SPECIAL FOCUS

Golf Industry Trends

from the National Golf Foundation

There is perhaps no other game....that has attracted so many from the professional ranks of other sports, e.g., Michael Jordan, Johnny Bench and Dan Marino.

The National Golf Foundation (NGF) analyzed the prospects for the future growth of golf in its most current trends report, "Trends in the Golf Industry 1986-1995," and observed some key factors that will influence the growth of golf in the United States over the next 10 years. Following are revealing excerpts from that report, reprinted with permission granted by NGF.

America's Changing Demographics

In the mid-1980s, the original "Baby Boom" helped create a demand for golf in the United States that was perhaps unparalleled in the games history.

Research continues to show that golfers not only play more as they get older, but that their overall spending on golf also increases. For example, although they represent only about 25% of the total U.S. golfer population, senior golfers (age 50 and above) account for dose to 50% of all rounds played and 53% of all spending on golf.

The first wave of those 78 million Americans who today constitute original boomers are just now reaching their 50s. If these golfers behave toward golf like their predecessors, we believe the U.S. will see another surge in rounds played and spending.

Just how long this surge will last is anyone's guess. What we do know, however, is that one of the pacing items is the "echo boomers," i.e., me sons and daughters of the original boomers. Most of the 72 million young adults who comprise this group will be well into their 20s and 30s by the year 2015, and this is the time of life that the vast majority of people take up golf. Consequently, there's reason to believe that the projected surge could last for at least 15 years.

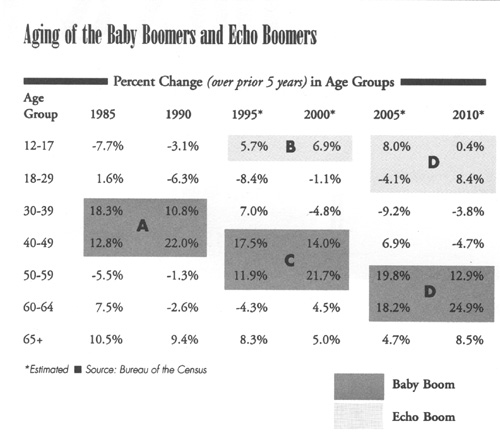

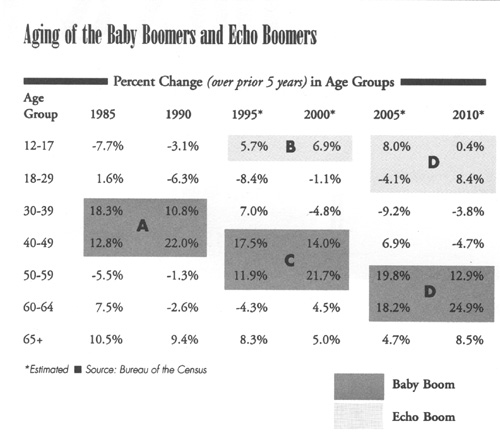

The aging of these two important "boomer" groups is charted in the table on page 39. As shown, the age group experiencing the greatest percentage increases in total number between now and the year 2010 will be the 50+ age groups.

While there's much about the baby boomers that bodes well for golf, demographers are forecasting some things about this group that could neutralize its expected impact on golf participation in the years ahead.

For example, most demographers believe that baby boomers will postpone retirement and continue to work, at least part-time, beyond the traditional retirement age of 65. They point out that, by the time most of today's baby boomers reach 65, upwards of 50% of them will continue to work rather man retire. This percentage is more than triple what it was 10 years ago.

They're also predicting that, by the rime todays boomers enter their 50s, many of them may not have as much time as they would like for golf or any other leisure time activity because of increased child rearing responsibilities brought on by delays in the decision to have children. And for those who do have the rime, there will be the question of how to spend that time given what sociologists foresee as an ever-growing number of choices for those seeking recreation and entertainment.

Leisure Trends

The NGF has long recognized that one of the cornerstones of golf's growth over the past 50 years has been golf's ability to hold its own when it comes to other sports and pastimes...and the choices the American public makes in deciding how to spend its

38 / Illinois Parks and Recreation

GOLF INDUSTRY TRENDS

leisure time and recreational dollars.

NGF studied the subject of commitment to golf in a recent study. We surveyed both golfers and non-golfers regarding their levels of commitment to various recreational and leisure time activities.

Among other things, this study revealed that golf enjoys a relatively high level of commitment from its players as compared to many other sports and pastimes.

Among committed golfers, our survey indicated that time with family and the time demands of work arc the factors that most affect frequency of play. The good news is that, for the bulk of the committed golfer population (the baby boomers), these limiting factors should abate over time as children grow up and work responsibilities gradually decrease as boomers move towards pre-retirement and retirement age.

A major component of the Leisure segment of American Demographics Well being Index is leisure spending. American Demographics reports that spending on leisure activities is up 35% since 1995 in real dollars (adjusted for inflation). A major conclusion from this trend is that people have been spending more on leisure because the time they allocate for leisure is considered more precious or more valuable than in the past.

To a greater extent on equipment and to a lesser degree on green and membership fees, golfers, too, have spent more on golf in the '90s than they did in the '80s. The relative affluence of golfers (supported by a growing trend toward two wage earner households) and increased demands on time argue for a more intense golf experience. American Demographics concludes that since time to recreate has been flat, spending on the scarce resource, recreational/leisure time, has increased in order to make the most out of the available time. This is a trend that is not likely to change in the near future and is very much evident in the golf industry's experience of stable rounds played and increased spending,

We also believe that much of golf's appeal lies in the fact that it can be played and enjoyed by people of all skill levels and ages. There is perhaps no other game, for example, that has attracted so many from the professional ranks of other sports, e.g., Michael Jordan, Johnny Bench and Dan Marino. The list also includes rock stars, TV personalities and many other luminaries.

We believe that the leisure time correlations presented here support our contention that golf will continue to compete successfully with other sports and, in so doing, continue to not only grow its player base when economic and other conditions are good...but also be able to retain that base when times are not as good.

Article reprinted with permission granted by the Notional Golf Foundation (NGF), 1150 South U. S. Highway One, Suite 401, Jupiter, FL 33477, 561.744.6006. The complete report con be purchased through the NGF's Membership Services Department at 1.800.733.6006.

The implications for golf of the demographic shifts shown here are as follows:

• Box A: Increases in these age groups brought on by the original baby boom contributed to the rapid growth in golf participation between 1980 and 1990.

• Box B: Increases in this age group (the children of the boomers or echo boom) are contributing to an increase in junior golf participation. These junior age groups are forecasted to gain numbers through the year 2005.

• Box C: As boomers mature out of the prime trial/start-up years for golf, they move into the prime spending years. While participation may be level, spending is at an all-time high and should continue to grow.

• Box D: The children of the boomers should begin to contribute more significantly to overall golf participation as they enter the key trial /start-up years for golf, mid-20s to mid-30s.

• Box E: By 2005/2010, boomers reaching pre-retirement/retirement years should positively impact both rounds played (because they have more discretionary time) and spending. The full force of the echo boomers begins to be felt.

— National Golf Foundation

May / June 1997/ 39

|

Sam S. Manivong, Illinois Periodicals Online Coordinator Illinois Periodicals Online (IPO) is a digital imaging project at the Northern Illinois University Libraries funded by the Illinois State Library |