed up the case for oil's involvement in coal in an advertisement published in national magazines in June: "Getting more out of coal takes skills that go beyond coal .... At a time when some people in government are trying to limit oil company participation in the coal business, Conoco's efforts to reduce dependence on foreign oil demonstrate [that] America will get more out of coal if any company that wants to can put its skills into coal."

Why western coal?

An equally nagging controversy in Illinois is interregional competition in coal. In 1977, a half-dozen companies, whose mines accounted for more than half the state's production, also owned coal mines in the West. This fact has led the United Mine Workers and others to publicly question these companies' commitments to their Illinois markets. It is argued that coal companies working in the West can make more money selling western coal than Illinois coal, mainly because most western mines are not unionized. Further, when sales from Illinois are hampered by restrictions on the use of high-sulfur coal, as they have been in recent years, companies with mines in both Illinois and the West can substitute western coal for their Illinois customers.

Illinois utilities imported an estimated 18 million tons of coal from western mines in 1978. It is now known exactly how much of that coal was delivered by companies selling western coal in their own Illinois backyards. Industry spokesmen say that the share is small. One bit of evidence was revealed in the summer of 1978. Hearings were called by Gov. Thompson to determine the economic impact of a decision by the Commonwealth Edison Co. to import western coal for its Powerton plant, and testimony showed that Arch Minerals,

August 1979 / Illinois Issues / 8

the owner of Southwestern Illinois Coal, one of two Illinois mines supplying Powerton, had sold coal to ComEd from two of its Wyoming mines during the previous five years. It has since been revealed that ComEd has another contract with Arch Minerals for 1.6 million tons per year through 1982. The Arch Minerals agreements, however, comprise only about 10 percent of the western coal ComEd expects to buy every year. This still leaves an unanswered question: How much western coal is being sold by companies with mines in Illinois to customers in other parts of Illinois' market area? In the absence of harder evidence, the public is left to take the word of a Peabody Coal spokesman who admitted to the media in February that while his company would sell its western coal in Illinois if asked, "We'd much rather sell western coal in the West."

Western coal is likely to be only a temporary irritant, however; the issue of interregional competition was rendered largely moot by the latest federal clean air regulations requiring scrubbers on all new coal-fired plants.

What about the future?

But what about the future? The chairman of Ashland Oil (which owns two southern Illinois strip mines through its subsidiaries) explained to the New York Times in April, "We're still convinced that one of these days the government is going to wake up to the fact that the only real indigenous energy resource we have now is coal, and that it will get on with the show."

What are the implications for Illinois if and when the U.S. "gets on with the show" and develops coal as its principal 21st century energy source? There are several things that will happen regardless of who owns the coal: New jobs will open in coal mining, coal transportation and coal conversion; the appreciation of coal values (which, measured by retail prices, have increased four or five times in the last decade) will give state and local governments vast new taxable wealth; land use and environmental issues are likely to become chronic talking points as mining expands; in some parts of the state land may become more valuable for the coal beneath it than for the soil atop it; and escalating land prices may squeeze small farmers off the land. Coal companies may become major political forces in some counties by virtue of their land ownership. This is an ominous prospect for communities in coal lands. On virtually every issue except making money, the companies and communities are in conflict. Issues like land reclamation, severance taxes, unioncontracts are usually in dispute, and often government must reconcile the conflicting interests. This is not a new problem to Illinois coal nor to Illinois industry generally. During the mine wars of the 1930's, for instance, a sheriff in a coal county was more likely to be described as a "Peabody man" or a "UMW man" than as a Republican or a Democrat. But critics worry that the domination of Illinois coal by national and international industrial giants means anything but "business as usual" in coming decades.

In a 1978 address, Richard Newcomb, a professor of mineral economics at West Virginia University, noted, "Looking forward, few observers in 1890 would have predicted [the bituminous coal industry's] revival and, indeed, its dominance by the year 2000. Today, one can be sure that coal will revive and dominate the domestic energy scene until the problems of other fuel choices can be resolved." Who will dominate coal in that period is already known. To what extent, and by what means, it is up to Illinois to decide.

James Krohe Jr. is associate editor of the Illinois Times in Springfield; he specializes in planning, land use and energy issues.

August 1979 / Illinois Issues / 8

|

|