|

Home | Search | Browse | About IPO | Staff | Links |

|

Home | Search | Browse | About IPO | Staff | Links |

|

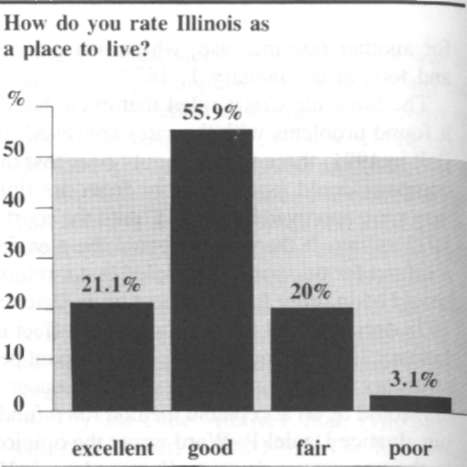

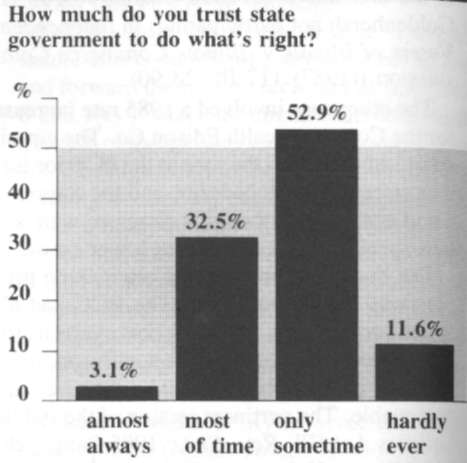

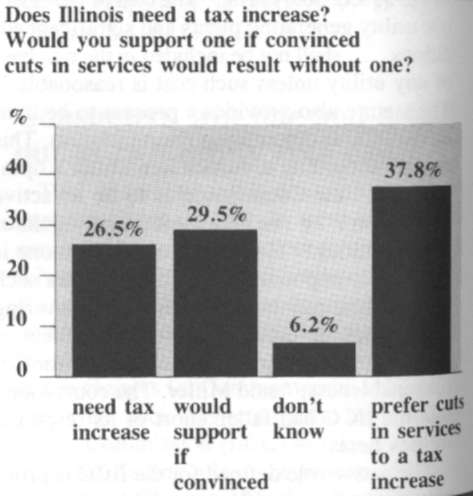

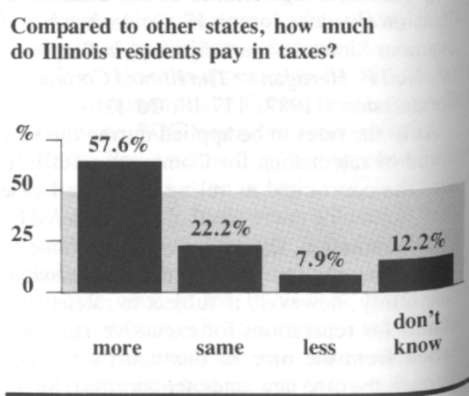

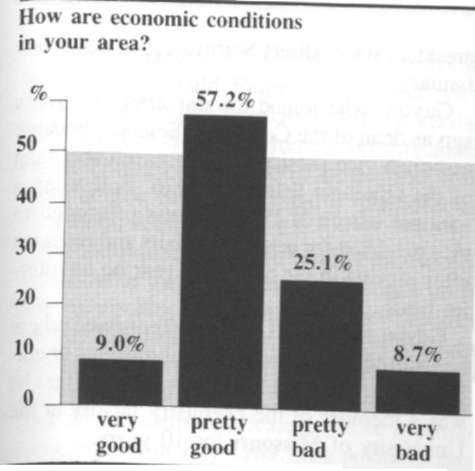

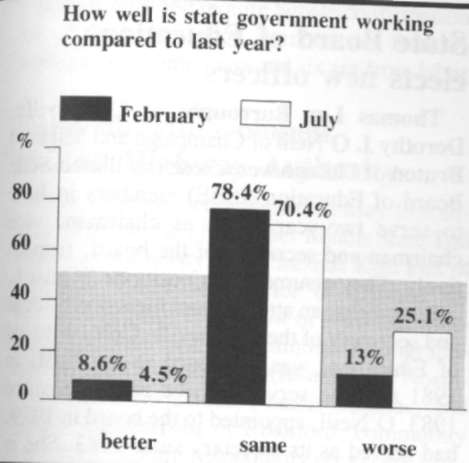

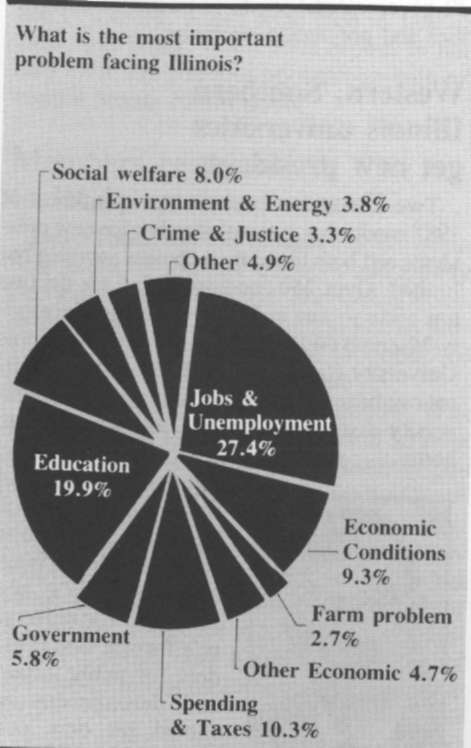

Illinois Issues Poll Ayes, nays and maybes on tax increases The Illinois Issues Poll was conducted as part of the regular polling activities of the Survey Research Office in the Center for Community and Regional Studies at Sangamon State University. The poll asked questions about the issues of spending and taxing in Illinois. It also measured public opinion about the social, economic, and political "state of the state," as it had six months ago (see May 1987 Illinois Issues, pp. 22-23), and it collected standard demographic information. Interviews were conducted during the last two weeks of July 1987, beginning the day after Gov. James R. Thompson announced budget cuts for state agencies. The findings of the Illinois Issues Poll are based on telephone interviews with 441 randomly selected households throughout Illinois. Readers can be confident that 95 percent of the time, results will differ by no more than plus or minus 5 percentage points from the results obtained if representatives of all Illinois households were interviewed. A significant majority (56 percent) of Illinoisans prefer an increase in some state taxes to reductions in state services and programs. Currently 30 percent do not think tax increases are necessary but would support such increases if convinced that the alternative is reducing state services/programs. About 38 percent are opposed to state tax increases, either choosing reductions in services/programs over tax increases or refusing to even consider the tax increase/service reduction choice. A significant number (41 percent) of Illinoisans are aware of the taxation-spending issue, and it was named by 79 percent of those who could recall at least one issue of the last legislative session. Only 25 percent identified the issue as an important Illinois problem — and only 10 percent identified it as most important, a percentage virtually identical to that in the February Illinois Issues Poll. Aspects of the taxation/spending issue, however, were mentioned in the context of education and through miscellaneous comments directed toward state government and specific incumbents. More people (27 percent) still identify unemployment and jobs as the most important state problem facing Illinoisans, but education is gaining: The percentage of those identifying education (including spending for education) as the most important state problem increased from 9 percent in February to nearly 20 percent in July. About 66 percent favor cuts in specific programs and services over cuts across the board. Table 1 shows the programs most frequently suggested for cuts as well as those most frequently mentioned for protection against cuts. Currently, a significant majority (58 percent) of Illinoisans believe Illinois residents pay more in state and local taxes than do residents of other states. Table 2 shows support for increases in various areas if increased taxation is necessary. While only 43 percent support tax increases in the individual income tax, this support climbs to 53 percent when such an increase is coupled with an increase in the income tax exemption and to 59 percent when such an increase is coupled with a guaranteed cut in local property taxes. No significant differences were found from February to July in evaluations of area economic conditions or in trust of state government. Evaluations of the working of state government were significantly lower in July than in February. As a place to live, Illinois rates good (56 percent), excellent (20 percent) or fair (20 percent), but 28 percent feel it has become worse over the last five years rather than better (17 percent). A significantly greater percentage believe that in the next five years Illinois will become a better (33 percent) rather than a worse (22 percent) place to live. The Center for Community and Regional Studies and its Survey Research Office are part of Sangamon State University, Springfield. Organizations or individuals who are interested in using the polling services should call the office: (217) 786-6571.

64/August & September 1987/Illinois Issues    Table 1. If state services and programs have to be cut, should spending be cut a lot, some, or not at all for the following?

Table 2. If some state taxes have to be increased, should the following ones be increased quite a bit, some, or not all?

August & September 1987/Illinois Issues/65 |

|

|