|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

|

By NORA NEWMAN JURGENS Insurance: less liability, but not reform The legislature's compromise solution to the crisis in commercial liability insurance arrived on the governor's desk July 31. Uncertain about its effectiveness, the governor would not act on the bill until after a series of meetings with business representatives. At press time, August 19, he had not yet acted on the bill.

"NOBODY liked it so it must be good" is a common definition of a compromise. It's also an apt description of the final legislative solution to the state's liability insurance crisis. The hottest topics in an otherwise lackluster session, the affordability and availability of commercial liability insurance were handled with kid gloves by the four legislative leaders. They wanted to help business and local government without infringing on the rights of victims. The so-called crisis with liability insurance was approached from every angle: • Changing the law that governs lawsuits involving "wrongful acts" (torts) not covered by criminal law or contract law. Business and local government supported this approach. • Expanding tort immunities for local government. This approach, of course, was backed by local government. • Creating new regulations for the insurance industry. Consumer interest groups advocated this solution. The two chambers of the legislature used different approaches resolving the issues, reflecting the different philosophies of the Democratic and Republican leaders. Both minority leaders, Sen. James "Pate" Philip (R-23, Wood Dale) and Rep. Lee A. Daniels (R-46. Elmhurst) came out early in favor of business-backed measures to radically change the state's tort laws. But the Democrats command the votes and vowed that no such changes would occur. President Philip J. Rock (D-8, Oak Park), who has more than once in his career taken a strong stand separate from House Speaker Michael J. Madigan (D-30, Chicago), was determined to allow full deliberation of all the different views on the insurance crisis. The Senate dealt with a series of bills introduced by the Illinois Coalition on the Insurance Crisis (ICIC) and the Illinois State Chamber of Commerce (ISCC) through normal channels - committee hearings, floor discussions and roll-call votes. With the reforms proposed by business and local government in one bill, the Senate adopted S.B. 2263 May 23, but added a provision to roll back insurance premium rates to levels set in 1984. The Senate also approved strict regulation of insurance rates in S.B. 2000. In the House, under the tight control of Speaker Madigan, Democrats locked up all bills dealing with insurance in its Rules Committee with one exception — the Senate bill on insurance rate regulation. That bill, which remains alive for consideration in the fall, may be used as a club to persuade the insurance industry and some business interests, which were extremely disappointed in the omission of radical tort law changes, that they should be happy with the the final insurance compromise. That compromise, engineered procedurally by Madigan to never be fully debated, is a combination of moderate tort reform, the immunities sought by local government, and some tighter regulation of the insurance industry. 28/August & September 1986/Illinois Issues With no House bill on insurance in the Senate and no Senate bill allowed to reach the House floor, there was no bill on the legislative calendar in June. But negotiations were going on. The now-common practice of the summit meeting among the governor and the four legislative leaders was expanded by Madigan to include representatives of "outside" interests involved for months in promoting solutions to the insurance crisis. The invitees included the ICIC, the ISCC, a coalition of consumer groups and the Illinois Trial Lawyers Association (ITLA). After a series of meetings sponsored by Madigan, the split was evident: business and local governments on one side, the trial lawyers on the other. (See "Liability insurance: Score-card for the final inning," June 1986, pp. 12-14.) As the meetings continued, House Republicans accused Madigan of subrogating the usual legislative process when the Democrats maneuvered a "vehicle" bill into position to contain any agreement reached by the insurance summit. The bill, S.B. 1200, left on the calendar from the 1985 session, dealt with last year's crisis in medical malpractice. It was deemed "germane" enough to insurance to satisfy constitutional requirements, and it was sent to a conference committee so this year's compromise could be grafted to it. Rock, who as chairman of the committee was determined to keep the process as open as possible, took the unusual step of announcing the time and place of the committee meeting. Usually closed door affairs, this conference committee held an open hearing to consider the draft report on the bill. The committee heard from those involved in the negotiations. Positions were reiterated on the issues. • Defense Attorneys: "It [the draft report] is only a first step," according to Richard Hoffman. "You will have to deal with this issue again." • ICIC: Representatives from the business community said that the proposals would do nothing to ease the crisis. Arthur R. Gottshalk, president of the Illinois Manufacturers Association, said the insurance crisis was getting worse, and if the bill were enacted, it would be a "crazy quilt," applying to some businesses but not to others. • ITLA: David Decker said that the trial lawyers "were not at all pleased" with the report and had "given up much" but were happy that all victims' rights hadn't been "given away." • Consumer groups: Robert Creamer of the Illinois Public Action Council said that the bill did not address the cyclical nature of the insurance industry, which his organization has contended from the beginning to be the real cause of the crisis. (See"Liability insurance crisis: coming to grips with long tails and deep pockets," January 1986, pp. 8-12.)

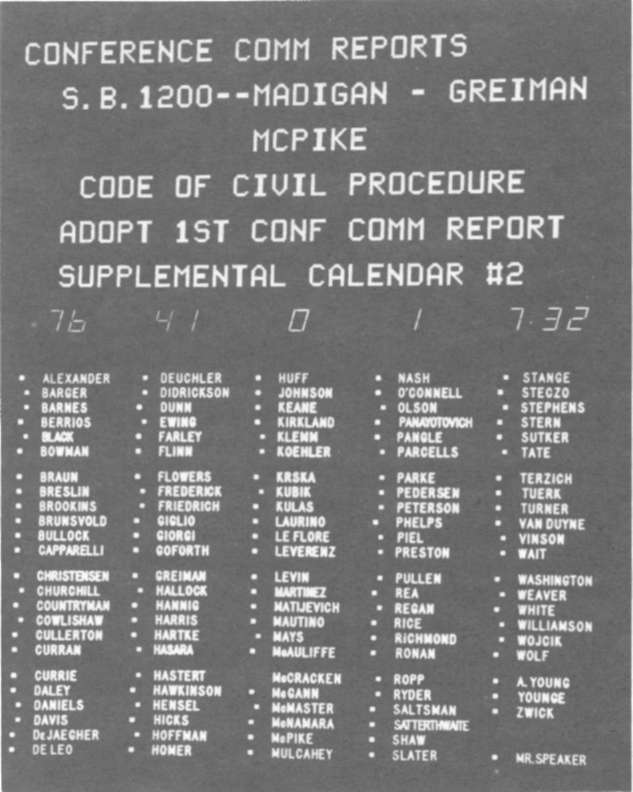

The conference committee vote was on straight party lines, six Democrats in favor, four Republicans against. Since the drama surrounding the issue had been played out and conference committee reports cannot be amended, the final floor deliberations on the 142-page report on June 30 by House and Senate members was anticlimatic. It passed both houses, mostly along party lines. The House adopted it, 76 to 41. Senate President Rock mustered the 30 votes — all Democrats — he needed, but only by flying in Sen. Glenn V. Dawson (D-18, Chicago), who had been absent because of illness. Twenty-three of the 28 Republican senators voted against the report, with five voting present. Remarks made by lawmakers as they discussed the pros and cons of the report echoed many of their frustrations and concerns. • Senate President Rock: "We have made significant concessions in the area of tort law. And at the same time, every one of us who votes affirmatively can be justifiably proud that we have not thrown out or trampled upon willy-nilly the rights of the injured plaintiffs, the rights of the people of this state." • Sen. Calvin W. Schuneman (R-37, Prophetstown): "What we have before us is a creature of the speaker of the House. The speaker of the House has allowed no public debate until tonight on this issue. He has carefully protected the interests of the trial lawyers." •Sen. Jack Schaffer (R-32, Crystal Lake): On the provision giving local governments the authority to create a reserve account for insurance (see box): "This is a tax increase without referendum, an authority you are going to give all 6,500 units of government in this state." • Rep. Alan J. Greiman (D-l, Sko-kie): "Some said it is some folks in a bunker someplace in Lloyd's of London [a major reinsurance company] that set our rates and impact on us here, so that when oil spills in the Caribbean, a ship goes down in the Persian Gulf, whatever catastrophe might happen, that day care rates are affected in Evanston, Illinois." • Rep. John T. O'Connell (D-47, Willow Springs): "I do not believe that the changes that we make in the tort system today will bring down insurance premium rates, certainly not in the near future." • Rep. Mike Tate (R-102, Decatur): "When this crisis is greater, I hope you [the Democrats] will take credit for the disaster you put together today." • House Minority Leader Lee Daniels: "I hold us [the members of the General Assembly] at fault for tolerating a system where we have been unable to openly debate, negotiate, amend and deal with the legislation as an assembly of modern times, and modern people and modern representatives have a right to deal with." August & September 1986/Illinois Issues/29 • Rep. Jack Davis (R-84, New Lenox): "It doesn't do anything to solve the problem which still exists, because availability will not come back to the marketplace. They [Lloyd's of London] will not take this piece of nothing legislation that nobody's happy with and come back to the market.'' • Rep. Jim McPike (D-112): "Never once did I hear anyone from the manufacturing sector express any concern about the pain, about the suffering or about the death of the victims." Details of the final bill Local governments will benefit most from the agreement that was reached. (See box.) The legislation extends immunities for local government bodies to grant them more protection against lawsuits. It is hoped that the provisions will entice insurance companies back into the business of covering local governments. They are also intended to ease fears of raising taxes to pay judgments. But, in what opponents see as a "backdoor" tax, local governments are permitted to issue general obligation or revenue bonds, without referendum, to pay judgments or to create a reserve against future judgments. The bill also extends to local governments the authority to levy taxes to pay costs for protection against liability for property damage or loss, including costs and reserves for participation in an insurance pool. Rock said that these provisions do not change current law, which already allows local government to create a tort judgment reserve pool. He said the bill "simply clarifies that bond issues may be general obligation or revenue bonds." But Sen. Schuneman disagreed, saying that under S.B. 1200, local governments would be able to "raise reserves so they can set up their own insuring mechanism. In order to do that they have to raise large sums of capital in advance." The bill doesn't give local governments more taxing authority, he said, but does give them more authority to create debt. The rest of the bill addresses the issues raised by business interests. • Frivolous lawsuits. The bill adopts a federal rule for state courts, allowing sanctions to be imposed for frivolous pleadings and motions. Insurers can also be sanctioned if they have knowledge of a defense attorney's frivolous pleadings or motions.

• Punitive damages. It becomes more difficult to obtain punitive damages since an original complaint may not include a demand for them. The plaintiff must first establish, at a separate hearing, that a case can be made for punitive damages. The court is given the discretion of distributing any punitive damages among the plaintiff, his attorney and the Illinois Department of Rehabilitation Services. • Modified comparative negligence. The bill establishes a narrower concept of comparative negligence, an important and controversial part of the business package. In negligence and product liability cases, under the compromise bill, a plaintiff who is more than 50 percent at fault cannot recover damages. The "catch" to the threshold percentage is that juries must be informed about the 51 percent rule. Opponents see a huge loophole. Juries may wind up rarely finding a plaintiff more than 50 percent at fault. • Joint and several liability. The most important issue for business interests centered around this concept. Under joint and several liability, a defendant can be forced to pay an entire judgment, even if not entirely at fault (the "deep pockets" problem). In an attempt to reach a compromise, the drafters of the conference committee report arrived at a 25 percent threshold, where a defendent found 25 percent or less at fault would only be liable for that percentage of damages. The provision excludes medical or medically related expenses and does not apply to environmental and medical malpractice cases. Medical malpractice was addressed a year ago, and most of the law was upheld by the Illinois Supreme Court (see "Medical malpractice act: Pretrial panels ruled out, other provisions upheld." p. 60). • Collateral sources. The other sticking point in the negotiations centered on whether an award should be reduced if the plaintiff had received compensation from another source. Business interests wanted the total amount of the "collateral" source deducted from an award. The trial lawyers and consumer groups did not want any deductions. A compromise was reached with the deduction of any benefits for medial expenses above $25,000, except in cases of medical malpractice. The deduction, however, cannot reduce a judgment by more than 50 percent, and any insurance premiums or direct costs paid by the plaintiff can be used to offset the amount of benefits received. This provision was not acceptable to business, which claims it will still have to pay since most benefits are less than $25,000. 30/August & September 1986/Illinois Issues Nor is the bill totally acceptable to consumer rights groups because it does not contain any insurance rate regulation. Measures proposed by the Illinois Department of Insurance and agreed to by the insurance industry were incorporated into the legislation, but they deal with consumer information. The bill provides that if an insurance company wants to raise premiums or cancel policies, it must provide more information to consumers and the department. Insurance companies must also provide loss information for customers who want to shop around for new insurance coverage. Prohibitions against "redlining," which is the refusal to sell homeowners' and renters' insurance because of location, are extended to the sale of all property/casualty insurance, unless the refusal is for a legitimate business reason. The provision was added to address problems faced by minority businesses who have not been able to get insurance. The establishment of an Insurance Cost Containment Act holds the most potential for future rate regulation. That part of the bill directs the director of the Department of Insurance to assess the condition of the property/casualty insurance industry by studying the relationship between insurance premiums and related income, and insurance costs and expenses. The ultimate goal of the assessment is to set up a cost containment system for the insurance industry, similar to the Illinois Health Care Cost Containment Council. An annual report on the condition of the insurance industry is to be submitted to the General Assembly by the state insurance director; the first report is due August 15, 1987. What the bill doesn't do Much to the dismay of the business community, the bill does not contain any limits on awards for noneconomic damages, including pain and suffering. Debate on that issue elicited emotional pleas by Democrats for compassion for accident victims. Industry groups were also unable to persuade lawmakers to set caps on attorneys' fees, or to get rid of the Scaffold Act, which allows workers to seek compensation from an employer for on-the-job injuries separate from the workers' compensation insurance. The Illinois Hospital Association (IHA) was particularly upset because hospitals are not included under the modified liability provisions. They will continue to be "dragged into" medical malpractice cases by doctors, according to an IHA spokesman. The effective date of the law also generated controversy. All provisions take effect 60 days after the bill is signed by the governor, but they only apply to cases which occur on or after the effective date. Business interests believe the bill is too weak to entice insurance companies to provide insurance coverage where they don't and to lower their rates where they do. . . . lawmakers will have to deal with Both the ICIC and the ISCC called on Gov. James R. Thompson to veto the measure and to call a special session. In a letter to the governor, ICIC coordinator William E. Dart claimed the legislation to be a "creation of the Illinois Trial Lawyers," and that a gubernatorial veto will be a "message" to the state's employers that "no one is being fooled by pronouncements that this bill is a compromise." Once the bill passed the General Assembly, attention shifted to the governor, who has played only a peripheral role since February when he declared in his State of the State message that a solution to the insurance crisis was a high priority item. Thompson did make clear that he was advocating many of the tort changes wanted by business, but as negotiations were grinding to a halt in late June, and it became apparent that the Democrats were in control of the outcome, he chastised business interests for their recalcitrance. He said on June 30 that "business could have had more had they agreed, but they would not, so they are putting themselves in my hands.'' He said then that he had yet to determine if the bill would provide "meaningful" tort reform. IMA president Gottshalk was blunt with his opinion of the compromise: "The bill was drafted artfully by those representing the narrow, special interests of personal injury lawyers to give the illusion of reform rather than bring about any substantive reform." On July 15, when the bill was in the process of being sent to the governor, the coalition released a lengthy analysis of the bill, claiming it would not help, and might even hinder, businesses and local governments. The ultimate question of whether or not the bill will make insurance affordable and/or available remains unanswered. The main concern of the insurance industry has been the lack of predictability in the marketplace because of the changing nature of tort law. While the bill does restore some predictability, particularly for liability coverage for local governments, it may not go far enough. Robert G. Schultz, executive vice president for the Illinois Insurance Information Service, which is underwritten by the industry, said that while insurance companies "weren't happy" with the legislation, anything that cuts down on the cost of losses and lowers the amounts of claims will have a "salutary" effect on the availability of insurance in the state. The industry is taking a "wait and see" attitude, Schultz said. "We would like to be pleasantly surprised by the effects of the bill." At press time, August 19, the governor had taken no action on the bill. The bill that nobody likes may be a first step in solving the insurance crisis. But lawmakers will have to deal with continuing problems in the commercial insurance business next spring. Some industry insiders hint that the crisis will spill over into the personal lines (auto, home, health, life). Throughout the session, the big companies who deal mainly in personal lines said that they are not experiencing any difficulties in those areas. But, as a possible forewarning, one of the largest insurers in the state has been sending out notices to its homeowners insurance policyholders, explaining that increases in the cost of their premiums are due to the continuing rise in the cost of claims. Don't be surprised if next year's "crisis" is in the personal lines. August & September 1986/IIlinois Issues/31 |

|

|