SPECIAL FOCUS

The Giving Season

JOHN W. COMERIO, CLP

is the development director for the Illinois Association of Park

Districts and manager or Friends of Illinois Panes, lAPD's nonprofit

organization established in 1998 to involve more

citizens in their local park district and forest

preserves. Comerio received his certification as a

fund-raising manager from the Fund Raising School

at Indiana University, Center of Philanthropy. He

can be reached at 217.523.4554 or

iapd@eosinc.com.

Some say philanthropy is the future of parks and recreation,

and this fund-raiser agrees

BY JOHN W. COMERIO, CLP

|

We make a living

by what we get,

but we make a life by what we give."

-Winston Churchill

|

'T is the giving season in more ways than one. Yes,

we are fast approaching the holidays, when people give

to friends and family...and to charities. (Those end-of-

the-year write-offs can benefit a particular cause as

well as an individual's bottom line.)

At this time, too, society's giving spirit is particularly aimed at nonprofit organizations, which could

include public park districts, forest preserves and

their fund-raising arms. In fact, giving to nonprofit

organizations is at an all-time high. Americans

contributed a record $174.52 billion to nonprofits in

1998, according to "Giving

USA 1999," a report

published by the American

Association for Fund

Raising Counsel

(AAFRC) Trust for

Philanthropy.

This kind of

generosity comes at

an opportune time

for park districts, forest

preserves, recreation and natural

resource agencies.

"Do more with what you've got" is the mantra of

our citizenry, and every agency hears it.

|

|

According to a recent economic assessment survey

by the Illinois Association of Park Districts, member

districts need more funds and more resources to satisfy

local demands for facilities, open space and recreational programming. While asking for more and

expecting the best from their public park and recreation agencies, taxpayers don't like tax increases. They

see "tax caps" as a way to protect their income. And,

already these agencies are realizing 50 percent or more

of their annual operating income from fees and

charges.

|

Savvy taxpayers, however, are also looking for ways

to reduce their personal taxes and ways to direct their

social capital. Districts can help these taxpayers and

themselves by taking advantage of "the giving season."

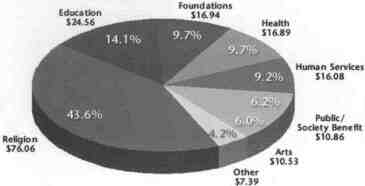

Who gives what?

For the first time since 1972, giving to charity

exceeded two percent of the gross domestic product.

Revenues to all four sources tracked (individuals,

bequests, foundations and corporations)

increased during 1998.

Personal giving by

living individuals

continues to represent

the vast majority of

charitable contributions.

More than 77 percent of

todays giving comes from

individuals who contribute nearly $135 billion, a

10 percent increase over

the past reporting year. (See

"Sources of Contribution" pie chart on page 29.)

Giving by bequest, a gift of personal property by

will, continues to increase, hitting $13.6 billion in

1998.

Corporate giving for 1998 was at $8.9 billion from

over 5.1 percent of the contributors.

Foundations weighed in as the second highest

source of contributions at $17.1 billion from 9.8

percent of the donors.

November/December 1999 /23

|

Illinois Giving

According to national statistics

compiled for 1996 by the Foundation

Center, there were 41,588 foundations

in the United States with grant-making

of nearly $14 billion and assets of $267

billion. Six percent of all U.S. foundations are located in the state of Illinois.

Illinois ranked as the fourth largest state

in the country in terms of the number

of foundations within its borders and

fifth in terms of total annual grant inakitig.

Illinois accounted for 5.5% of all U.S.

grant-making and 5% of all foundation

assets.

Of the top U.S. foundations, Illinois is

home to:

four of the largest corporate

foundations (by grant-making

activity).

six of the largest corporate

foundations (by asset size).

three of the largest independent

foundations (measuring both

grants and assets).

According to national tax return figures,

taxpayers in Illinois claimed $3.888

billion in charitable contributions in

1996. Applying the Giving USA

methodology, the $3.888 billion in

individual giving accounted for 80% of

all individual philanthropy. Illinois

individual giving can be estimated at

$4.75 billion.

Illinois ranked fifth compared to rest of

states in terms of total dollars claimed

by charitable contributions.

The average contribution by Illinois

taxpayers who took a charitable

deduction was $2,637 per return,

slightly below the national average of

$2,698.

According to 1997 data, there were

1,933 foundations and corporate giving

programs in Illinois with total assets

of $ 16.2 billion and total annual

grant-making of $917 million.

Illinois ranked fifth in the nation for

its grant-making activity, followed by

New York, California, Pennsylvania

and Michigan.

Chiicagoland Funders

One out of every two grants made by a

Chicago-area foundation was under

$10,000. Fifteen percent of the grants

were for $50,000 or more.

The majority of grant dollars reported

by Chicago-area funders (44%)

benefitted national organizations

outside Illinois; a nearly equal amount

of funding (42%) supported Chicago-

based organizations and recipients.

One in ten philanthropic dollars

supported arts organizations, with two-

thirds of this amount going to Illinois-

based arts organizations and artists.

Education received the largest share of

local philanthropic resources; half of

this support went to Illinois-based

schools, educational organizations and

programs.

Environmental issues were a major

focus for family and private independent foundations; though the majority

of these resources (80%) supported

organizations outside Illinois.

Human services ranked first, based on

the total dollars awarded, funded by

these types of foundations: community

and family foundations and corporate

funders.

Compared to the nation, local funders

awarded twice the amount of research

dollars and significantly less for

capitol support.

"Giving in Illinois," Donors forum of Chicago

|

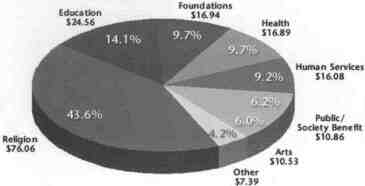

Who gets the money?

Organized religion dominates for

contributions by type with nearly 44

percent of the funding at $76 billion. (See

second pie chart on page 29.) Nonprofits

that are more directly or traditionally

aligned with parks, recreation, arts, natural

resources, wildlife or the environment also

represent a significant percentage of the

recipients. For example, the category

"other" includes environment/wildlife

organizations receiving $5.25 billion.

In addition, giving to foundations

($16.94 billion), along with arts ($10.53

billion), public/society benefits ($10.86

billion), provided a combined total of

$43.5 billion from nearly 25 percent of all

inventoried sources. Each of these four

recipient categories represent potential gift

sources or leads for your fund-raising arm

or your agency.

The "Sources of Contribution" pie chart

is especially revealing. A commonly held

belief is that corporations are the best or

greatest source of giving to nonprofits.

Many Illinois-based corporations are, in

fact, generous through direct giving,

workplace giving, as well as in-kind

contributions through their marketing,

community relations and advertising

budgets. Park districts, forest preserve

districts and conservation districts have

come to rely on corporate giving and

corporate sponsorships for major events,

activities, programs and facility development.

Giving by individuals is the real story.

All sources and research to date report the

same significant finding: the preponderance of giving comes from individuals.

Thus, personal giving remains the most

potent force for park and recreation

agencies to tap into.

Nancy Raybin, chair of the AAFRC

Trust for Philanthropy, believes nonprofit

organizations should strike a balance

between raising money from individuals

and foundations.

According to Raybin: "Individuals have

more capacity to give than foundations do,

and their capacity has not yet been

unleashed at its highest possible level."

How do you get the money?

Park districts and forest preserves can

take advantage of all this generosity in

ways that are appealing and attractive to

donors while meeting the community's

needs. Here are several ways to do this.

Dedicate a staff member to corporate

sponsorship of agency programs, events

and facilities. Champaign Park

District's "Partner in Parks," a

corporate sponsorship program, to

date has raised $115,000 for park

projects.

Hire a development officer to garner

funds from nontraditional sources. This

is becoming increasingly popular

among park and recreation agencies.

The Deerfield, Barrington and Skokie

park districts are realizing success from

the creative efforts of their development directors to secure funds.

Create a "friends" affiliate organization

focused on a specific district need.

Homewood-Flossmoors friends group

launched a "Save the Auditorium"

campaign, which realized $72,000 for

an important district facility.

The 501(c)3

Another popular approach used by

districts across Illinois is a 501(c)3

nonprofit corporation. We know the

American public is extremely generous as

evidenced by the statistics on giving.

Generally speaking, individuals do not like

to give to government for specific causes.

Many believe they give enough to

government in the form of taxes.

Establishing a nonprofit corporation

offers distinct advantages to the district

and, in turn, to potential donors. The

advantages of a nonprofit corporation

include:

Ability to focus community support

for an identified mission.

Leadership by a governing board of

individuals interested in the mission,

financially able to give and influential,

so that others follow their lead.

Can supply and apply their resources

directly to identified purposes and

provide prudent stewardship of

resources.

24/ Illinois Parks and Recreations

Provides protection and identifies

limitations established by federal law.

Has a separate identity with an

independent, accountable governance

board.

Allows assets to be protected from

potential litigation against the district

(a corporate veil).

Allows gifts like cash, investments,

securities, endowments, planned gift

instruments (life estates, memorial

gifts, trusts, and donations of land) to

be managed by the corporation or its

agent.

Provides opportunities for forging new

partnerships and alliances in and

outside the community or district.

Enhances the district's ability to solicit

and garner community support.

Allows donor contributions to be tax-

deductible, within limits identified by

the Internal Revenue Code.

Creating a nonprofit organization,

however, does not automatically ensure

success. When considering establishing a

501(c) 3, be aware of other considerations

The nonprofit must have a

mission that prospective

donors can relate to, find of

interest and wish to support.

People do not give to causes,

but rather they give to people

with causes; hence, the need

for dedicated and committed

leadership to direct the

nonprofit.

Brick and mortar projects are

very popular and successful.

In contrast, fund-raising

efforts to increase operating

expenses often are very

difficult to market.

|

Giving 1998: $ 174.52 Billion

Note :$'s in billions

Source : Giving USA 1999 / AAFRC Trust for Philanthropy

|

Giving 1998

Note: Percentages represent "allocated" giving and add to more than 100%.

"Other" includes Environment/Wildlife, $5.25 (3.0%), and International Affairs, $2,14 (1.26%).

Source : Giving USA 1999 / AAFRC Trust for Philanthropy

|

In Illinois, 54 park districts

and forest preserves have a

"Friends" group or foundation,established to benefit the mission of their

organization. Some of those organizations

have separate governing boards. In several

cases, the district trustees are also directors

of the foundation board. Not all of these

supporting organizations are designated501(c)3 nonprofit corporations.

Some of the nonprofits are more

successful than others. Typically, those less

successful lack a focused mission or a

passionate leader. Those with a limited,

identified and established purposefor

November/December 1999 /25

example, a museum, nature preserve or

zoo are realizing success.

Each district or community must

identify its long-term needs and the best

course of action to address its future and

the challenges that lie ahead. Supporting

organizations, particularly a nonprofit

501(c)3 corporation, oner considerable

advantages and possibly untapped sources

for your district.

And what better time than this, the

giving season, to consider a fund-raising

program for your agency.

26/ Illinois Parks and Recreation