|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

|

Legislative Action Dueling lobbies: tax increases, spending cuts The 10th of June dawned hot. The tax increase rhetoric was hotter. The sun was high in the sky at 11:30 a.m. when gasoline tax increase opponents gathered on the Capitol's west steps. Comptroller Roland W. Burris fired them up by complaining of the use of Road Funds to pay for a formal garden (he called it a rose garden) at the Executive Mansion. He got applause from a crowd carrying signs that read "Roads not Roses" when he quipped that Thompson was wearing rose-colored glasses. Burris said of the tax hike, "It is unfair. It is unjust. And it is unnecessary." Then he led the flock in cheers. "Say No," he exhorted. "No," the crowd shouted back. "Say No." The ensuing chants reverberated between the Capitol and the Stratton Building. Other speakers were tame by comparison. Secy. of State Jim Edgar observed that because of opposition, the gasoline tax and the license fee hikes "may very well be running out of gas." Taxpayers' Federation of Illinois president Douglas L. Whitley contended: "The administration has asked for too much, too soon.'' When the speeches were over, the group headed upstairs to buttonhole lawmakers. At noon the Illinois Federation of Teachers rallied on the Capitol's east steps —100 yards but ideological worlds away. The rhetoric was less torrid. The crowd was calm by comparison. Gov. James R. Thompson was the main attraction. He recalled the 1985 education reform effort. Then he turned up the heat a bit and suggested if lawmakers would not raise taxes, they did not care about education. "And that's not what they told you last fall when they asked for your vote." Next up was Sen. Emil Jones Jr. (D-17, Chicago), who said if a tax increase came to a vote, "I will be with those who have been with me in the past and you are my friends.'' Then union president Robert Healy exhorted his members, "Don't go lie on the lawn. Go upstairs and talk with them [lawmakers]. Let's get this dialogue going." The rally broke up at 1. The buses left at 2:30. There had been other rallies. There would be more. New tax proposals would surface daily. Thompson pledged to slash appropriations to $10.4 billion without new taxes. Lawmakers pledged to give him a manageable budget and began the work of crafting a no-tax spending plan. The tax eaters — schools, human service groups and state agencies — lobbied for higher taxes. Business interests and conservatives urged spending cuts. It was a spring of dueling lobbies. It was a spring of posturing politicians. It was a spring of good theater. The dueling continued June 17. Welfare recipients, one of the least potent lobbies, rallied at noon for a grant increase: "We like leaders who have the courage conviction to stand up for what is right, "Betty Williams of the Illinois Campaign for Family Stability told the group. Nursing home operators sought a tax increase to prevent cuts in Medicaid rates. "A tax increase after the rebates and cuts over the years is not much to ask for,'' Pete Peters of the Illinois Council on Long-Term Care told a 1:30 rally on the west steps. Deputy Gov. Reilly exhorted the group, "In football terms, we're real late in this game and we're very far behind." Half an hour later on the east steps Daniel Scalf, executive director of "Just Say No," repeated the opposition of the conservative Republican-based organization: "Taxes to politicians is like cocaine to drug addicts.'' Costumed as a farmer, Scalf hoisted a small piglet from a galvanized garbage can to protest pork barrel politics. His was the smallest show of the day. It drew the most television cameras.

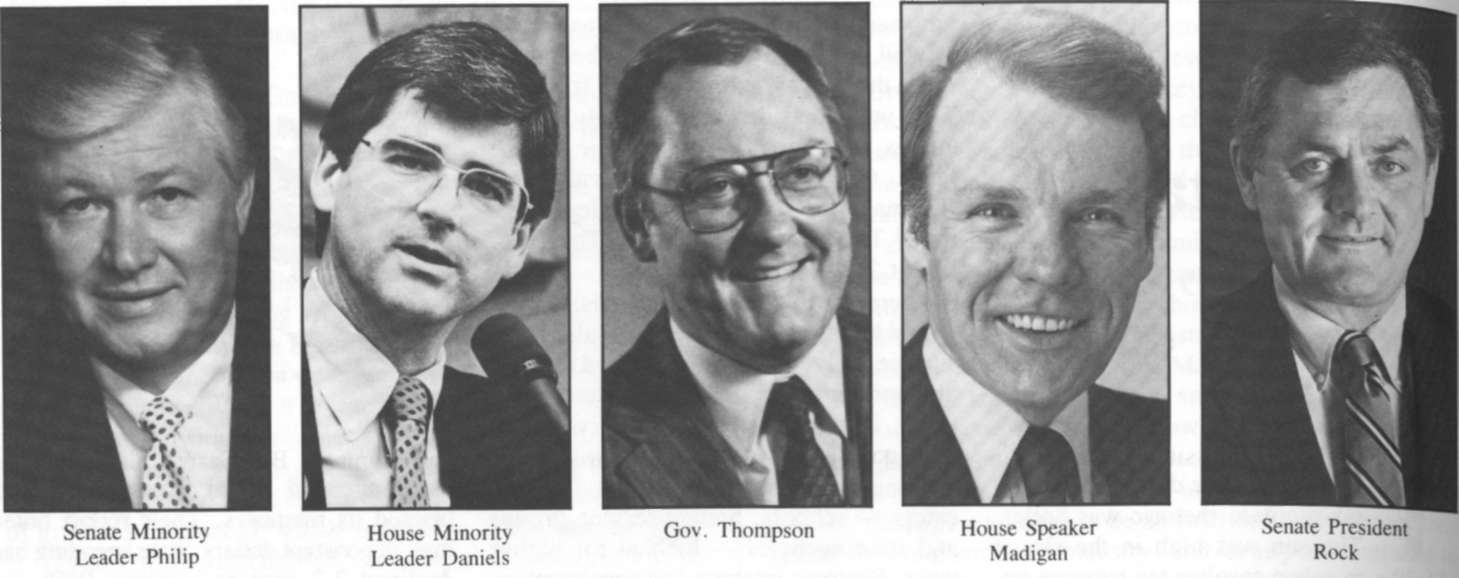

The dueling lobbies produced conflicting numbers. The Illinois State Chamber of Commerce on June 11 released a study by two University of Illinois economics professors that showed state spending had outstripped revenues. The chamber said the study proved the state needed to limit spending, not to raise taxes. That same day the legislature's Economic and Fiscal Commission staff briefed its members. Their report noted that, in constant dollars, state spending had declined 2.2 percent between 1978 and 1986. Over the same period state revenues, adjusted for inflation, declined 4.1 percent. "If anything, spending has been kept in check," executive director Paul Vallas told the five commission members in attendance. More dueling was inevitable at the summit meetings between Thompson and the four legislative leaders. None of the leaders was enthusiastic about a tax hike. None wanted to be accused of killing it. The first session, Summit I, came June 12. Thompson proposed a 1 percent hike in the individual income tax, a corresponding hike in the corporate tax; he had dropped his proposed sales tax on services. "Our taxes are so low that we could move to that position without hurting our competitive standing with neighboring states," Thompson told the gaggle of reporters waiting outside his office afterwards. House Speaker Michael J. Madigan (D-30, Chicago) said he remained unconvinced of the need for any increase, but maintained rank-and-file lawmakers' views were more important than his own. The next move came from the Senate Republicans. After Summit I they unveiled a plan to cut spending by $502 million and reallocate money to other areas. The plan would have eliminated state funding for the General Assistance welfare program and curtailed Build Illinois. Money saved would go to elementary, secondary and higher education, mental health and corrections. August & September 1987/Illinois Issues/43  The Republican "502 plan" would be scuttled by Senate Democrats within a week. The big ticket was the $272 million elimination of the General Assistance program, a welfare program for people without children. Republicans contended it would move the program down to the township level and would let the state meet other needs. "We're just saying we don't want the prisons closed. We don't want the courts to run the mental health system," argued Sen. Jack Schaffer (R-32, Cary). Senate President Philip J. Rock (D-8, Oak Park) vigorously opposed the change: "We are taking, my friends, a dramatic step backwards if we adopt this amendment." The measure lost by one vote, 28 to 29. Later Rock contested other parts of the 502 plan, and suggested the underlying problem was that Thompson had no support for a tax hike among Senate Republicans: "Lest anybody misapprehend, this is not a $500 million cut in state spending. It is a $500 million reallocation. From the have nots to the haves, I suggest. It's bad policy." But Senate Minority Leader James "Pate" Philip (R-23, Wood Dale) defended the effort: "Most of us on this side of the aisle are convinced there is a slim to none chance of a tax increase. . . .we thought we ought to agree on what we thought the priorities for the state of Illinois should be . . . and reallocate those funds where we think they are necessary. And that was our attempt today." On June 16 Senate President Rock emerged from Summit II and declared the tax hike plan dead. Madigan was not so strong: "My assessement is the governor has not . . . convinced a majority of the legislature to vote for a tax increase." Then Thompson emerged and said there was no change. There would be no summits for now. Instead The governor would shuttle between the leaders. Thompson said he was not disheartened. "A lot of the major groups who might be supporting the plan that I announced last week have yet really to be heard from. I mean education just came together formally yesterday .... We need some time for the interest groups to talk to people. To persuade the legislature that they care. If they don't care, the budget will be cut." Thompson said he had told Chicago Mayor Harold Washington that to pass a tax increase, he would have to put all Chicago Democrats on the roll call. Asked later whether that was realistic, Thompson quipped, "I thought that was always within the capacity of a mayor of Chicago. Those are the legends I grew up with." Thompson said the House speaker knew what was necessary. "Mr. Madigan knows we need this tax increase as well as anybody alive." Following the summit the governor moved to make his case to legislators one-on-one. Sen. Penny Severns (D-51, Decatur) was one so summoned to his office. Severns recalled later that Thompson made his pitch and asked what she was going to do. She replied she would do what she and the governor had pledged before the election: oppose tax hikes. How about the gas tax, Thompson asked. Severns said no. She said she wondered whether the governor was out of touch because the loudest complaints she heard were about the gasoline tax. And the maneuvering continued. House Minority Leader Lee A. Daniels (R-46, Elmhurst) told reporters on the House floor June 19 that Madigan had to commit. "I think there's a lot of members on my side — perhaps upwards of 15 — that could vote for new revenues for the state, but have been unhappy as to the lack of any meaningful discussion coming out of the city of Chicago and are saying, wait a second, we Republicans aren't going to pass this tax." On June 23 Thompson met for an hour and a half with Daniels and emerged saying he was encouraged. "I'd have to tell you after two days of hearing where some people might be — under the right circumstances — I'm encouraged. I've received some discouragement, but I've been encouraged, too. And he criticized Madigan: "It's the 23rd of June and the speaker has issued no opinion on the state of the budget. That's remarkable." Two days later House Republicans pushed their own budget balancing plan — a 2 percent across-the-board cut in all appropriations bills. The GOP maintained that its cut — some $210 million — was needed, not Thompson's 4 percent reduction. All that passed in an afternoon of heated debate were 2 percent cuts for the Governor's Office and the Bureau of the Budget. Both were later stored. Rep. Mike Tate (R-102, Decatur) complained as the last of those cuts to defeat: "This was the Republican plan. I guess we know what the Democratic is. The Democratic plan is to spend money on individual pork projects, and we can take responsibility for raising taxes over here" 44/August & September 1987/Illinois Issues Thompson convened Summit III on June 26. When he emerged at 8 p.m., a tax increase seemed as likely as it ever would. (Insiders later acknowledged the momentum had already peaked and that the tax increase was doomed before Summit III.) "In answer to a direct question by me, each of the four legislative leaders said that they could support an increase on the income tax, personal and corporate, under certain conditions," Thompson said. The governor also reported Daniels' observation that it was impossible to pass an income tax increase without a gas tax increase, and said he agreed. Outside Thompson's office Madigan contended he was still not convinced of the need, but that he had given Thompson two bill sponsors — Carol Moseley Braun (D-25, Chicago) and Alfred G. Ronan (D-12, Chicago). And he moved to deflect criticism from his lack of a position on a tax increase: "Why don't we stop participating in a propaganda campaign that has been underway for about four or five days and acknowledge that everybody's support will be needed. Summit IV was held Saturday morning, June 27. Lawmakers reviewed an assortment of plans. By now the one in greatest favor would raise the individual income tax rate retroactive to Janunary 1 by half a percent, and by another quarter percent on January 1, 1988. Corporate rates would rise correspondingly. The plan would provide $370 million for elementary and secondary education. Thompson left the Saturday session by the back door, but there told reporters computer runs were being done on the .75 plan: "My bottom line is this state is going to get out of debt once and for all. We're not going to spend money we don't have once and for all, no matter how appealing it is." But Philip and Rock said later they thought a hike was less likely. "It's down and wounded and bleeding," Philip said. Daniels agreed, saying it was "unlikely" a package would be passed. House Republicans caucused on Sunday, and Daniels found little support for the income tax. Instead they proposed a series of excise taxes --- on liquor, jet fuel, cigarettes and nonprescription drugs - that would raise $252 million. Democrats, and some Republicans, doubted the possibility of passing the taxes and suggested the result was to confuse the issue. Summit V was convened Monday morning. The end came quickly. At 12:40 the governor convened a press conference to declare the issue dead. Thompson said: • Rock was willing to support a half-percent increase in the personal income tax and a corresponding corporate rate hike, without conditions. • Philip would support a similar increase, if accompanied by changes in workers compensation and unemployment insurance laws, by more state money for schools which now get little and by property tax relief.

• Daniels preferred the 2 percent solution (the across the board cuts defeated on June 25) and said there was little support for an income tax increase. • Madigan refused linkage to Philip's issues and opposed property tax relief. Thompson blamed the lawmakers. "Perhaps it's a good lesson after 11 years for everyone to focus on the fact that in addition to having a governor in this state, we have a General Assembly as well. And that it takes leadership by all to accomplish things." Madigan blamed Thompson: "I think one reason would relate to the fact that this was the second time that others had said there would be a request for a tax increase after the election and it actually did happen. Secondly, apparently there is a strong movement within the Republican party which to my knowledge is grass roots in nature and which has had quite an impact upon the ordinary Republican legislator." From there the spotlight shifted to the appropriations process as lawmakers moved the appropriation bills. Sen. Howard Carroll (D-l, Chicago), chairman of the Senate Appropriations I Committee, detailed a $10,760 million budget that included $188 million in new spending that he said was within available resources. The budget would neither repay the $100 million borrowed by the state in February nor have anything left in the state's treasury on June 30, 1988. "We are sending him a budget spending every dollar. That is a responsible legislative budget. All of these are estimated revenues. We expect the governor will pick and choose [spending programs]." But Carroll also contended that draconian cuts threatened by Thompson were not necessary and that layoffs were not required: "It is not $400 and $500 and $600 million in cuts. It's how much do you want in the bank." Final passage was not so smooth as the House and Senate wrangled over adding money to the Department of Mental Health and Developmental Disabilities budget. The House approved a conference committee report without the mental health increase and adjourned. That left the Senate to do the same or have no budget. Senators were irked by the House adjournment and refused, so Thompson called a special session. On July 1 the public was treated to that rarest of events, a real conference committee session, to deal with the mental health funding. Madigan invited Thompson. He declined, writing Madigan, "You have publicly stated on numerous occasions that the General Assembly has sent me a budget for Fiscal 1988 which you consider to be 'manageable.' I fail to understand, therefore, why you need my personal appearance to guarantee the manageability of two out of dozens of appropriations bills." Thompson's chair, appropriately marked with a name tag, sat empty throughout the proceedings, during which $8 million was added to the budget. Lawmakers went home. The east steps were used mostly by tourists who entered the Capitol to gawk at the refurbished dome. The west steps were used by staffers making their way back and forth to the Stratton Building. The duels, however, continued; this time over how deeply Thompson had to cut the $10.7 billion budget lawmakers had given him. Michael D. Klemens August & September 1987/Illinois Issues/45 |

|

|