|

By BEVERLEY SCOBELL

Paxton Mayor Jim Kingston

Leading the cities' battles with state

for surcharge revenues, against tax caps

|

Photo by Bob Maney/Paxton Daily Record

Paxton Mayor Jim Kingston,

president of the Illinois Municipal League

|

Walking into the Arcade Cafe in Paxton is like joining a family gathering in a big country kitchen. People are talking, enjoying each other's company at round tables and the booths tucked along the wall. There's a turn-of-the-century soda fountain with its mirrored wall behind the long counter, and an aroma in the air of something good and hearty cooking on the stove. Cozy it is, but conversation often turns to discussing the tough problems faced by the community — and the world.

Places like the Arcade Cafe are in every community, but in Paxton when Mayor Jim Kingston joins the group, he is more than mayor of this community of 4,500 in Ford County. He is also president of the Illinois Municipal League.

Kingston is leading the intensive effort of the 1,080-member, 80-year-old league in its budget battle with the state along two fronts: fighting to keep local governments' special share of the income tax surcharge due to expire June 30 and fighting against enactment of property tax caps on every local government in the state. Underlying the battle is the ongoing war over state mandates to local governments, forcing cities and others to provide services but without state money to pay the bills.

|

Gov. Jim Edgar made it clear in his budget message that he wants the surtax extended but with local governments' current share of the surcharge to go instead to the state. He wants those funds to pay for programs that help children, especially those in elementary and secondary education or needing services from the Department of Children and Family Services. "Kids vs. concrete" is the governor's battle cry, his line in the sand with local governments.

On the other side of that line stands an angry Kingston. "First off, I don't see it as any of their damn business how

we spend our money," says Kingston. "We know best what the people in our community need, and if it's sidewalks so they can have accessibility to our community, and if it's sidewalks so we can comply with the ADA [Americans With Disabilities Act], and if it's sidewalks that need to be put out in front of our schools so our kids can get back and forth to school safely, then so be it."

Kingston, a full-time employee of Central Illinois Public Service Co., has been fighting battles for his community for nearly 30 years. A former police officer, he served two terms as alderman and is completing his fourth term as mayor. He served on the Illinois Municipal League board of directors for eight years before being elected president last fall. "I really don't think of myself as political," says Kingston. "I just try to get the job done that needs doing."

But politics permeates Springfield, as Kingston readily admits: "[The legislature] is playing politics. They're playing politics with your and my tax money; they're playing politics with your and my futures." Kingston says that both House Speaker Michael J. Madigan (D-22, Chicago) and Senate Minority Leader Emil Jones Jr. (D-14, Chicago) have told him that they support the league's positions on both the surcharge and the tax caps. "The Democrats are being very vocally in support of us because it makes the governor look bad," says Kingston, "I'm smart enough to know that if the shoe were on the other foot then we would be dealing with the Republicans and hollering at the Democrats."

Kingston's main agenda as president of the league is to improve communication among the membership and between the membership and the General Assembly. "That is

my vision," says Kingston, "but I spend most of my time

12/May 1993/Illinois Issues

putting out fires, reacting to what the legislature does to us."

The disagreement over the distribution of the surcharge tax money boils down to fairness, according to Kingston. "The state tells you here's the tax you gotta pay, so you send your money to Springfield. But unless you're a special interest, unless you're on welfare or unless you're receiving some sort of support or you're in one of these groups the

governor wants to earmark, on Medicare, in a nursing home or whatever, you don't get a bit of that money back, not one penny. I think there should be a fair distribution of the money we send to Springfield to come back to use for our own purposes locally."

|

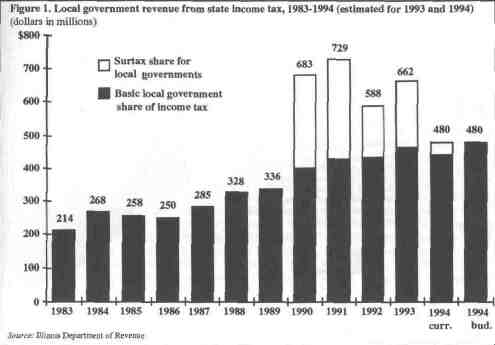

Cities do get their dollars back, explains Mike Klemens, spokesman for the Illinois Department of Revenue. Besides a direct share of income tax surcharge funds (estimated for fiscal year 1993 to total $220 million), local governments have always received one-twelfth of state income tax collections, distributed by formula based on population (estimated for fiscal 1993 at $460 million). Since 1990, when a temporary 20 percent higher tax rate was first applied to state income taxes, that one-twelfth portion has meant "a bigger piece of a bigger pie," according to Klemens. In 1989, before the rate change took effect, the local governments received $336 million. Under Gov. Edgar's proposed fiscal year 1994 budget, locals would receive $480 million through the one-twelfth formula applied to the revenue estimated for collection if income tax rates remain at the 20 percent higher rates. Current law says the personal income tax rate drops back to 2.75 percent from 3 percent on July 1 (the corporate rate will drop to 4.4 percent from 4.8 percent).

|

The increase to locals solely from the one-twelfth formula distribution amounts to $144 million for fiscal 1994 compared to fiscal 1989, according to the governor's scenario

|

The increase to locals solely from the one-twelfth formula distribution amounts to $144 million for fiscal 1994 compared to fiscal 1989, according to the governor's scenario. Sen. John W. Maitland Jr. (R-44, Bloomington) uses this argument to defend his support of Gov. Edgar's proposal to end local government's getting any special portion of the surcharge so the state budget can absorb that revenue by extending the current rates. Local governments, says Maitland, still benefit by the personal income tax rate not dropping back on July 1. "So they are not left high and dry without anything to take home," Maitland says, adding that their one-twelfth portion will grow annually as the economy grows.

Kingston and his Municipal League members, however, view the governor's proposal as a sizeable financial hit for cities still struggling out of recession. If the special portion of the surcharge is not continued for locals next year, Paxton would lose $120,000. Kingston says that's a lot of money to a small community. "That's a lot of streets. The

|

"1994 curr." assumes current law remains in force, which on June 30, 1993, drops income tax rates for individuals and corporations and provides a one-time $40 million payment to local governments on top of their 1/12 share of income tax.

"1994 bud." refers to Gov. Jim Edgar's budget plan and assumes income tax rates stay at higher levels with 1/12 share going to local

governments but no other special portion earmarked for them.

|

May 1993/Illinois Issues/13

governor talks about concrete. That's a lot of sidewalks that need to be repaired, a lot of services we can provide our people." Without those funds, Kingston says "it is a given" the community will have to increase its property taxes.

That brings us to the second front: property tax caps, now in place only in the northeastern counties around Chicago. Statewide property tax caps would be "devastating" for municipalities in the long run, says Roger Huebner, director of legislative programs for the Municipal League. "People have to realize that the long-term effect of this is a dimunition of the service level." Sen. Maitland agrees with the league on tax caps: "I think it is a different issue outside the suburbs, downstate."

Maitland believes local elected boards know best what amount of money they need to extend to property taxes. "They're right there locally where they sit at the coffee table every morning with the people they are going to be raising the taxes on, and let them plead their case. Why should we as a legislature come in and tell them what they can or cannot do. I don't think we have the right to do that."

Huebner says that placing caps on property taxes leaves municipalities with "no ability to raise revenues to pay for things they didn't ask for," meaning state-ordered programs carried out at the local level. In mid-March Kingston received a report from Municipal League staff, detailing the

introduction into the General Assembly this year of more than 100 bills that could create more mandates without funding for municipalities. Having to meet state and federal mandates with fewer state dollars is a legitimate argument, says Sen. Maitland. "But," he adds, "so is the argument that you are denying children who are wards of the court and DCFS where we intend to use some of this money ... to have a life of their own too."

Kingston, who lives in a predominantly Republican district, says Edgar has been "reasonably fair" in managing state-dictated programs. "The governor has been as fair to municipalities as any governor has been in his pledge to not give any more mandates to municipalities than we already have," says Kingston. "I cannot think of a law that he did not veto, or have it amended, because of the fact that it was going to create an undue burden in the form of a mandate."

But Jim Kingston continues to fight for cities, who want to retain that special surcharge revenue and not be burdened with limits on property taxes. He sits at the coffee table in the Arcade Cafe and looks the voters in the eye. He thinks the governor has lost touch with some of the people he represents. "The governor's a nice guy, but he does not know the needs of the people in Paxton," says Kingston. If that conviction is carried through 1,079 other communities, it could be a tough gubernatorial campaign next year in all the Arcade Cafes in the state.*

14/May 1993/Illinois Issues

|