Who files and what must be disclosed

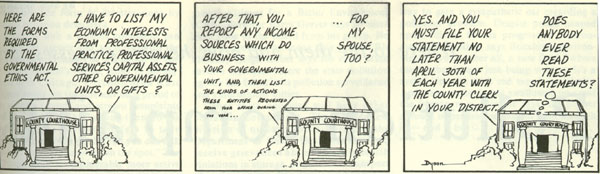

THE ILLINOIS Governmental Ethics Act, as amended in 1972 by Public Act 77-1086, requires virtually all elected and appointed state and local officials as well as upper echelon public employees to disclose "economic interests" which could place them in a conflict of interest situation. The act applies also to candidates for elective offices. State and local personnel must file their statements by April 30 or when they become candidates for office or are appointed to office if a statement in reference to that office has not been previously filed by the individual. State officials, employees, and candidates file with the secretary of state; their local counterparts file with the county clerk of their home county.

State officials required to file include members of the General Assembly, state judges, elected executive branch officials, members of constitutionally mandated commissions and boards, nominees and candidates for these positions and state employees who earn over $20,000 (except teachers) and those who must be confirmed by the Senate. Like state officials, local officials are required to report only those "economic interests" which bear upon their employment with state or local government. This is, individuals who must file are not required to list income, assets or business affiliations and transactions which do not involve state or local government. The following local officials are required to file:

(g) Persons who are elected to an office in a school district, defined to include community college district, or in a unit of local government as defined by the Illinois Constitution, and candidates for nomination or election to such office;

(h) Persons appointed to the governing board of a school district, defined to include community college district, or of a special district and persons appointed to a zoning board, or zoning board of appeals, or to a regional, county or municipal plan commission or to a board of review of any county;

(i) Persons who are employed by a school district,

defined to include community college district, or by

any unit of local government as defined by the Illinois Constitution, and are compensated for services

as employees and not as independent contractors at

the rate of $20,000 per year or more and other persons so employed who are compensated at a rate of

less than $20,000 per year for such employment, if

they receive fees for professional services rendered

for the State or any unit of local government or

school district, defined to include community college district, in such an amount that their total income from public employment, including such fees,

is $20,000 per year or more.

The following information must be filed by

both state and local officials:

(1) The name, address and type of practice of any professional organization or individual professional practice in which the person making the statement was an officer, director, associate, partner or proprietor, or served in any advisory capacity, from which income in excess of $1,200 was derived during the preceding calendar year;

(2) The nature of professional services (other than services rendered to the unit of government in relation to which the person is required to file) and the nature of the entity to which they were rendered if fees exceeding $5,000 were received during the preceding calendar year from the entity for professional services rendered by the person making the statement.

(3) The identity (including the address or legal description of real estate) of any capital asset from which a capital gain of $5,000 or more was realized in the preceding calendar year.

(4) The name of any unit of government which has employed the person making the statement during the preceding calendar year other than the unit of government in relation to which the person is required to file.

(5) The name of any entity from which a gift or

gifts, or honorarium or honoraria, valued singly or

in the aggregate in excess of $500, was received during the preceding calendar year.

The following information must be filed only

by local officials:

(1) The name and instrument of ownership in any entity doing business with the unit of local government in relation to which the person is required to file if the ownership interest of the person filing is greater than $5,000 fair market value as of the date of filing or if dividends in excess of$ 1,200 were received from the entity during the preceding calendar year. (In the case of real estate, location thereof shall be listed by street address, or if none, then by legal description). No time or demand deposit in a financial institution, nor any debt instrument need be listed.

(2) Except for professional service entities, the name of any entity and any position held therein from which income in excess of $1,200 was derived during the preceding calendar year if the entity does business with the unit of local government in relation to which the person is required to file. No time or demand deposit in a financial institution, nor any debt instrument need be listed.

(3) The name of any entity and the nature of the

governmental action requested by any entity which

has applied to the unit of local government in

relation to which the person must file for any license,

franchise or permit for annexation, zoning or rezoning of real estate during the preceding calendar

year if the ownership interest of the person filing is

in excess of $5,000 fair market value at the time of

filing or if income or dividends in excess of $1,200

were received by the person filing from the entity

during the preceding calendar year.*

Economic disclosure statements filed with 57 of 102 county clerks as of April 30, 1976

|

|

|

||||

Alexander |

|

|

|

|||

Bond |

|

|

|

|||

Bonne |

|

|

|

|||

Carroll |

|

|

|

|||

Clinton |

|

|

|

|||

Cook |

|

|

|

|||

Crawford |

|

|

|

|||

DeWitt |

|

|

|

|||

Douglas |

|

|

|

|||

Edgar |

|

|

|

|||

Edwards |

|

|

|

|||

Ford |

|

|

|

|||

Fulton |

|

|

|

|||

Grundy |

|

|

|

|||

Hardin |

|

|

|

|||

Henderson |

|

|

|

|||

Henry |

|

|

|

|||

Iroquois |

|

|

|

|||

Jasper |

|

|

|

|||

Kane |

|

|

|

|||

Kankakee |

|

|

|

|||

Kendall |

|

|

|

|||

Knox |

|

|

|

|||

Lake |

|

|

|

|||

Lee |

|

|

|

|||

McDonough |

|

|

|

|||

McLean |

|

|

|

|||

Macon |

|

|

|

|||

Marion |

|

|

|

|||

Mason |

|

|

|

|||

Massac |

|

|

|

|||

Menard |

|

|

|

|||

Monroe |

|

|

|

|||

Morgan |

|

|

|

|||

Ogle |

|

|

|

|||

Peoria |

|

|

|

|||

Perry |

|

|

|

|||

Piatt |

|

|

|

|||

Pike |

|

|

|

|||

Pope |

|

|

|

|||

Pulaski |

|

|

|

|||

Putnam |

|

|

|

|||

Randolph |

|

|

|

|||

St. Clair |

|

|

|

|||

Saline |

|

|

|

|||

Sangamon |

|

|

|

|||

Scott |

|

|

|

|||

Shelby |

|

|

|

|||

Stephenson |

|

|

|

|||

Tazewell |

|

|

|

|||

Union |

|

|

|

|||

Vermillon |

|

|

|

|||

White |

|

|

|

|||

Whiteside |

|

|

|

|||

Will |

|

|

|

|||

Winnebago |

|

|

|

|||

Woodford |

|

|

|

|||

Totals |

|

|

|

|||

Source: Information derived from Illinois Issues survey.

January 1977 / Illinois Issues / 17