SPECIAL FOCUS

Who Plays Golf?

According to the National Golf Foundation, the aging of America

is still key to golfs prospects for growth

|

There are a number of stories to be found in the

1997 edition of the National Golf Foundation's

(NGF) annual "Golf Participation in the U.S."

report.

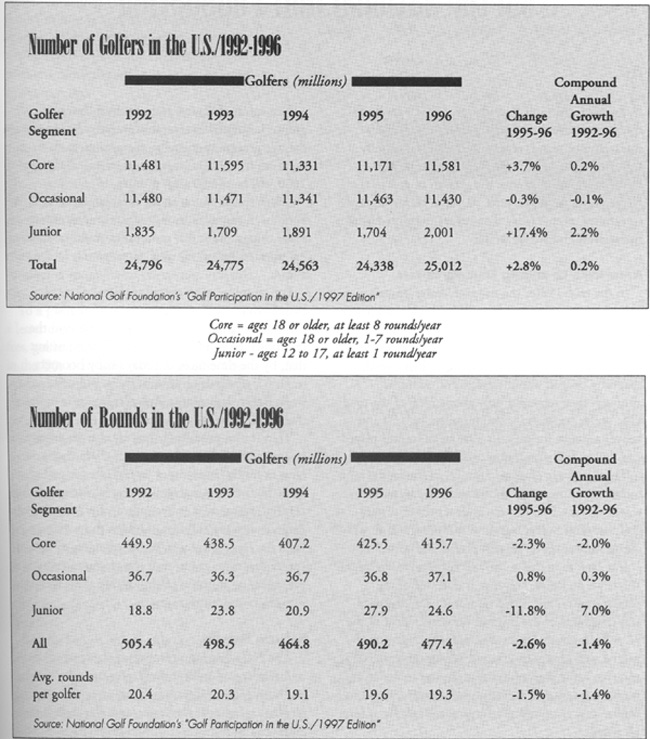

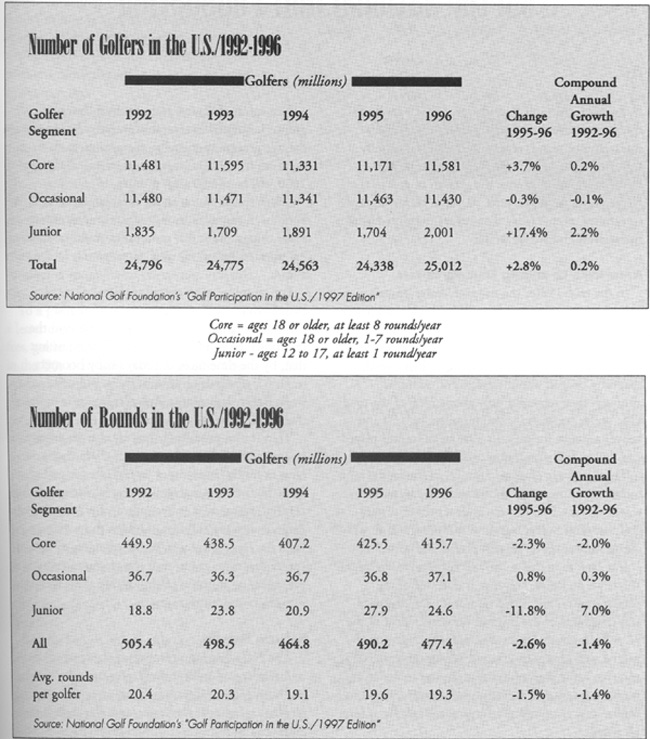

The top line numbers, for example, show that in

1996 the game's two main growth indicators—

number of golfers and rounds played—totaled 25

million and 477 million respectively, which is pretty

much where they're been for the past six years now.

By the same token, there's other data in the report

that says some interesting changes are taking place

which are being followed with interest by those

who, like the NGF, believe that the baby boom

and the aging of America will be working in

golfs favor in the years ahead.

The scenario for this story can be found

in the age group breakouts contained in

this year's report. These crosstabs show

that the senior golfer segment (age 50 and

over) is the only one that has exhibited

any appreciable growth in recent years.

Since 1991, for example, the senior

segment has grown 16 percent, or by

nearly one million golfers. Todays 6.4

million senior golfers now represent 26

percent of all golfers. Five years ago, they

accounted for just 22 percent. By the same

token, all other age groups have lost members

or, at best, remained level during this time

period.

"We've been saying for several years now

that, when they leave their child-rearing years

and begin to approach retirement, todays 78

million baby boomers will be one of the driving

economic forces in golf," says Richard Norton,

the vice president who heads up NGF's research

department.

Norton is quick to point out that the first wave of

this generation turned 50 last year and that there's

much to be gained by the golf industry if these new

seniors behave like their predecessors and play more

often as they get older.

|

Rounds vs. Revenues

"Todays seniors are among the game's most avid

players," says Norton. "They not only average about

36 rounds a year—which is about three times what

it is for all other golfers—they also spend half again

as much on golf."

Norton also points out that the current leveling

off in golf participation does not appear to have had

a negative impact on golf consumer spending which

a 1995 NGF research report showed as nearly

doubling since 1986, going from $7.8 to $15.1

billion.

"It would appear," he says, "that, while they

might not be playing more, today's golfers are

willing to spend more on everything from equipment to lessons and fees. So, although rounds

played may be down at some courses, the average

revenue per round may be going up."

Those Bellwether Beginners

In addition to seniors, the NGF's annual surveys

measure another market segment that is equally

important to golf and its economy: beginning

golfers, i.e., those people who take up the game for

the first time each year.

(article continues on page 36)

May / June 1997 / 33

SPECIAL FOCUS

For the past 10 years, the game has been seeing

approximately two million beginners a year, with the

18-29 age group producing the largest single sub-segment. Prior to 1996, the age group regularly

accounted for about 35 percent of all beginning

golfers. Last year, it jumped to 42 percent.

The NGF will be paying special attention to this

percentage in the years ahead because it's one that

will verify another belief that's held by the NGF and

others, i.e., that golfs future growth is tied also to a

generation known as the "echo boomers" . . . those

72 million young men and women who were born

between 1977 and 1993 and whose parents are the

original boomers. The leading edge of this group

turned 18 in 1996.

"We expect to see the 18 to 29 age group become

even more predominate among beginners as more

echo boomers move into their twenties," says

Norton. "And, of course, one of the big

unknowns here is the influence that players

like Tiger Woods and Karrie Webb will be

having on these young men and women

over the course of the next several years."

Other Insights

Among the other findings in this years

report:

• Avid Golfers (25+ rounds per year)

The size of this group has remained

essentially unchanged over the past six

years. It numbers 5.3 million, which is

about where it has been since 1991. Half of

all avids are age 50 or older. Eighty-two

percent are male.

• Core Golfers (8+ rounds per year)

Although they constitute roughly half of all

golfers, they account for close to 90 percent

of all rounds played. Their average age: 45.

• Female Golfers

Although they comprise just 21 percent of

all golfers, they continue to account for

more than 30 percent of all beginning

golfers. Also, avid female golfers compare

very favorably to their male counterparts

when it comes to rounds played. They

average just five less rounds per year (59 vs.

64). The growth potential of this segment

is reflected in the fact that the participation

rate among women is about 5 percent

versus 18.5 percent for males.

• Public vs. Private Golf

Approximately 80 percent of all golfers in

the U.S. today play the majority of their

rounds at public courses. On the other

hand, the average private club golfer plays

more than twice as many rounds per year

(34) as the average public golfer (16). The

private club golfer also leads when it comes

to household income, but not by as much

as you might think. They average $69,700

vs. $57,700 for all public golfers.

36 / Illinois Parks and Recreation

WHO PLAYS GOLF?

Factoring In the Margins

The national mail panel survey upon which this

report is based was conducted for the NGF by

Market Facts Inc. of Chicago, one of the world's

largest market research organizations,

As in past years, a total of 30,000 households

were surveyed and weighted with U.S. census

demographic variables to make them nationally

representative. The large sample size produces a low

margin of error. For example, in estimating number

of golfers, it allows a margin of +/-2 percent with 90

percent confidence.

"In looking over the fluctuations that have

occurred recently in total number of players and

average rounds played per golfer," says Norton,

"we've noted that these changes have all been well

within our margins of error. And it's for this reason

that, when we reflect on the past six years, we look

at these growth indicates as remaining essentially

level."

Article reprinted with permission granted by the National Golf Foundation

(NGF), 1150 South U. S. Highway One, Suite 401, Jupiter, FL 33477,

561.744.6006. Copies of 'Golf Participation in the U.S. /1997 Edition"can

be obtained from NGF Membership Services at 1.800.733.6006.

May / June 1997/ 37

This page is created by

Sam S. Manivong, Illinois Periodicals Online Coordinator

Illinois Periodicals Online (IPO) is a digital imaging project at the

Northern Illinois University Libraries funded by the Illinois State Library

|