|

|

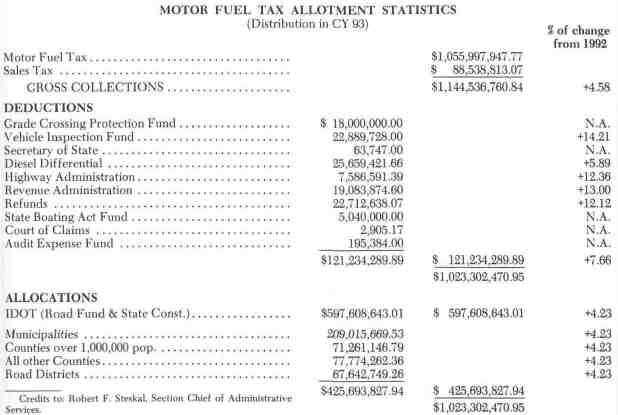

MOTOR FUEL TAX FUNDS

By WILLIAM T. SUNLEY, Engineer of Local Roads and Streets

|

Motor fuel consumed on Illinois highways for the

first nine months of calendar year 1993 is up 3.3 percent

compared to the first nine months of 1992. Total vehicle

miles of travel for the first nine months of 1993 are also

2.3 percent higher than 1992 travel for that same time

period. These corresponding figures of fuel consumption and total miles of travel indicate that the fleet may

be nearly saturated with the more fuel efficient vehicles

mandated by Congress through the Corporate Average

Fuel Economy standards. In view of this, as long as fuel

consumption remains essentially constant, we can expect to see little change in motor fuel tax allotments to

local governments each year.

Due to the slight increase in motor fuel consumption

last year, motor fuel tax revenue experienced a very

modest increase during 1993. Gross collections which

included $88,538,813.07 of sales tax revenue, were 4.58%

above calendar year 1992. This increase is largely due to

the big sales tax deposit ($51.2 million) made in the

month of May. This deposit included $18.6 million in sales tax transfers which were delayed from September, October and November of 1992. Actual revenue from the sale of fuel was up only 0.12% above last

year.

The chart below shows Illinois motor fuel tax revenues that were distributed in calendar year 1993. Municipalities received $21.57 per person, up from $20.77

last year. Road Districts received $946.93 per mile, up

from $909.06 last year. Counties received their allotments on the basis of registered license fees for the

previous year.

Each month your motor fuel tax allotment varies

directly with the total monthly motor fuel tax collection

(including the sales tax) which is deposited in the State

Treasury. Should you have questions concerning your

motor fuel tax allotment or should you not receive your

monthly allotment by the end of the following month,

please call Patricia Marr in the Bureau of Local Roads

and Streets in Springfield at (217) 782-1662.

February 1994 / Illinois Municipal Review / Page 21

|